TSLA Beats Top- & Bottom-Line: Record Revenues As Margins Decline

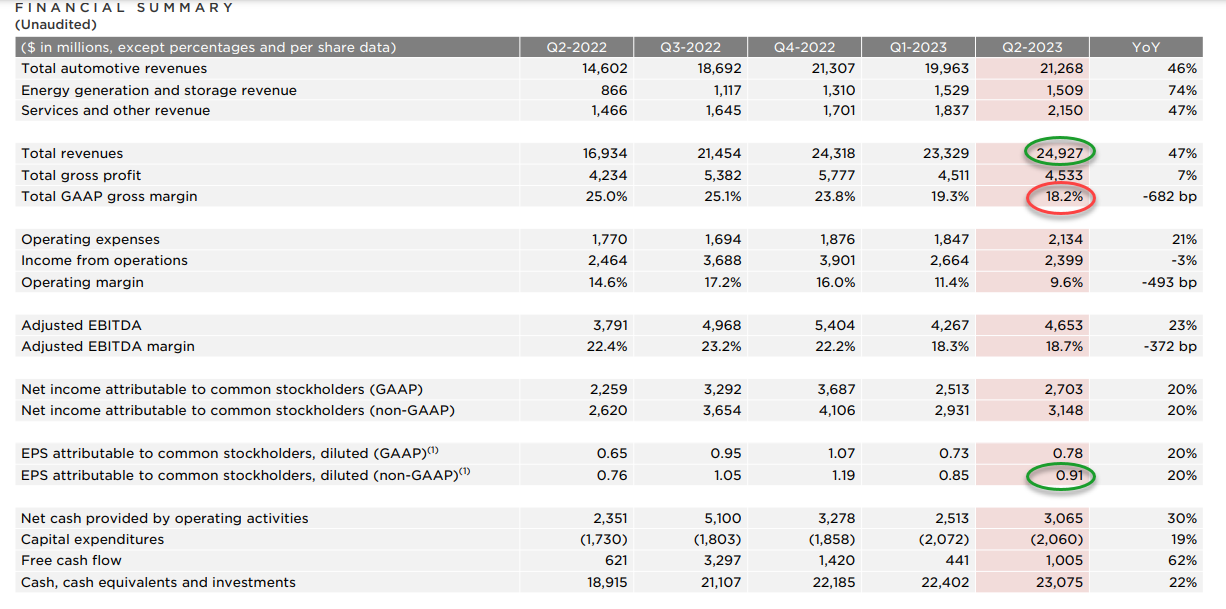

The headline from TSLA's earnings tonight for Q2 2023 appear positive with top- and bottom-line beats:

- *TESLA 2Q REV. $24.9B, EST. $24.51B

- *TESLA 2Q ADJ EPS 91C, EST. 81C

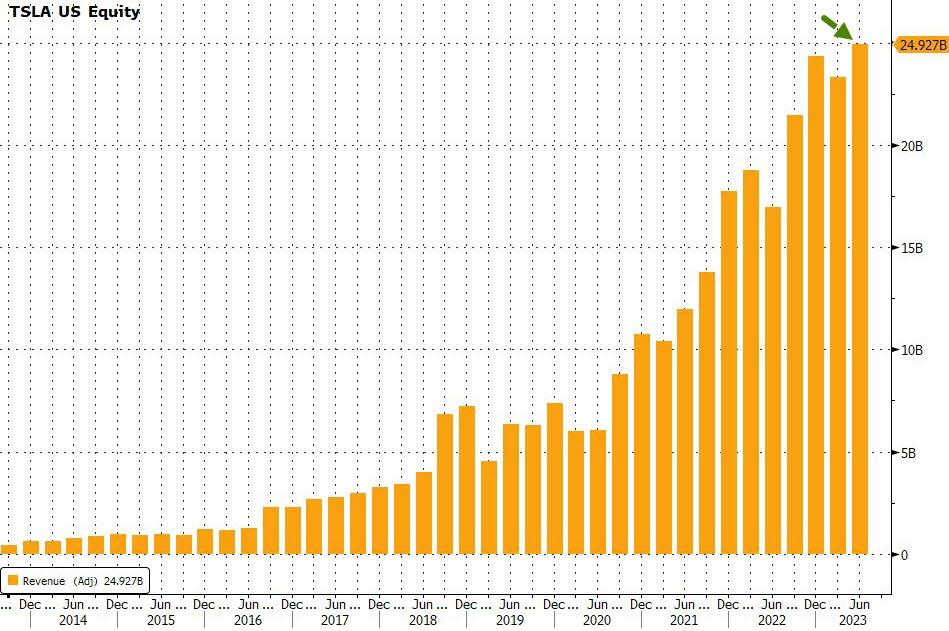

That is a record revenue for TSLA...

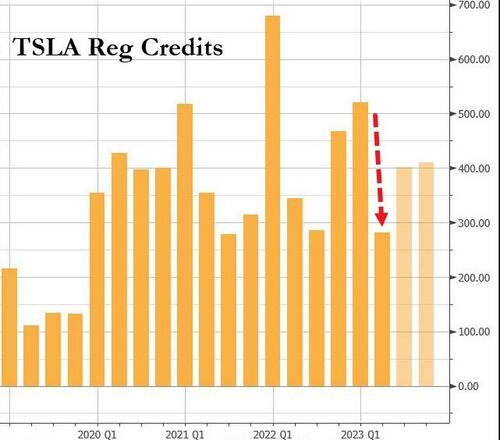

There was a big drop in regulatory credits this quarter - $282 million, down from $521 million in the prior quarter.

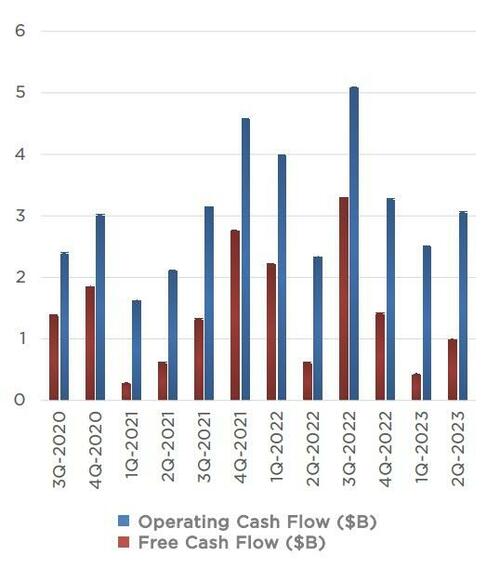

But free cash flow disappointed:

-

*TESLA 2Q FREE CASH FLOW $1.01B, EST. $2.18B

And margins declined disappointingly:

-

*TESLA 2Q GROSS MARGIN 18.2%, EST. 18.8%

Tesla attributes its gross margin and operating margin declines to:

- price cuts

- cost of ramping the new 4680 battery cells

- cost of getting Cybertruck into production (as well as “AI and other large projects”)

- negative FX impact

The company said:

"Q2-2023 was a record quarter on many levels with our best-ever production and deliveries and revenue approaching $25B in a single quarter. We are excited that we were able to achieve such results given the macroeconomic environment we are currently in."

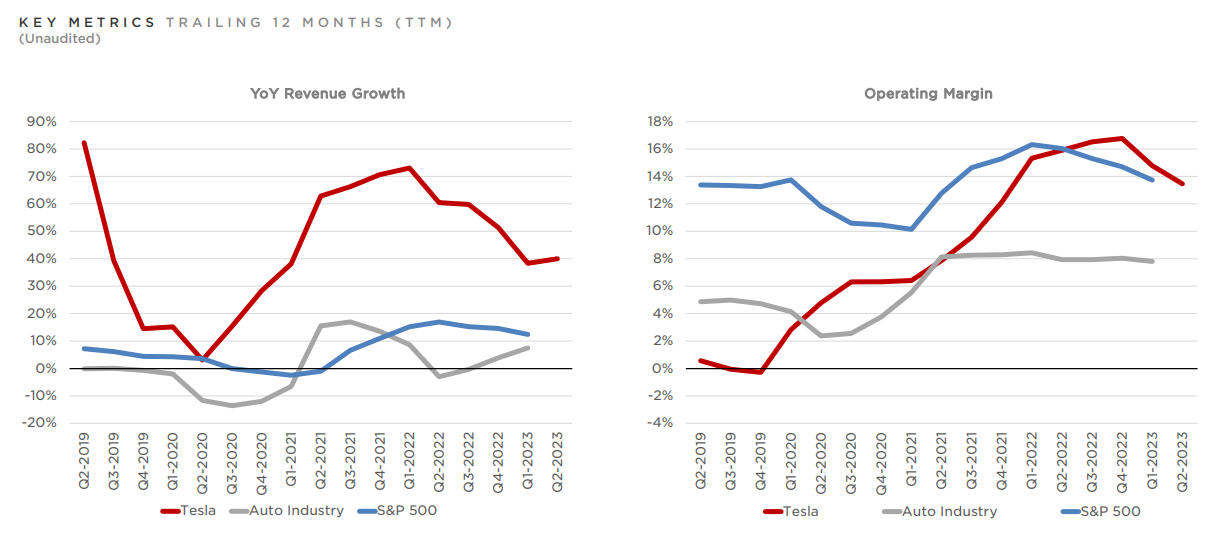

(Click on image to enlarge)

Revenue growth accelerated in Q2 (as margins declined)...

(Click on image to enlarge)

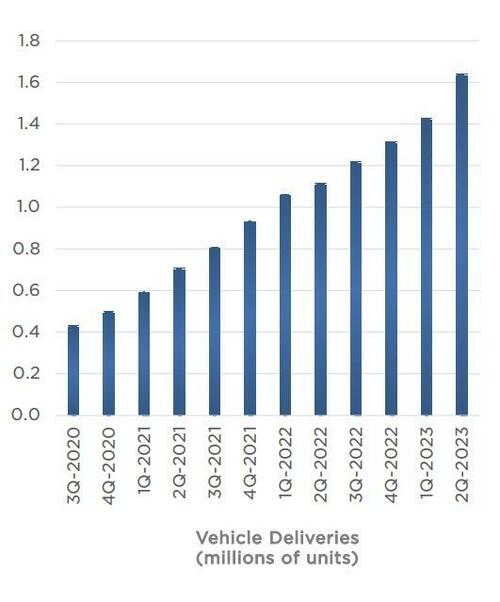

Tesla confirmed that it sees fiscal year production of 1.80 million vehicles (expectations are for 1.88 million)...

Tesla's share price is swinging around wildly after hours, up modestly as we print...

(Click on image to enlarge)

Finally, we note that Tesla says Cybertruck remains on track to begin initial production later this year at Gigafactory Texas.

Musk wants to make it clear that Tesla is an AI company:

"Our commitment to being at the forefront of AI development entered a new chapter with the start of production of Dojo training computers. We are hopeful that our immense neural net training needs will be satisfied using our in-house designed Dojo hardware. The better the neural net training capacity, the greater the opportunity for our Autopilot team to iterate on new solutions. "

Tesla concludes: "The challenges of these uncertain times are not over, but we believe we have the right ingredients for the long-term success of the business through a variety of high potential projects."

More By This Author:

Morgan Stanley Slides As Sales & Trading Disappoint; Credit Loss Provisions Soared

U.S. Airport Traffic Returns To Pre-Pandemic Levels

Endgame: US Federal Debt Interest Payments About To Hit $1 Trillion

Disclosure: Copyright ©2009-2023 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies ...

more

Beating doesn't mean much these days since the numbers they have to beat are just made up by someone and they don't tell the full story. Just for headlines as it doesn't mean the company is doing better or worse.