TSMC Stock Drops Amid U.S. Chip Scrutiny And China Export Rules

Image Source: Pexels

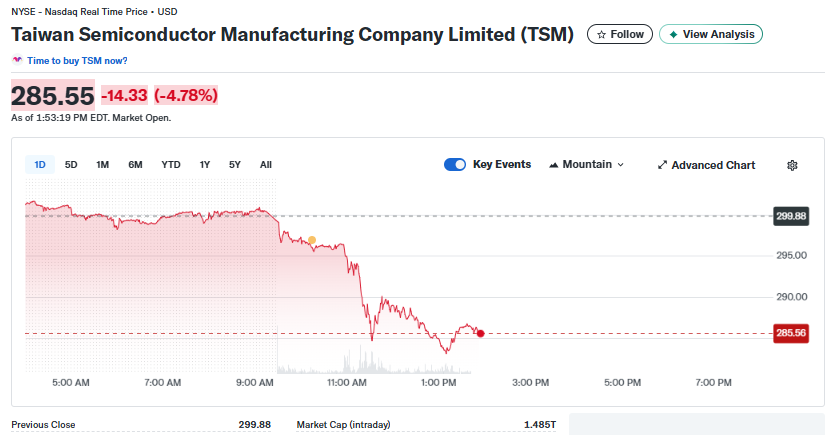

TSMC (TSM) stock slid 4.78% Friday amid escalating US scrutiny of the global semiconductor sector. Washington recently revoked export waivers that allowed TSMC, Samsung, and SK Hynix to deploy US-origin technology in China.

The move has heightened concerns about potential disruptions to supply chains and technology transfers. Investors are now weighing the impact of these policy changes on upcoming earnings reports, especially as TSMC prepares to release its Q3 2025 results.

Despite the stock drop, analysts point out that the immediate financial impact on TSMC remains relatively small. The company’s Nanjing plant contributes roughly 3% of total production capacity and accounted for just 2.6% of profits in the first half of 2025. While the waiver revocation adds regulatory uncertainty, the direct risk to revenue is contained, particularly because the plant operates on older 16 nm and 28 nm process nodes.

(Click on image to enlarge)

Taiwan Semiconductor Manufacturing Company Limited (TSM)

China’s Rare Earth Restrictions

The pressure on TSMC is compounded by China’s recent tightening of rare earth export rules, crucial materials for semiconductor production.

These restrictions create broader challenges for all global chipmakers, including those outside China, as sourcing critical minerals becomes increasingly complex.

Materials and equipment suppliers not reliant on US technology could benefit, but uncertainty around supply and licensing delays may shift some orders to alternative Chinese foundries such as Semiconductor Manufacturing International Corp. (SMIC) and Hua Hong Semiconductor.

Q3 Sales Beat Expectations

In spite of regulatory hurdles, TSMC reported stronger-than-expected Q3 2025 sales, fueled by robust demand for Nvidia’s Blackwell chips and early orders placed ahead of potential tariffs.

Analysts are closely monitoring gross margin trends and assessing how US policies may influence outsourcing strategies and supply chain logistics. The combination of strong sales performance and manageable exposure to China suggests that TSMC may weather short-term market volatility while maintaining its long-term growth trajectory.

Samsung Faces Greater Risk

Bloomberg Economics highlights that Samsung could be more affected than TSMC due to its higher reliance on Chinese demand.

However, the company may offset some of these challenges by supplying chips to emerging AI projects like OpenAI’s Stargate. Investors are now evaluating which firms are best positioned to navigate tightening US regulations while sustaining profitability in a shifting global semiconductor landscape.

Navigating Regulatory Uncertainty

TSMC has a 120-day transition period to seek individual licenses from the US Commerce Department, allowing current operations to continue while limiting capacity expansion or technology upgrades.

The company may also substitute some US-origin tools with Chinese alternatives, although local lithography capabilities remain limited for advanced nodes. Meanwhile, designers and device manufacturers may increasingly diversify suppliers to mitigate risk, potentially benefiting smaller or non-US-dependent foundries.

While TSMC shares reacted negatively to the news, the market drop reflects regulatory caution more than operational disruption. The company’s strategic positioning, diversified production, and strong demand pipeline provide buffers against short-term volatility, even as geopolitical and policy risks reshape the semiconductor landscape.

More By This Author:

Intel Stock Slips As Panther Lake Ushers In The 18A Era Of U.S. Chipmaking And Arizona Fab ExpansionSolana Outperforms Ethereum’s Early Stage With $2.85B Revenue

Opendoor Stock Jumps 14% After CEO Confirms Bitcoin Integration Plans