UBS Liquidates Funds, Faces $500 Million Exposure To First Brands Fracas

Image Source: Pexels

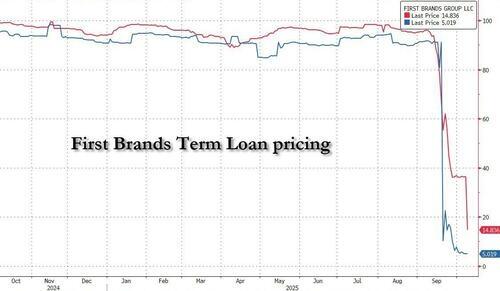

Having already followed Deutsche Bank into the risk-transfer business, hedging its exposure to its own deals (UBS Group's asset management unit is working on a new fund that will invest in significant risk transfers, which could include deals issued by itself), the big Swiss bank, The Financial Times reports that UBS has told clients that it will wind down an investment vehicle with significant debt exposure to First Brands Group, in the first major fund liquidation following the US auto parts maker’s shock bankruptcy.

As we detailed previously, UBS O'Connor: the once iconic hedge fund associated with the only major Swiss bank left standing after the Credit Suisse collapse, has 30% of its portfolio tied to First Brands, leaving Switzerland’s largest bank grappling with a bankruptcy that has convulsed global finance.

-

Overall, UBS has more than $500mn of exposure to First Brands’ debt and invoice-linked financing, across various parts of its investment arm.

-

As the FT reported, "clients are braced for big losses after UBS O’Connor, a private credit and commodities specialist owned by the Swiss bank, revealed that 30 per cent of the exposure in one of its funds is tied to the auto parts group."

-

O’Connor recently told investors in its “Opportunistic” working capital finance strategy that the fund had 9.1% of “direct” exposure, financing facilities based on invoices First Brands’ was due to pay, and 21.4% of “indirect” exposure, based on invoices its customers were due to pay (source FT).

-

And now, The FT reports that, according to unidentified people familiar with the matter, UBS has told clients of its Chicago-based O’Connor subsidiary that it is liquidating several invoice finance funds, including a strategy that did not have exposure to First Brands.

“We informed investors last month that O’Connor’s Working Capital Opportunistic funds are being wound down and the majority of the funds’ assets will be monetized by the end of the year,” UBS told the Financial Times.

“As a priority, we’re taking steps to protect clients’ interests and maximize recovery of the remaining First Brands Group-related positions through the complex bankruptcy process”

UBS is reportedly aiming to monetize 70% of the O’Connor fund with First Brands exposure by the end of the year.

The FT adds that the level of exposure has sparked anger among some investors who were previously assured that the fund would not hold more than 20 per cent of assets in a single “position”.

UBS has argued that it complied with these rules, however, as 21.4 per cent of the exposure was “indirect” and split across First Brands’ various customers.

The bank is also liquidating a “High Grade” fund that invested in invoices linked to less risky companies, even though it did not have exposure to First Brands. The whole of that fund’s assets are expected to be sold by year-end, the person added. The invoice finance funds have a total of around $600mn in assets.

We suspect UBS will not be the last to liquidate funds to cover these private credit losses.

More By This Author:

China Introduces New Exports Controls On Antimony, Tungsten And Silver

U.S. Household Debt Hits Record $18.6 Trillion As Student Loan Defaults Explode

WTI Holds Losses After Big Crude Build, Record US Production

Copyright ©2009-2025 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every time you ...

more