Under The Spotlight: Gentex Corporation

Gentex (GNTX) designs, develops, manufactures, and supplies the digital vision, connected car, dimmable glass, and fire protection products, including automatic-dimming and non-automatic-dimming rearview mirrors and electronics for the automotive industry; dimmable aircraft windows for the aviation industry; and commercial smoke alarms and signaling devices for the fire protection industry. Automotive revenues represented about 98% of the company’s total 2020 revenue.

Photo by Łukasz Nieścioruk on Unsplash

Innovative Market Leader

More than 45 years ago, Gentex opened its doors as a manufacturer of high-quality fire protection products. Company founder, Fred Bauer, revolutionized the industry with the first dual-sensor photoelectric smoke detector. While millions of Gentex smoke detectors and signaling devices are found in hospitals, hotels, and office buildings, Gentex is best known as the pioneer of the electrochromic automatic-dimming mirror industry. Over the years, Gentex has made driving safer for millions of drivers around the world by providing mirrors that detect and eliminate dangerous rearview mirror glare. With an estimated 94% market share in 2020, Gentex is the dominant auto-dimming mirror supplier to the auto industry with over 30 auto manufacturers now offering Gentex mirrors as standard or optional equipment on 570 vehicle models.

Employing decades of experience in electrochromic, Gentex delivered the first electrochromic dimmable aircraft windows in 2010. At the touch of a button, window shades for aircraft cabins easily switch from a bright, clear state to an extreme dark state or to a comfortable intermediate level. In 2013, Gentex acquired HomeLink, the automotive industry’s leading car-to-home automation system, now integrated into Gentex mirrors enabling remote connection with garage doors, entry door locks and gates, home lighting, and security systems. In 2015, Gentex began shipping the Full Display Mirror, an on-demand, mirror-borne LCD display that streams live video of the vehicle’s rearward view to improving safety. Gentex boasts more than 1,700 patents on its technology and products, providing Gentex with competitive advantages in its markets. As vehicle electrification and autonomous driving trends progress, Gentex’s core technologies stand to become integral components in connected cars.

Strong Balance Sheet

Gentex has always maintained a strong balance sheet thanks to the company’s excellent free cash flow generation that has compounded at double-digit rates over the last decade. Gentex operated debt-free until 2013 when it took on $265 million of long-term debt to help finance the HomeLink acquisition. Gentex steadily paid down the debt and has operated debt-free since 2018. During the first half of 2021, Gentex generated $220.9 million in free cash flow, a stellar 110% of net earnings, a sign of HI-quality reported earnings. After paying $58 million in dividends and $214 million in share repurchases during the first half of 2021, Gentex sported $560 million of cash and investments on its sturdy, debt-free balance sheet as of 6/30/21.

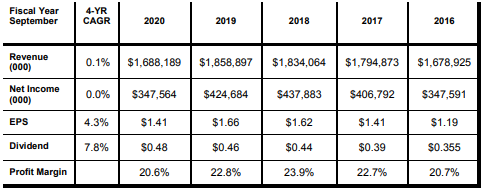

Sound Capital Allocation

Beyond funding capital expenditures and acquiring emerging technologies that fit well with its portfolio, Gentex’s robust cash flow allows for a growing dividend that has compounded at an 8% annual clip since 2016 along with substantial share repurchases. In addition to paying $720 million in dividends since 2015, Gentex has repurchased 86 million shares, reducing the share count by nearly 18%. Management remains “hyperfocused” on returning 100% of free cash flow to shareholders through dividends and share repurchases. The board recently approved an additional 25 million share repurchase program. Given expected continued semiconductor supply shortages and other macro headwinds, management lowered 2021 revenue guidance to between $1.88 billion to $1.98 billion with 2022 revenue expected to be 10% to 15% higher than 2021. Long-term investors should reflect on Gentex, a high-quality, innovative market leader with a strong balance sheet and a sound capital allocation strategy. Buy.

Disclaimer: Copying, reproduction or quotation is strictly prohibited without written permission. Information presented here was obtained from sources believed to be reliable but accuracy and ...

more