Twilio Stock: An Undervalued Opportunity

Even after a strong rebound in the past two days, Twilio (TWLO) stock is down by over 55% from its highs of the year. This has little to do with the company's fundamentals, it is mostly related to market conditions. Growth stocks, in general, have been in a horrible bear market in the past year.

Warren Buffett famously said that "A rising tide lifts all boats. It's not until the tide goes out that you realize who's swimming naked." This principle works the other way around too, a bear market storm can bring both the good and bad ships under the water for a while. The big difference is that a mediocre company may never recover from a decline, while a high-quality business such as Twilio tends to emerge stronger than ever.

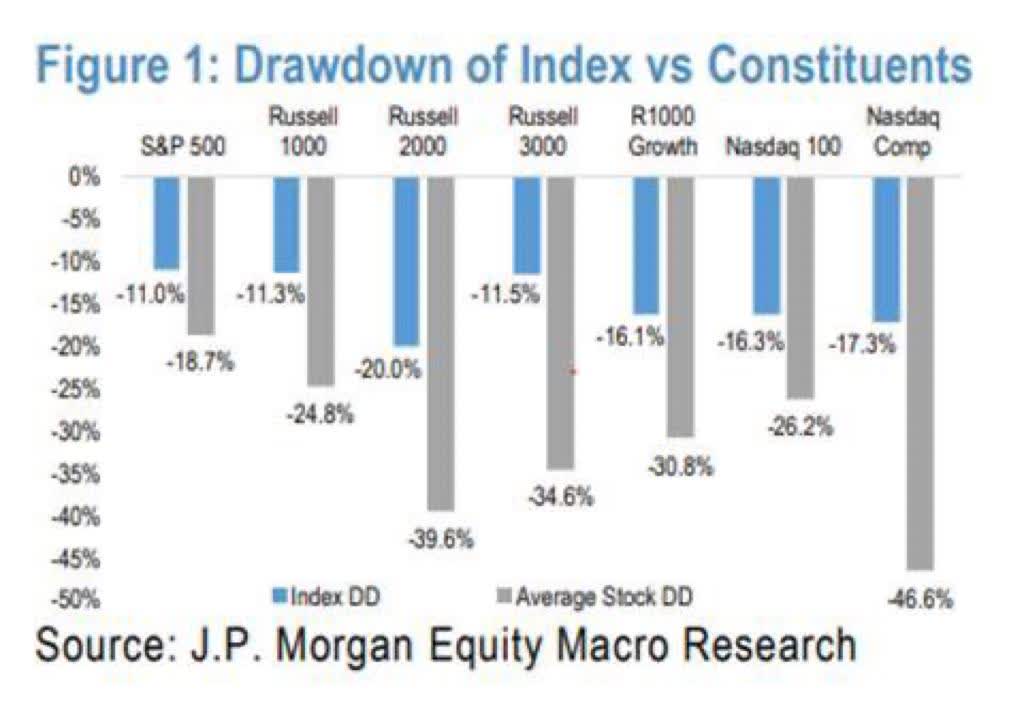

The chart from JP Morgan shows that the average stock in the Nasdaq Index is down by almost 47% from its highs, quite a staggering bear market for growth stocks.

(Click on image to enlarge)

JP Morgan

When something like this happens in the market, panic-driven investors tend to throw out the baby with the bathwater, and this can be a source of opportunity for long-term investors.

Historically Low Valuation

Twilio is a cloud-based communication platform-as-a-service, or CPaaS, company. Twilio provides a platform that allows developers to integrate communication functionalities into business applications through application programming interfaces (APIs), software development kits (SDKs), and prebuilt solutions. Twilio offers a broad product stack covering messages, voice, email, and video integration into all kinds of applications.

Communications are crucial for all kinds of companies in all industries these days. The digital transformation of the communications industry was already well in place before the pandemic, demand accelerated due to the lockdowns during COVID, but this trend is here to stay.

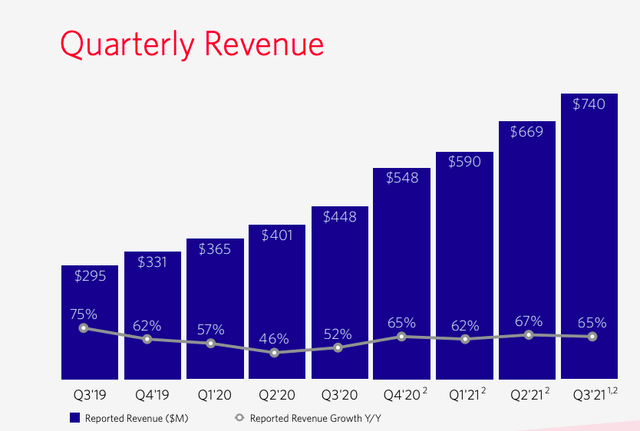

Twilio has delivered consistently strong total revenue growth over the recent quarters, although organic revenue growth was a bit below expectations at 38% year over year last quarter.

Twilio revenue (Twilio Investors Relations)

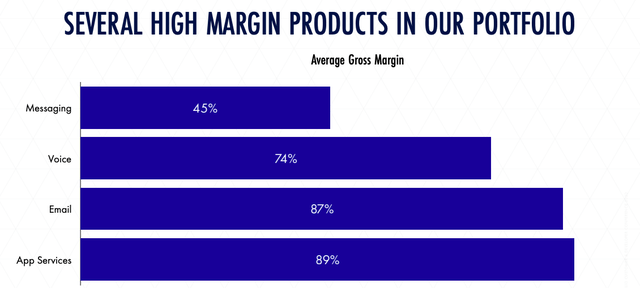

The reported gross profit margin was also below expectations, which management attributed to a "nice problem to have". The messaging business, which has lower margins than other areas, has continued growing more than expected, and this is slowing down the expansion in gross margin, although it is obviously a positive in terms of gross profits measured in U.S. dollars.

Long-term guidance is for a gross profit margin in the 60-65% range and an operating profit margin above 20% of revenue.

Twilio Investors Relations

Looking at the big picture, the fact remains that Twilio keeps delivering vigorous revenue growth in spite of challenging year-over-year comparisons. The dollar-based net expansion rate was 131% last quarter, and the company ended the period with more than 250,000 customers versus 208,000 customers in the same quarter last year. Most companies in the world can only envy this kind of performance, especially when facing such a high bar for comparisons versus prior years.

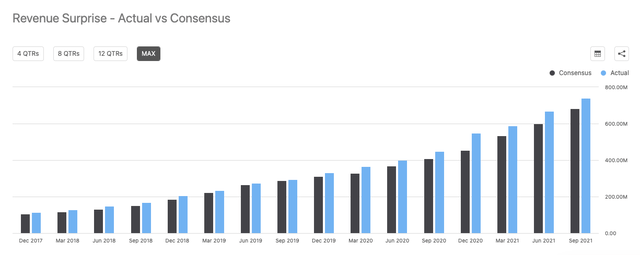

Interestingly, Twilio has outperformed revenue expectations in each and every quarter as a public business, quite an impressive track record of consistency.

Revenue vs. Expectations (Seeking Alpha)

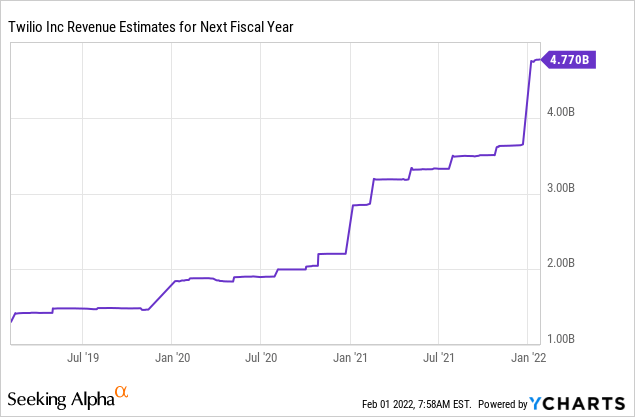

The chart below shows how revenue estimates for the next fiscal year have fluctuated over time. Wall Street analysts have consistently underestimated Twilio's revenue generation, and expectations have adjusted upwards by orders of magnitude. Regardless of short term market conditions, stock prices tend to move in the same direction of sales and profits over the long term.

Data by YCharts

Valuation levels are at record lows for Twilio by recent historical standards. The Enterprise Value to Gross Profit ratio is at similar levels to those of March of 2020. At that time, the world was fighting a pandemic and we had no idea about how the vaccines and treatments would evolve. The global economy was entering a recession of unknown magnitude and duration.

Before that, we need to travel back in time to 2018 to find similar valuation levels for Twilio. It is important to note that Twilio is now a much stronger company than it was in 2018, not only financially but also strategically.

EV to GP (Koyfin)

Build Or Die

Even looking at the business as it is right now, Twilio is very reasonably valued, and it could deliver attractive returns from current levels when market conditions improve for growth stocks. More importantly, if the company makes a successful transformation towards higher value-added services, this could be a game-changer in the years ahead.

Twilio CEO Jeff Lawson is deeply focused on how the recent acquisition of Segment can be pivotal to both Twilio and its customers. In simple terms, Twilio is building an engagement platform on top of its communications platform, and this can be transformative if management executes well.

All kinds of companies in different industries are concerned about the dominating power of the big tech giants and how this affects their business models.

Businesses these days need to pay their fees to Apple (AAPL) in order to do business, or they have to pay Meta (FB) and Google (GOOG/GOOGL) for advertising in order to constantly re-acquire those customers. This is not a comfortable position to be in, so these businesses are increasingly looking to have a more direct relationship with their customers with more control of the overall customer journey and the data it generates.

Companies want to talk directly to their customers without any intermediaries, and they also want to own the data and - importantly - to understand how to use this data in order to drive more consumer satisfaction.

Many companies now have their customer data across different silos. The mobile app and the website collect some data, the marketing system has some data, and the contact center gets additional data too. The key is combining all this information in order to extract value from it, generating a superior customer experience, and driving more business over time.

Twilio's approach has some similarities to what we traditionally understand as CRM, although it is more data-driven. In traditional CRM, a salesperson enters notes and insights about a customer into a sales automation system. Twilio wants to do something more similar to what Amazon (AMZN) and Netflix (NFLX) do with data, using your data in real-time to drive better recommendations.

This is a mission-critical priority for all kinds of companies in the digital transformation age, so it is no longer about "build or buy". Companies need to have the best tools in order to compete effectively and survive. In the words of Jeff Lawson: It is "build or die" now.

With the acquisition of Segment and the new Twilio Engage product, the company is making a transformative move. Twilio is no longer about communication alone, but about providing businesses with the tools to understand their customers in order to build a superior experience and generate increased engagement.

All this being said, it is still very early in the game for this product, the opportunity is very attractive, but management needs to prove that they can execute and capitalize on such an opportunity.

TWLO's Risk And Reward Going Forward

Competition is always a risk, especially in SMS which is a low-margin business. However, it is not easy for a client to replace Twilio with another solution. Developers build their own tools on top of Twilio's and Twilio keeps consistently adding more value over time. The company's spectacularly high dollar-based net expansion rate confirms this.

The volatility and unpredictability in gross profit margins will probably keep weighting on the stock price over the short term. This can create some jitters in times when investors are worried about rising interest rates.

Interest rate fears are overblown in my opinion, I don't think that the economy has the strength to tolerate large increases in interest rates. Nevertheless, the market still tends to prefer companies with positive and predictable cash flows in this kind of economic environment.

Management is doing the right thing by prioritizing long-term growth above current margins, but investors in Twilio should acknowledge that this will remain an uncertainty driver for the stock over the next few quarters at least.

The balance sheet is very solid. Twilio has almost $5.4 billion in cash and liquid investments versus less than $1 billion in long-term debt. From that point of view, financial strength is not much of a problem.

This is a tough market for growth stocks, and it will probably remain so until we have more clarity about inflation and the direction of monetary policy in the coming months.

Nevertheless, Twilio is an excellent company with enormous room for growth and trading at remarkably attractive valuation levels. For long-term investors who can handle the short-term ups and downs, the upside potential is well worth the volatility.

Disclosure: I/we have a beneficial long position in the shares of TWLO, AMZN either through stock ownership, options, or other derivatives.

Disclaimer: I wrote this article myself, and ...

more