Tracking Grizzly Bears

This morning (so far), stocks and bonds are rebounding on relief that US CPI in July eased to 8.5% (consensus forecast was 8.7%) from 9.1% in June, suggesting that the US Fed may hike less than 75 bps in September. The drop in price pressure was led primarily by disinflation in used vehicles, air travel, communication, and apparel, while inflation continued in essentials for the masses like shelter, food and medical care.

Most importantly for the economic outlook and earnings, real incomes and productivity continue to slump to the lowest level in decades.

This morning marks Nasdaq’s 5th 2% gap-up day since the 2022 bear market began, and such rebounds are typical within ongoing bear markets.

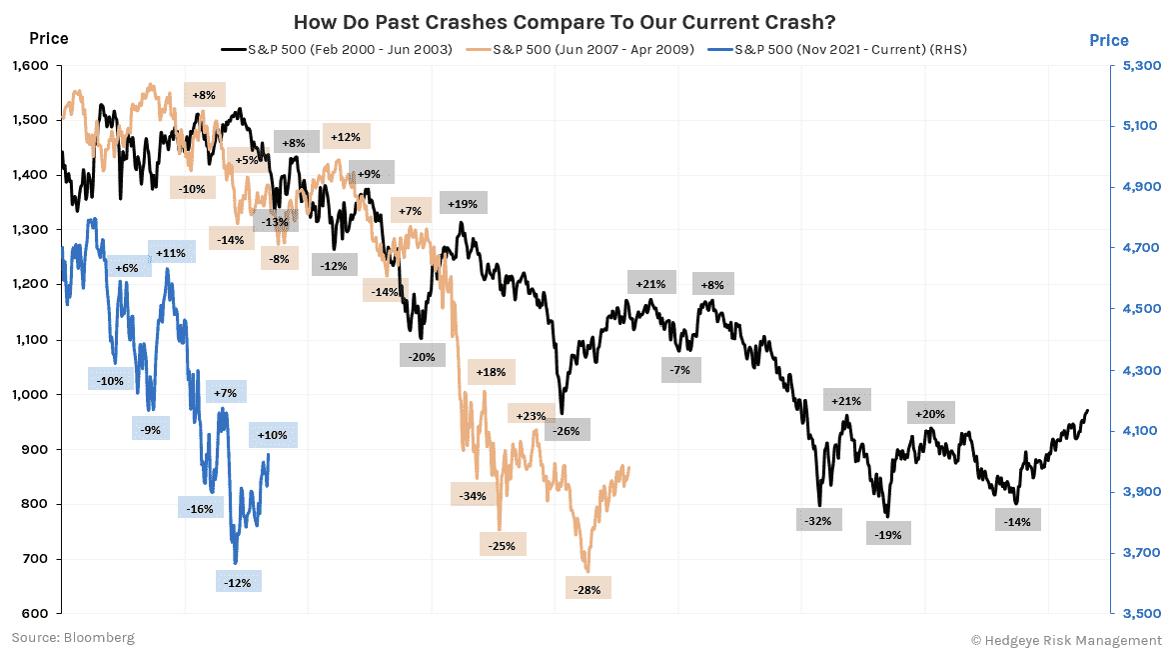

In the chart below, Hedgeye Macro analyst Ryan Ricci plots the S&P 500 recessionary bear markets of 2000 and 2008 compared with the current downturn. In terms of duration, the latest bear has lasted just 20% as long as 2000 and 37% as long as 2008.

Numbers on the chart show the interim bounces and drops within each bear cycle:

For 2000, the average up move was +15%, and the average down move was -18%.

For 2008, the average up move was +12%, and the average down move was -19%.

For the current bear, the average up move is +9%, and the average down move is -12%.

Ricci offers some useful context for the bullish chorus who never see downturns coming and continually urge us to buy stocks regardless of macrocycles:

“The largest bear market bounce in our current market is +11%, in 2008 +23%, and in 2000 +21%. Our current max bear market bounce (+11%) is lower than the average bounces in 2000 and 2008! Can you imagine all the talking heads in this country when there is a +23% bear market bounce?”

BOTTOM LINE: Patience should be a core asset allocation.”

Macro analyst Alfonso Peccatiello offers more historically informed insight in Bear Market Rally or Turning Point.

After a sharp decline in markets throughout 2022, many investors were caught off guard by the recent rally in equites. Is the bear market over? Should we expect a rally from here? “Hold your horses” says Alfonso.

More By This Author:

Contagion Between Public And Private Markets

Bear Market Update

Bears Are A Series Of Ladders And Snakes

Disclosure: None.