Under The Spotlight: Maximus, Inc.

Since 1975, Maximus (MMS) has operated under its founding mission of “Helping Government Serve the People,” enabling citizens around the globe to successfully engage with their governments at all levels and across a variety of health and human services programs. Maximus delivers innovative business process management and technology solutions that contribute to improved outcomes for citizens and higher levels of productivity, accuracy, accountability, and efficiency of government-sponsored programs.

Source: Maximus.com

Healthy Growth

Maximus was founded in 1975 and grew both organically and through strategic acquisitions during the early 2000s. Beginning in 2006, the company narrowed its service offerings to focus in the area of business process services primarily in the health services and human services markets. Growth over the last decade was driven by new work, such as that from the Affordable Care Act (ACA) in the United States and a growing footprint in clinical services including assessments, appeals, and independent medical reviews in multiple geographies.

Most recently, Maximus experienced both favorable and unfavorable impacts as a result of the Coronavirus (COVID-19) global pandemic. Underscoring the importance of the services the company provides, many of its U.S. contracts were designated as "essential" by government agencies in the midst of COVID-19. Keeping these programs open ensures vulnerable individuals and families can access vital healthcare and safety-net services during these uncertain times.

While some of the programs have experienced reduced volumes due to the pandemic, Maximus has also been successful in winning new contracts tied to public health initiatives such as contact tracing and unemployment insurance programs to help governments respond to the COVID-19 crisis. The individuals and families served under these programs are considered some of the most vulnerable to COVID-19.

Most of the company’s revenue is derived from long-term contractual arrangements with governments, which provides management with good visibility in terms of predicting revenues. Contracts are typically multi-year arrangements that enable the company to identify 90% of its anticipated revenues over the next 12 months. Client relationships frequently last for decades.

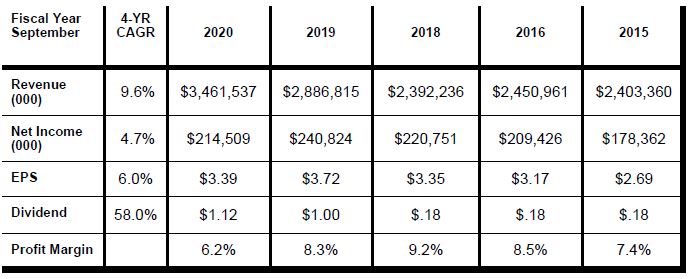

Over the past five years, sales have compounded at a 9% annual rate with net income and EPS compounding at healthy 5% and 6% rates, respectively, thanks to demographic, economic, and legislative trends.

Strong Free Cash Flow

During fiscal 2020, the company generated approximately $204 million in free cash flow. Thanks to strong cash flows, the company sharply boosted its annual dividend from $.18 per share two years ago to $1.12 a share in 2020. Free cash flow is expected to increase substantially in fiscal 2021 to a range of $300 million to $350 million.

The company’s capital allocation strategy in 2021 is to manage the business conservatively with more than adequate liquidity while continuing to pay its dividend, repurchasing shares opportunistically, and resuming merger and acquisition activities.

Fiscal 2021 Outlook

Signed contract awards during 2020 totaled $2.7 billion. The sales pipeline at 9/30/20 was $33 billion comprised of about $2 billion in proposals pending, $1.5 billion in proposals in preparation, and $29.6 billion in opportunities tracking. Maximus expects revenues in fiscal 2021 to range between $3.2-$3.4 billion, representing 10% organic growth when adjusting for the Census contract which is winding down. In 2021, EPS are expected in the range of $3.45-$3.70. Long-term investors should contract with Maximus, a high-quality firm with healthy long-term growth and strong cash flows. Buy.