Trivago Set To Travel South

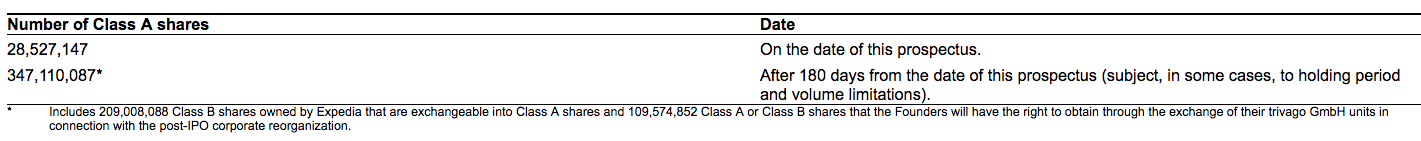

A restriction that prevents major pre-IPO shareholders from selling their shares right after an IPO, the lock-up period generally lasts 180 days for companies following their initial public offerings. The 180-day lock-up period for Trivago N.V. (Nasdaq: TRVG) is scheduled to expire on June 14, 2017.

After that date, the pre-IPO shareholders will be able to sell their 374M restricted shares. This could potentially flood the market, causing the stock price to drop and presenting an opportunity for investors to sell or short their shares in advance of the event.

(Click on image to enlarge)

(Source: SEC Filings)

Company overview

Trivago is an international search platform that consumers can use to compare hotels by location to find the best hotel at the lowest price. For the year that ended on Sept. 30, 2016, the company reported that it had 487 million searches and offered access to 1.3 million hotels in 190 countries. Users do not purchase the hotels on the website. Instead, they are referred to other websites in order to complete their transactions through referrals. The company is headquartered in Dusseldorf, Germany.

Management overview

The chief executive officer of Trivago, Rolf Schrömgens began serving as a managing director of the company in 2016 and has served in that role for Trivago GmbH since 2005. Previously, Schrömgens founded ciao.com and served as its vice president from 1999 to 2001. He holds a diploma in management from Leipzig Graduate School of Management.

Axel Hefer is the chief financial officer and was appointed in 2016. He has also served as a managing director for Trivago GmbH since 2016. Previously, he served as the CFO and chief operating officer of Home24 AG and as a managing director of One Equity Partners. He holds a diploma in management from Leipzig Graduate School of Management and a Master of Business Administration from INSEAD.

Recent IPO performance and financial highlights

Trivago priced its IPO at $11 per share. On its market debut, it opened up at $11.20 per share and closed up 7.7 percent at $11.65 per share. Since its debut, the company has demonstrated a strong early market performance. Its share price has steadily climbed, and it most recently closed at $18.66 on June 5, 2017.

Trivago's first-quarter earnings report offered good news to investors. Its first-quarter earnings soared by 68 percent year-over-year from the same period in 2016. For the three months that ended on March 31, 2017, the company reported total revenues of €267.6 million while in the same time period in 2016, it reported total revenues of €159.4 million. The company also became profitable, reporting a net income of €7.7 million during the quarter as compared to a loss of € (0.1) million during the first quarter of 2016.

Conclusion: Recent Success Bodes Well For Quick Short Sale

Trivago's strong performance since its IPO, combined with its substantial increase in revenues and its turning profitable, may lead some of its pre-IPO shareholders to want to take advantage of the strong increase in its price. This may lead them to offer their shares, flooding the market and causing the price to fall.

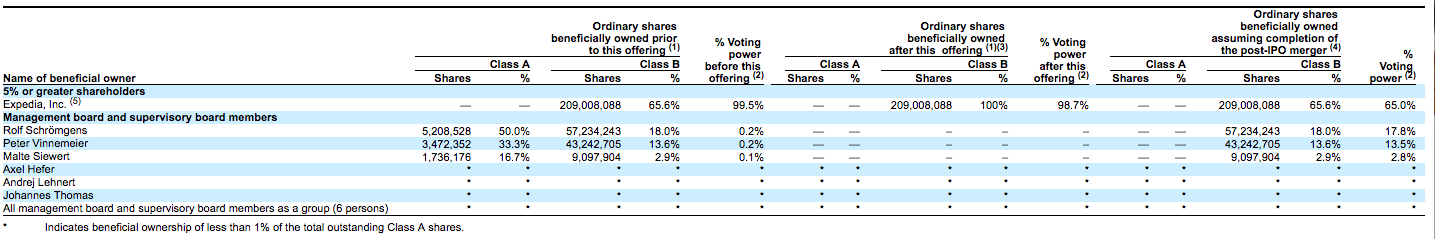

Expedia is trivago's major shareholder, possessing 65.6% of shares. The firm is followed by three key individuals. If any of these insiders decides to sell even a portion of their holders, it could significantly depress TRVG price.

(Click on image to enlarge)

(S-1/A)

We believe this may present a good opportunity to short or sell shares in advance of the lockup period expiration in order to take advantage of the likely price drop.

Disclosure: I am/we are short TRVG.

Disclaimer: I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any ...

more