Two-Fer

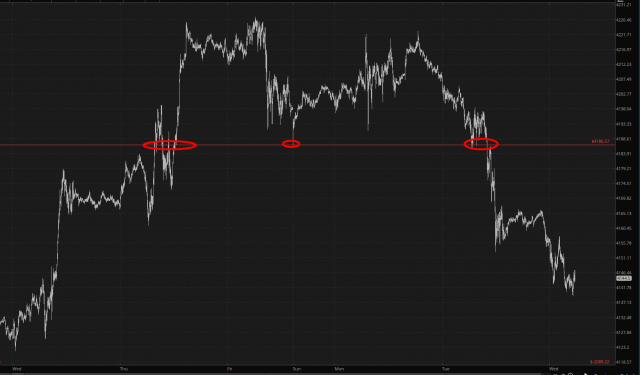

Good morning, everyone. My goodness. TWO whole mornings in a row with red quotes? Quick, call the Democratic Socialists of America! Call the Fed! Get Yellen on the phone! Something must be done! I must say, however, I raise my cup of coffee to the Fibonacci gods, who had wielded amazing power over the /ES:

(Click on image to enlarge)

As I mentioned in passing yesterday, for one of the rare times in my life, I actually got into puts at precisely the right millisecond. I bought IWM July puts (very aggressive for me) at almost the perfect point yesterday, and we finished the day with a beautiful shooting star pattern. More important, we are about 90% done with a gargantuan topping pattern.

(Click on image to enlarge)

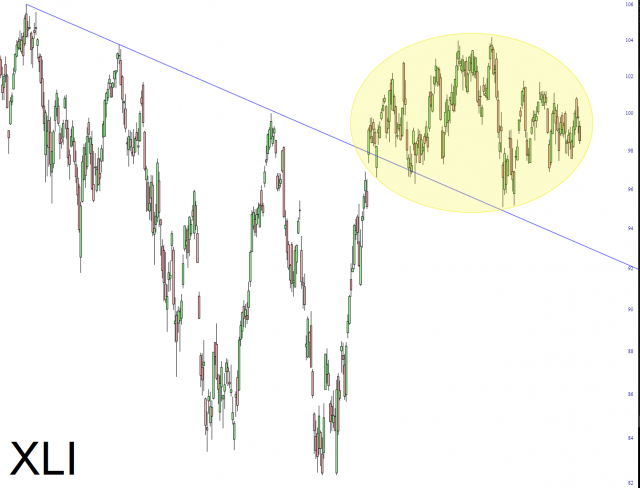

I also acquired puts on the XLI, which is in a fantastic diamond pattern. I’ve been lazy and tinted it with an egg-shaped highlight below, but you get the idea.

(Click on image to enlarge)

As for my own positioning, I abandoned my stand about not entering any more trades until this idiotic debt ceiling is over, and I’m relying strictly on charts. Yesterday I committed all my cash back to trades (although, as I stated a few days ago, I extracted a big hunk o’ cash out of the account to reduce risk overall) and presently am in this format:

- 18 positions total;

- 14 based on individual stocks (put positions, most expiring in the last three months of this year)

- 4 based on ETFs (IEFA, SMH, XLI, and IWM)

- Basically no cash left at all.

Good luck out there. This is a beast of a tough market to trade.

More By This Author:

When The Oracle Speaks ...

Paper Losses

Driven To Complacency