Trump Media & Technology: Show Me The Money

Image Source: Pexels

Before Donald Trump was president, I covered many different announcements from the man. That included the opening of Doral in Miami, Florida, the Trump Hotel in Washington, D.C., the golf course in Aberdeen, Scotland, and many others. I’ve been on The Apprentice set, and I even witnessed Trump announce his election to run for office in 2015. All these announcements were somewhat predictable.

After all, I had been in close contact with Trump. I usually knew what to expect. I even knew Trump was running for office before most people. He asked me my opinion long before his official announcement. But this recent announcement really surprised me.

Trump Media Bets Big on Fusion

The news was that Trump Media & Technology (DJT) is merging with TAE Technologies in a $6 billion deal. That came out of left field. After all, we’re dealing with a public company and the Securities and Exchange Commission (“SEC”).

For a bit of context, TAE Technologies is a company that focuses on nuclear fusion technology. Fusion is different than traditional nuclear fission power, which generates power from splitting atoms. As the name suggestions, fusion combines atoms to generate power. Put even more simply, it’s the power of the sun.

If achieved at scale, fusion has some breathtaking implications – virtually limitless, clean energy to power the world for years to come. TAE Technologies is a global leader in fusion power with five reactors built to date that targets utility-scale power generation.

Looking into TAE Technologies, there’s no question that the company has a track record for innovative value creation. The company touts 4 Nobel Prize laureates, 8-plus U.S. Department of Energy awards, 8 scientific awards, and 7 Maxwell Prize winners.

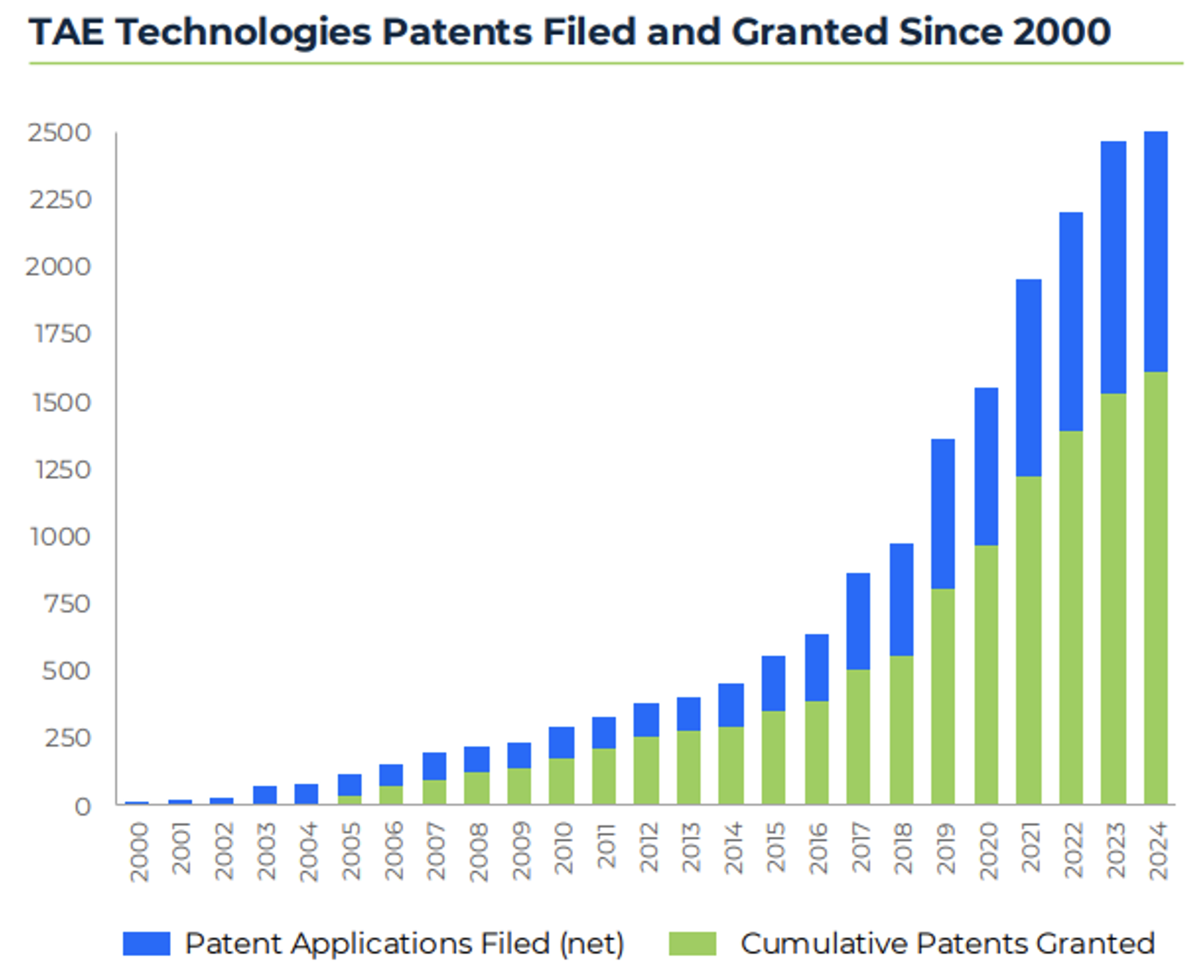

More impressive, TAE Technologies has over 1,600 patents granted for licensing of proprietary products with a track record of innovation that could lead to future value creation.

Source: DJT Investor Deck

Nonetheless, as impressive as TAE Technologies is, why the heck is Trump Media considering this merger?

An Unlikely Couple

To date, Trump Media is still a special purpose acquisition company that owns a social-media platform (Truth Social), streaming platform, financial services, and a financial technology brand (incorporating America-first investments).

TAE Technologies, as we just covered, is a young company with an ambitious goal of realizing nuclear fusion at scale. At first glance, it seems like an odd paring. But the answer is actually simple: TAE Technologies needs capital to build nuclear fusion reactors.

The company is targeting fusion-generated electricity in 2031, or five years from now. And to accomplish that goal, it’s going to need funding. Trump Media can provide it.

According to filings, TAE Technologies is receiving up to $300 million in cash before the deal closes (Trump Media has roughly $850 million in cash and short-term investments), and the merger will be formed by 50% Trump Media shareholders and 50% of TAE Technologies shareholders.

Trump Media’s CEO Devin Nunes and TAE Technologies’ CEO Michl Binderbauer will become co-CEOs. The deal should close in mid-2026, subject to closing conditions and shareholder approval (by both companies).

Now, keep in mind, $300 million is not enough to build a nuclear fusion reactor. Washington-based Helion raised $425 million in January in a Series F round that brought total funding over $1 billion with the goal of being the first to produce usable electricity through nuclear fusion. So, $300 million is just a down payment. TAE Technologies will need an almost infinite supply of cash to capitalize on its mission.

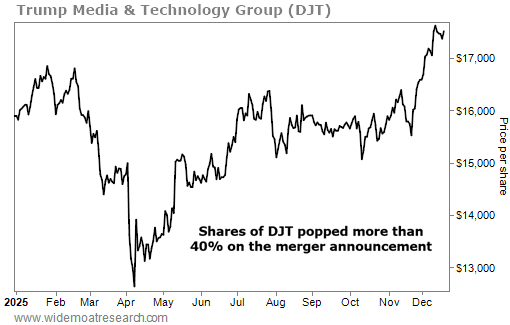

Trump Media investors appeared to like the announcement – the stock moved up about 44% on the news. But, before you rush in, a word of caution.

A Long Road Ahead

Trump Media investors have been simply buying into the hype. Yes, it is a big development. But to date, there’s no land, no buildings, and no commercial fusion reactor -- just some very impressive intellectual property.

I recently wrote an article explaining why I don’t invest in IPOs and start-ups. I specifically called out data-center startup Fermi (FRMI), which has seen its shares plummet from over $30 to a recent close of $8.22. Ouch.

But as you can see depicted below, investors have been piling into Trump Media on the news of a shiny, new toy.

Keep in mind, Trump Media is a special purpose acquisition company in which Donald Trump’s ownership stake is held in a trust (managed by Donald Trump Jr.) that is now valued at more than $6 billion (combined entity). Clearly, this valuation isn’t justified based on existing Trump Media’s revenue, which is less than $4 million annually, and TAE Technologies’ impressive intellectual assets.

Obviously, the Trump family wins here as their 52% stake in Trump Media increased by more than $500 million as a result of the merger deal with TAE Technologies.

In addition, TAE Technologies is also a winner with the deal as the company now has a quicker path to liquidity, with obvious benefits to being able to scale the fusion business without waiting for SPAC approval or listing shares. But I’m not so sure Trump Media shareholders win here -- at least not yet.

At Wide Moat Research, we focus on cash flow investing and assets that create shareholder value. While I agree that energy independence is critical to maintaining American dominance, there’s still a long road ahead before this new company can generate fundamentals that justify its lofty price tag.

I continue to believe there are better opportunities out there with real assets that are generating stable and reliable cash flow.

More By This Author:

Our Biggest Stock Wins & Mistakes Of 2025: Portfolio In ReviewTrump’s Gift To The Cannabis Sector

Land Rush 2026: The Biggest AI Real Estate Opportunity In A Decade?

Disclosure: I am co-owner of an exchange-traded fund index that is affiliated with DJT’s financial services and fintech business. I do not own shares of DJT.

Brad Thomas is the Editor of ...

more