Twitter, Twitter Heavy Hitter

I am very bullish on Twitter (TWTR) for the long term and consider it as a buy on dips. For folks who are averse to risks in a market infected by COVID-19, TWTR can be bought in a SIP (Systematic Investment Plan).

TWTR added 26 mDAUs (Monetizable Daily Active Users) in 2019 because it improved its core product – the jump represents a 21% growth over the previous year and makes its foundation more solid. The future seems even more exciting because the company has unveiled dynamic growth plans during its Q4 2019 earnings call and after.

Here’s my analysis on why TWTR makes for a solid investment:

The road map for Twitter in the next four years

Jack Dorsey laid down TWTR’s road map for the next 4 years in its Q4 2019 earnings call:

1. The perception always was that the company was slow to convert ideas to reality. The company will now increase focus on stronger development at a faster pace. Focus areas are to improve its machine-learning models, improve ad platforms and content organization and give more control to users over their conversations.

2. The company plans to curb the spread of misleading conversations on its platform to increase trust with its users. It will also broaden interests and topics, enrich content delivery on timelines to increase engagement and attract more users. In Q4 2019, it protected the integrity of election-related tweets resulting in a 27% drop in reports that certain tweets violated its terms of service.

3. The great news is that the company has discovered bugs that adversely impacted its revenue performance in the previous years. While work on rectifying these bugs in progress, TWTR has developed a new ad stack that has already successfully managed the Super Bowl Traffic. There’s plenty more to do and the development team may be burning the midnight oil as I write this.

4. The company feels that Twitter is a global platform and therefore it should not concentrate its operations in San Francisco. It plans to distribute its workforce around the globe. This is terrific news because now the platform will be able to deliver superior content per geography.

The company's efforts started paying off in 2019 – for example, National Basketball Association (NBA) and Turner Sports brought more live and on-demand content to the platform than before. TWTR also live-streamed the “Oscars All Access” official red-carpet pre-show.

Twitter started as a social network but is now more perceived as an “interest” network that people visit to get information on people or topics.

The company will, very soon, allow people to easily create a list and pin it to the top of their timeline. Many other capabilities will be added to enrich the list-sharing experience. It will be like creating a playlist and sharing it.

To increase engagement, Twitter now displays topics and accounts based on a user’s last action. For example, if you tweet about movies, Twitter will display movie-related tweets and handles on your timeline, and if you follow any handle or interact, its AI will dig deeper start narrowing down topics and accounts that will likely hook you into increasing your engagement.

Over time, the management team intends to turn Twitter into a very personalized “discover-your-interests” kind of channel.

2020 Outlook

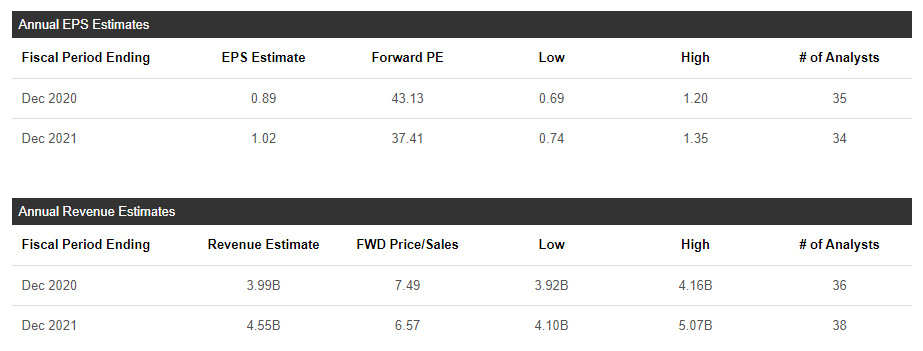

Image Source: Seeking Alpha

Twitter is a growth stock but it’s not a slow burner. Though the EPS projected for 2020 is just $0.89, investors have plenty to look forward to in terms of platform enrichment, ad server improvement, new partnerships (Olympics, EuroCup, U.S. Presidential Election, etc.), live events and much more.

Also, in 2020, the company plans to up its capex by 50% by investing $800 million in a new data center.

Charts

Image Source: Investing.com

The stock has broken out from all its weekly Ichimoku Resistances (Conversion Line, the earlier bearish Span Lines) and it seems like it will head higher. However, the markets are now hit by the COVID-19 disruption and it seems like we may witness a dip until there is some clarity on a vaccine.

The Verdict

There’s a good chance that Twitter will succeed in becoming an “interests” platform per country. Its AI is getting sharper, content and ad delivery is getting better, the number of users and their engagement is increasing, new features are in the works, and more.

If Twitter succeeds in its goal, it will become a multi-bagger. I’m very bullish on the stock and have no hesitation in recommending it for the long-term. As the markets are soft now, it makes sense to buy it in a SIP.

Disclosure: I have no position in the stocks discussed, and neither do I plan to buy/sell it in the next 72 hours. I researched and wrote this article. I am not being compensated for it (other ...

more

I was very impressed with Twitter's decision to ban all political ads. I used to have zero respect for Twitter but they are starting to establish themselves as a more trustworthy platform $TWTR.

Absolutely. It is looking like a winner any way you look at it