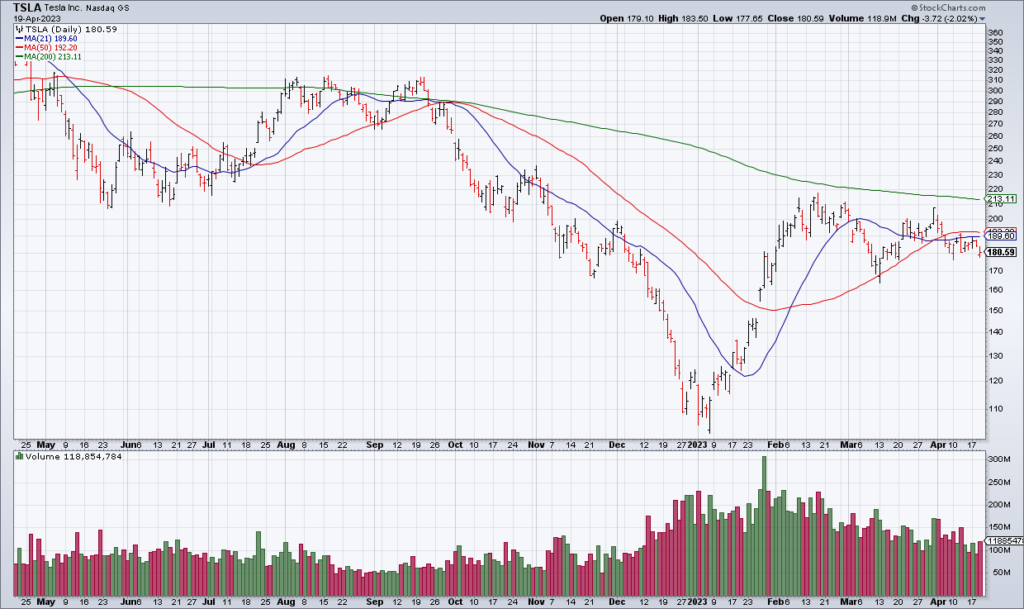

TSLA: Margin Squeeze

(Click on image to enlarge)

Tesla (TSLA) reported 1Q23 earnings Wednesday afternoon and margins were squeezed by price cuts. TSLA cut prices to maintain volumes at the expense of profitability. That is probably the right long-term decision but it resulted in a hit to profitability for the quarter.

Adjusted EBITDA Margin fell 849 basis points from a year ago to 18.3%. As a result, Non-GAAP diluted EPS fell 21% to 85 cents.

TSLA stock has had a great run this year – and I continue to like shares long term – but it has probably gotten ahead of itself. The stock is currently -6% in the after-hours.

More By This Author:

NFLX Is Not A Growth Stock Anymore

KMX: Great Companies Will Adopt But The Macro Environment Is Brutal

ACI Is Significantly Undervalued