Trump Pushes Off EU Tariff Deadline, Lifting Equity Futures, But...

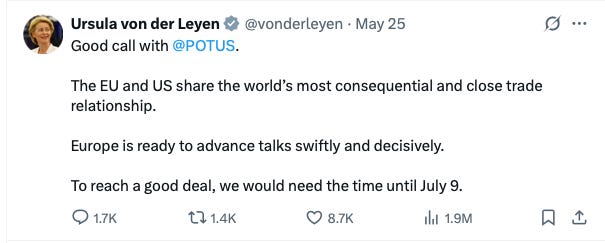

Coming off yesterday’s Memorial Day holiday, one that had the US stock market closed, futures are ripping higher this morning following President Trump delaying the introduction of 50% tariffs on EU imports until July 9. After complaining last week that trade talks with the EU were going nowhere, it appears Trump’s bombastic strategy to jumpstart those conversations by threatening those 50% tariffs starting June 1 worked. Over the weekend, President of the EU Commission Ursula Von der Leyen tweeted, “Good Call with @Potus… Europe is ready to advance talks swiftly and decisively.”

While the market enjoys this quick rebound, which should offset the market’s move lower last week, investors have a crammed schedule this week as we once again try to fit five days of data and developments into four. Looking at the economic data and earnings calendars, you’ll see it's stacked toward the second half of the week, which also happens to be the end of May. Following the US-EU trade development, the two biggest pieces of economic data the market will face are the next iteration of the Fed’s monetary policy meeting minutes due Wednesday afternoon, and the April PCE Price Index data on Friday.

In terms of those market focal points, given the inflation findings in S&P Global’s Flash May PMI report as well as comments from a growing list of companies that price increases are on the way, we would once again argue their contents will skew more toward the rearview mirror than breaking new ground. To us, more meaningful data to watch will come in early June when we get ISM’s May PMI data and what it says about inflation, as well as the pace of job creation.

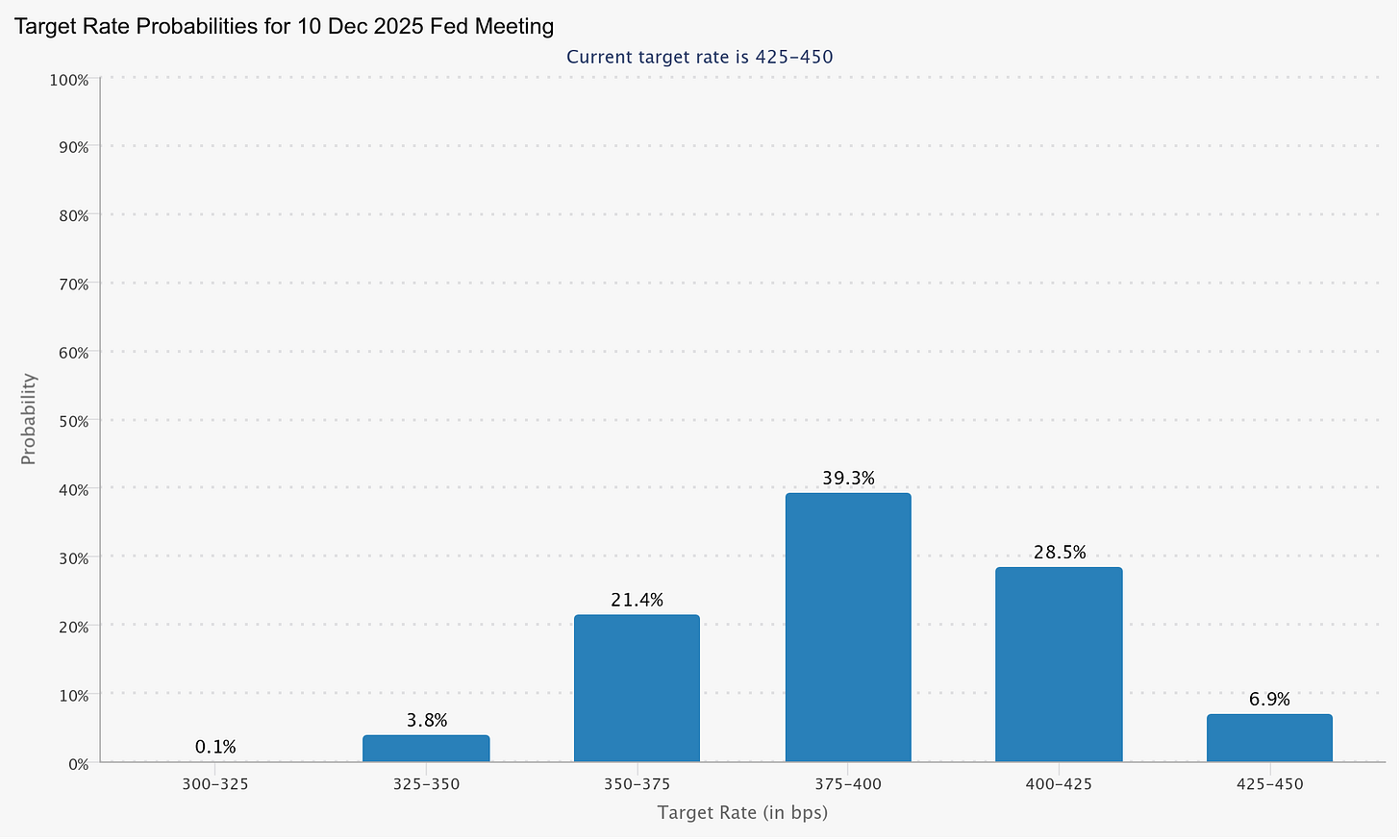

We’ve also started to see Fed officials telegraph rate cuts are likely off the table at least until the Fed’s September policy meeting. While that strongly implies a rate cut is off the table following the central bank’s next policy meeting, which concludes on June 18, it does mean we will be very interested in what its updated set of economic projections call for. Remember, the last set of those projections from March showed just two rate cuts penciled in for the year; as of now, the CME FedWatch Tool still shows the market expecting three.

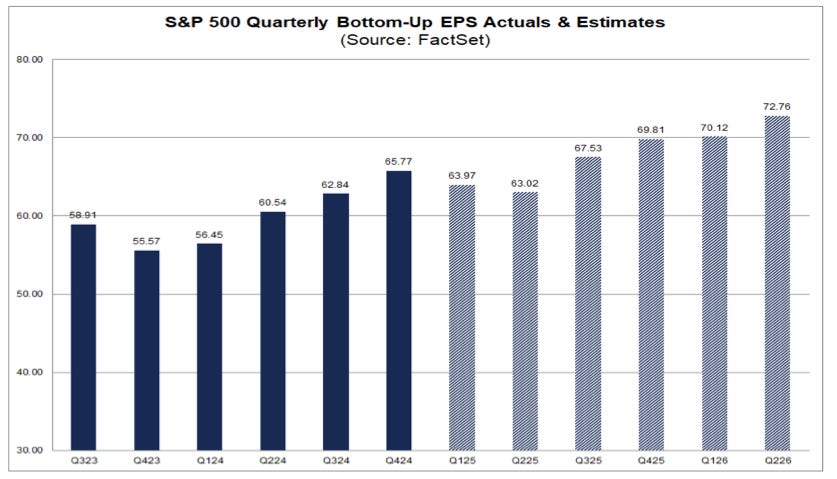

The vacuum between those policy minutes and the April PCE Price Index data will be filled by a combination of quarterly earnings reports, including the one from market heavyweight Nvidia (NVDA), and the next wave of investor conferences. During those investor conference presentations, we’ll be interested in what management teams say not only about the current quarter but also how demand patterns, tariffs, and corresponding uncertainty are influencing their thoughts about 2H 2025.

What we’ll be trying to ascertain ahead of the June quarter earnings season are the odds that the basket of companies that comprise the S&P 500 will deliver 8% EPS growth in 2H 2025 compared to 1H 2025? The answer will likely impact investor conversations around market multiples, but it will also be one that hinges on trade deals and the passage of Trump’s “big, beautiful bill”. For those, it means keeping eyes on Washington.

Nvidia shares are the second-largest component for the S&P 500 (~6% ) and the Nasdaq 100 (more than 11%), which means it will be one of the most closely watched reports in recent weeks, with ample eyes pouring over its guidance. While the signals we’ve shared for AI and data center point to robust activity, the question is once again whether Nvidia can not only top market consensus forecasts but also those stretch whisper figures, which tend to be a good deal higher than those consensus figures. When Nvidia missed whisper figures for its last quarter, the shares dropped 8% the next day and trended lower in subsequent days. Something to keep in mind as we watch the market rebound today.

In addition to Nvidia, we will also be parsing results and comments from Elastic (ESTC), Marvell (MRVL), HP (HPQ), Dell (DELL), Best Buy (BBY), and Salesforce (CRM) about AI and data center, cloud, and AI PC demand. e.l.f. Beauty (ELF) shared last week that it will be boosting prices on some products, and with that in hand, we expect we will be hearing more of the same from other retailers next week. We also wouldn’t be shocked to see them follow in the footsteps of Ross Stores (ROST), American Eagle Outfitters (AEO), and others that withdrew their guidance. We’ll also be listening for comments about the use of markdowns and promotions, which could weigh on margins but also signal that consumers continue to tighten their belts.

More By This Author:

Home Depot & Homebuilding Earnings, May Flash PMI Coming SoonWhat To Watch As The Market Nears Being Overbought

April Inflation & Retail Sales Data Ahead, But Why Earnings Will Matter More

Disclosure: None.