Turning Panic Into Premium: How Smart Traders Profit From Market Fear

Image Source: Unsplash

In today’s markets, fear isn’t an occasional guest—it’s a permanent resident. What used to be “black swan” shocks now arrive monthly: surprise central bank pivots, geopolitical tremors, algorithm-driven selloffs. For most investors, these episodes are painful. But for traders who understand the mechanics, panic is a resource that can be harvested again and again.

The Fear Premium: Why Panic Now Pays

When stress hits, three types of players show up:

-

Retail investors and momentum algos: they sell first, think later.

-

Institutions with risk mandates: they’re forced to unload positions when volatility crosses preset limits.

-

Patient capital: traders who stay liquid, wait, and step in when everyone else is dumping.

That imbalance creates the Fear Premium—extra return available to those willing to buy liquidity when others are desperate to sell. In simple terms: impatient money pays a tax, patient money collects it.

A Play in Action: The Liquidity Vacuum

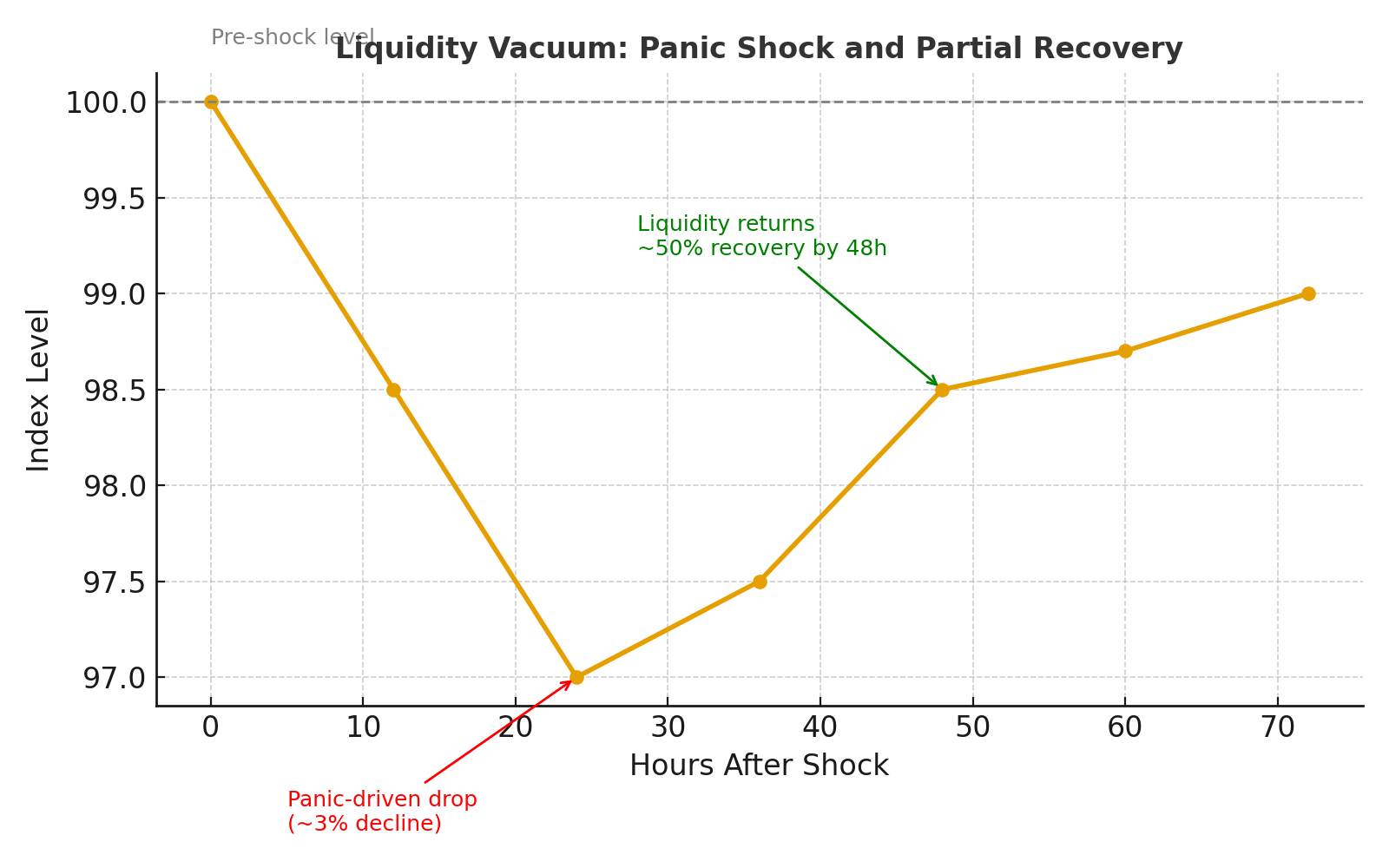

One of the most reliable ways to capture the Fear Premium is the Liquidity Vacuum Trade. It plays out in windows of 24–72 hours when selling overwhelms the market’s plumbing.

Example:

After a surprise Fed announcement, the S&P 500 futures dropped 3% in less than two hours. Bid-ask spreads widened, ETF prices decoupled from their underlying baskets, and options implied volatility spiked far above realized moves. Fundamentals hadn’t changed nearly as much as the price. Within two days, as liquidity returned, half the drop was retraced. Traders who recognized the vacuum—and had the courage to step in—were paid simply for being patient liquidity providers.

(Click on image to enlarge)

What Traders Can Watch For

Even without a full playbook, you can start spotting these dislocations by keeping an eye on:

-

Bid-ask spreads: widening fast is often a sign liquidity is gone.

-

Options skew: puts get disproportionately expensive during panics.

-

Cross-asset stress: widening credit spreads or sudden USD strength often confirm fear is spilling across markets.

-

Breadth washouts: when a huge share of stocks hit new lows in a single session, selling may be exhausting itself.

None of these signals are enough in isolation—but when they align, you may be looking at a textbook liquidity vacuum.

Building a Panic Playbook

The edge comes from preparation. Veteran traders don’t rely on gut feel in a meltdown—they follow pre-set rules and dashboards:

-

Alerts for when realized volatility outruns implied volatility.

-

Event calendars to anticipate stress around Fed meetings or month-end rebalancing.

-

Risk rules that cut trades if liquidity doesn’t return on schedule.

The key is removing emotion. Where others see chaos, disciplined traders see structure.

The Beginning of a Campaign

The Liquidity Vacuum Trade is only the foundation. It’s the master key that unlocks more complex strategies—from volatility harvesting to credit dislocations and event-driven fades. Each one builds on the same principle: forced sellers create temporary opportunities, and patient capital is rewarded for stepping in.

You’ve just seen how one trade turns panic into premium. The remaining thirteen strategies show how to apply this mindset across credit, options, FX, and beyond. Together, they form a complete panic playbook for 2025’s markets.

More By This Author:

Real Assets Reclaim Attention As Gold Equities Surge And Allocators Eye Portfolio Resets

Identity At The Center: How Surging Cyber Demand Is Powering The Next Leg Of Enterprise Software

AbbVie’s Oncology Wins, Bank Of America’s Momentum, And Costco’s Consumer Test: Three Stocks To Watch Now