Under The Spotlight - United Parcel Service

Photo by Sam LaRussa on Unsplash

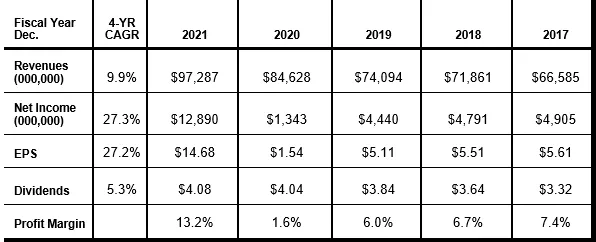

United Parcel Service, founded in 1907 as a private messenger and delivery service, is the world’s premier package delivery company and a leading provider of global supply chain management solutions serving customers in more than 220 countries and territories. The global market for these services includes transportation, distribution, contract logistics, customs brokerage, insurance, and financing. UPS operates one of the largest airlines and one of the largest fleets of alternative fuel vehicles under the global UPS brand. The company’s 500,000 plus employees embrace a simply stated strategy: Customer First. People Led. Innovation Driven.

Market Leader

In 1907, 19-year-old Jim Casey borrowed $100 from a friend to launch the American Messenger Company in Seattle, Washington. Jim’s slogan for the business was “best service and lowest rates.” In 1919, the growing firm made its first expansion beyond Seattle and adopted the United Parcel Service name. Jim Casey’s strict policies of customer courtesy, reliability, round-the-clock service, and low rates are the principles that continue today to guide UPS, a market leader with more than $97 billion in sales.

UPS’s first international operations started in 1975 when the company expanded its operations to Canada. Today, UPS runs an international network serving more than 220 countries and territories, with international sales accounting for 24% of total 2021 revenues.

In 2021, UPS delivered an average of 25.2 million packages per day, totaling 6.4 billion packages during the year, including more than 1.1 billion COVID- 19 vaccine doses in over 110 countries around the world with 99.9% on-time delivery. Global demand for UPS’s end-to-end delivery services is expected to remain high, rooted in favorable e-commerce trends.

UPS has constructed an immense international transportation network interconnected with one of the largest technological infrastructures in commercial history, unlikely to be replicated by many. Economies of scale, excellent customer service, a strong, trusted brand, and operating efficiencies translate into high profitability for the firm.

Strong Cash Flows

UPS has a flexible capital allocation strategy that allows the company to reinvest in its business, make dividends a priority, and take a balanced approach to share repurchases. Since going public in 1999, UPS has delivered parcel loads of free cash flow to shareholders via dividends and share buybacks.

During the first quarter of 2022, UPS generated a free cash flow of $3.9 billion with the company delivering $1.3 billion in dividends to shareholders and repurchasing $254 million of its common stock. UPS plans to pay about $5.2 billion in dividends and doubled its share repurchases for 2022 to a target of $2 billion, reflecting management’s confidence in its financial outlook and position. The stock currently yields a hefty 3.6%.

First Quarter Results

UPS reported first quarter revenues rose 6.4% to $24.4 billion with operating profit up 17.6% to $3.3 billion. Operating margin increased 70 basis points to 13.6% during the quarter as all business units delivered operating growth. Net income and EPS each declined 44% to $2.7 billion and $3.03, respectively, due to a change in pension income from the prior-year period.

These were solid financial results despite a challenging macro environment in the first quarter which resulted in daily volume coming in less than planned. In January, Omicron hurt sales and pressured volumes. Later in the quarter, performance was impacted by record-high inflation, upstream supply chain constraints, a surge in energy prices, and COVID-19 lockdowns in Asia. Total average daily volume in the US was down 3%, driven mostly by residential volume as UPS was lapping generous federal stimulus payments last year. Revenue per piece increased 9.5%, more than offsetting the volume decline in the first quarter. UPS has ceased operations in Ukraine, Belarus, and Russia. Revenue from those three countries represented less than 1% of total revenue in 2021, but the war has impacted fuel prices which remains a concern.

The firm maintains ample liquidity and a solid financial condition. UPS ended the quarter with $12.5 billion in cash and investments, $19.7 billion in long-term debt and finance leases, and $15.4 billion in shareholders’ equity.

UPS affirmed its 2022 full-year financial targets with revenue of $102 billion expected with operating profit margins of 13.7% and a return on invested capital above 30% for the year. Long-term investors should consider packaging up UPS for their portfolio. UPS is a high-quality market leader with strong cash flows, a hefty dividend, and is poised to deliver future long-term growth. Buy.

Disclaimer: Copying, reproduction or quotation is strictly prohibited without written permission. Information presented here was obtained from sources believed to be reliable but accuracy and ...

more