Two Days Of Selling Has Us Looking At Market Breadth Metric

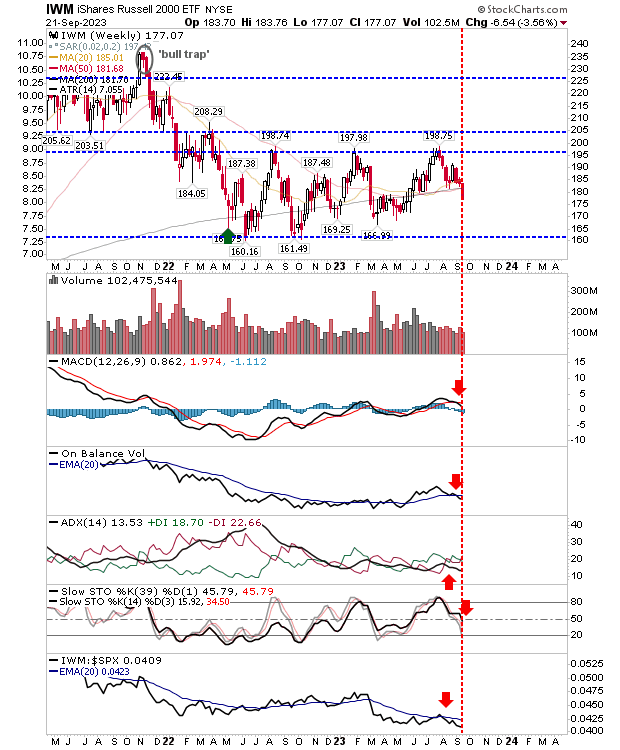

Friday's action will determine how we finish on weekly time frames, but the likelihood of an ugly close to the end of the week is high. If things stay as they are we will see a breach of the 200-week MA (along with 20-week and 50-week MAs) in the Russell 2000 (IWM) and the likelihood that this most recent breakdown will lead to a large sell-off, something the index managed to avoid on earlier such breaches in 2022 and early 2023.

Taking a step back on the S&P, I want to see how (and if) the index makes it back to its 200-day MA. It's clear the index has shifted from a bearish phase in early 2022 to a bullish cross of the 200-day MA in early 2023 - and that the index has remained above this average, and therefore bullish - since. Investor sentiment is running a similar pattern to what happened in October/November 2021, which isn't good news, but we should see a bottom inside 6 months if the selling continues. There is an area of price congestion between 4080 and 4180 that is likely to be tested in the coming weeks.

Nasdaq sentiment has started to bottom, with the percentage of Nasdaq stocks above their 50-day MA now at 20% ($NAA50R), and in the bounce zone. This is the weakest (and therefore, most volatile) of the breadth metrics. I still view last summer as *the* bottom of consequence, so I won't be expecting the current decline to reach such breadth extremes, but investors should look to buy tech stocks when three of the four breadth metrics reach an oversold state.

The Fed decision may have 'disappointed' the market, but longs are likely to have the better opportunity in the coming weeks as a bottom of consequence takes shape.

More By This Author:

Russell 2000 Undercuts 200-Day MA As Indices StruggleS&P 500 And Nasdaq Flag Distribution Heading Into Next Week's Fed Decision

Successful Test Of 200-Day MA In Russell 2000

Disclaimer: Investors should not act on any information in this article without obtaining specific advice from their financial advisors and should not rely on information herein as the primary ...

more