TSM Earnings, Fed Speakers, Quarterly Results & Guidance

Image Source: Pexels

After four days of US equity markets moving lower, this morning’s futures point higher, lifted by quarterly results from Taiwan Semiconductor (TSM) and others reporting early this morning. TSM delivered a beat and raise March quarter fueled by 26% YoY growth in smartphone and 18% YoY growth for its Higher Performance Computing business that contains both data center and AI. For the current quarter, TSM sees its consolidated revenue rising to $19.6-$20.4 billion compared to $18.87 in the March quarter and the market forecast of $19.44 billion.

From a model perspective, TSM’s results, and guidance point to continued strength for Tematica’s Artificial Intelligence and Digital Infrastructure & Connectivity models. TSM reiterating its capital spending for this year between $28-$32 billion also supports the CHIPs Act model.

Turning to today’s economic docket, initial jobless claims and Philly Fed business outlook for April are expected to land at the same time before the bell. For the initial jobless claims, economists predict a rise to 215K, while Philly Fed business outlook is expected to fall to 1.5. Later this morning comes the March Existing Home Sales report, which is expected to show a fall to a rate of 4.20M from 4.38M in February.

In terms of Fed speakers, we have three on tap for today - Fed Governor Michelle Bowman (9:05 AM ET), New York Fed President John Williams (9:15 AM ET), and Atlanta Fed Raphael Bostic (11 AM ET, 5:45 PM ET). Coming off Fed Chair Powell’s remarks on Tuesday icing expectations for rate cuts and yesterday’s Fed Beige Book finding the economy grew slightly faster, businesses adding more workers, and little progress on lowering inflation, we should not expect meaningfully different comments from this trio of Fed heads later today.

For those that may have missed them, Powell’s latest message was that "…. recent data have clearly not given us greater confidence and instead indicate that it's likely to take longer than expected to achieve that confidence."

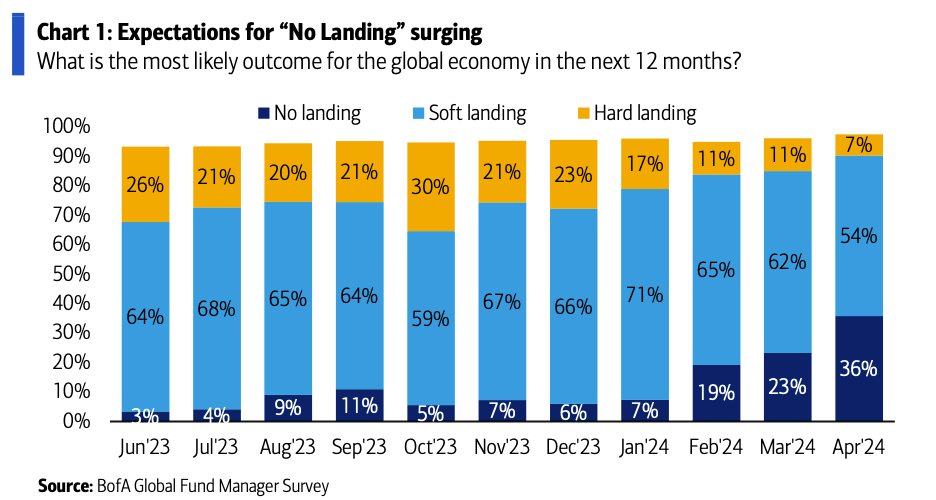

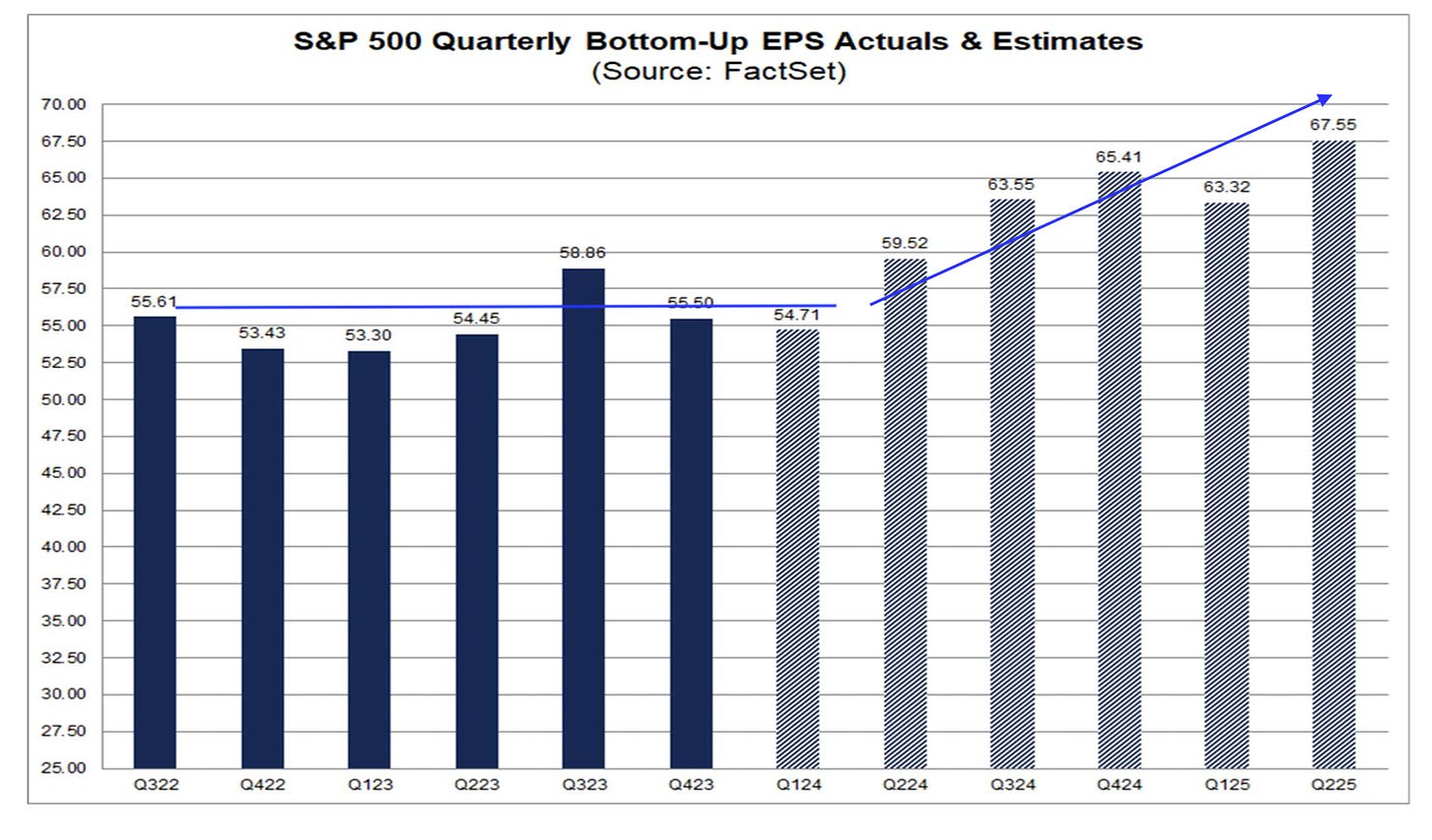

No surprise to those of us who have been eyeing recent inflation data, but other economic data this week led the Atlanta Fed’s GDPNow model to revise its 1Q 2025 GDP expectation to +2.9% up from 2.3% earlier this month. That supports the current market narrative of an improving economy, more folks working with real wage growth occurring, and companies investing alongside infrastructure and other stimulus spending. Such a combination is expected to drive favorable EPS prospects despite monetary policy being restrictive. While it may not be a popular thought, in that environment, imagine what would happen to inflation if the Fed started to cut too soon…

Next week, the pace of quarterly earnings picks up and as we close it out, we’ll have a much better sense of how well March quarter guidance stacks up against market expectations. Our thinking is that will determine the market’s next move.

More By This Author:

More Bank Earnings, Housing Starts, Waiting On Israel And PowellFed Speakers, 10-Year Treasury Yield, And The Dollar

ADP Jobs Data, March Service PMs, Powell, And The Fed Heads

Disclosure: None.