Trump And April Tariffs - Will He Or Won’t He?

Photo by Natilyn Hicks Photography on Unsplash

Market Recap

The “On-Again, Off Again” tariff game played heavily into yesterday’s market action. This is to say that, as we already know, freer markets are happy markets. Small caps led the way, with the Russell 2000 rising 2.55%. Exposure to Mag 7 and technology in general was additive, evidenced by the Dow gaining 1.42%, the S&P 500 adding 1.76%, and the Nasdaq Composite closing 2.27% higher. Indeed, 6 of the Mag 7 names (excepting Microsoft [MSFT]) featured in the top 10 contributors to the performance of the SPDR S&P 500 ETF Trust (SPY) with the remaining slots filled in by Eli Lilly (LLY), JP Morgan Chase (JPM) and Visa (V).

All sectors except Utilities (-0.18%) were higher, and Consumer Staples were essentially flat as staples producers like Kimberly Clark (KMB), Kraft Heinz (KHC), and Proctor & Gamble (PG) posted losses that were just about offset by gains from staple retailers like Costco Wholesale Corp (COST), Walmart (WMT), and Target (TGT). Consumer Discretionary saw the largest jump, rising 2.98%, buoyed by Amazon (AMZN) and Tesla (TSLA) combining to contribute to 66% of the sector’s result.

The Cboe Market Volatility Index (VIX) continued to retreat, falling just over 9% to close at 17.48 but despite this, gold remained elevated, trading at $3,008.80/oz in the early evening. Oil traded higher in the overnight session as news broke that Iranian oil tankers have been using forged Iraqi paperwork to evade sanctions.

The Tematica Select Model Suite saw positive results across the board with the expected exclusion of Market Hedge which gave back about half of its 8% quarter-to-date excess return over the S&P 500 Index as of Friday’s close given the broad index’s rally. Leadership in the suite came from Space Economy and Nuclear Energy & Uranium.

Trump and April Tariffs - Will He or Won’t He?

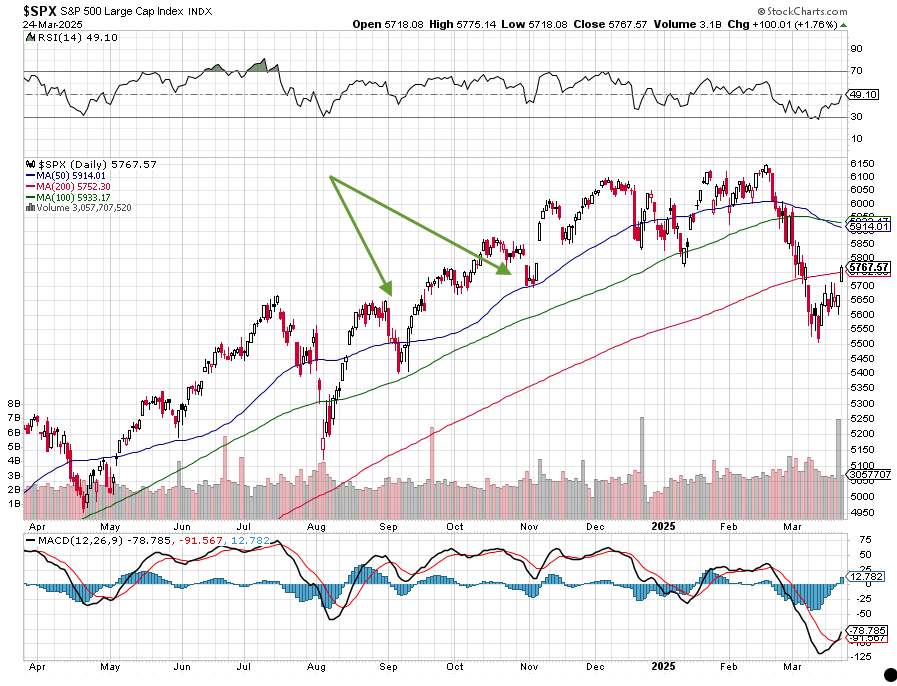

Following yesterday’s pop in the market, futures point to equities giving a fraction of those outsized gains back this morning. That move, which was fueled by potentially less-than-feared April Trump tariffs, led the S&P 500 to move even further away from being oversold and closing over its 200-day moving average. The question is does that become a level of support for the S&P 500? If the answer is “yes” that market barometer has the potential to climb another 3% or so until it hits another wall of resistance between 5,914-5,933. That would be enough to land the S&P 500 in positive territory on a year-to-date basis.

Ahead of Trump’s April 2 line in the sand, European Union trade chief Maros Sefcovic is scheduled to meet Tuesday with Commerce Secretary Howard Lutnick and US Trade Representative Jamieson Greer. Also, ahead of the day, Trump is calling “Liberation Day”, India’s government is likely to see tariff exemptions as part of scheduled bilateral trade talks early next week.

Would it be like Trump to announce trade deal wins and a smaller set of tariffs, touting it as a win? Let’s remember, the president fancies himself a great deal maker, so it is possible. And while Trump has downplayed the stock market’s February slide and the potential impact of tariffs on the economy, he has historically used both as a barometer of his presidential performance. Should that be the outcome we get, we could see the market’s relief rally continue.

However, if that isn’t the outcome, the impact of tariffs that are put in place and countries on the receiving end to respond in kind, odds are high companies will serve up disappointing June quarter guidance in the coming weeks. The ensuing pressure on 2025 EPS expectations for the S&P 500 would rekindle valuation questions, and likely lead to a bumpy patch in the market similar to what was experienced with the S&P 500 in September and October of last year.

This means over the next several days, investors will be focused on Trump’s comments even as we get the next pieces of economic data, and potentially at least some negative earnings pre-announcements. Since we’ve laid out some potential scenarios for the coming days, as evidenced in The Art of the Deal the president believes that being bold, assertive, and sometimes unpredictable keeps opponents off balance, giving him an upper hand. While Trump may be comfortable in that landscape, it’s far less comfortable to Wall Street, which prefers predictability.

More By This Author:

Nike, FedEx, And Micron: Setting The Tone For Q2 2025 GuidanceTrump And Nvidia Today, Tomorrow Brings The Fed

Stocks May Have Rebounded But Headwinds Remain Ahead

Disclosure: None.