Top Stocks: Investment In The Energy Sector In 2022

Energy Sector’s Characteristics and Performance

The energy sector generates the highest returns compared with other sectors for S&P 500 Index. We are aware that the characteristics of the current energy stocks include the lowest forward P/E (8.5), the most predicted FCF yield (11.94%), the largest dividend yield (3.77%), and the highest anticipated FCF headroom (8.17%), an indication that there will continue to be a lot of free cash available for dividend increases or share repurchases.

(Figure 1: S&P 500 Different Sectors’ Performance)

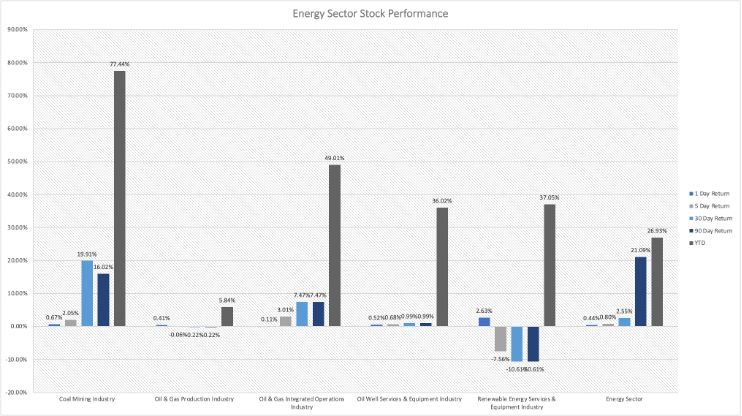

Renewable energy stocks, oil and gas stocks, and utility stocks are among the companies in the energy sector. This large sector of the economy is essential for supplying the energy required by the economy. The overall energy sector’s 1-day, 5-day, 30-day, 90-day, and YTD returns are all positive. The energy sector’s total return YTD is as high as 26.93%. In general, the stock market shows good performance for the energy industry.

(Figure 2: Energy Sector Stocks’ Returns for Different Time Periods)

Top Ten US Stocks in 2022

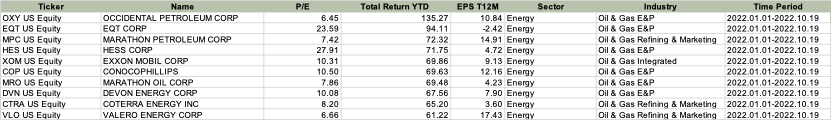

We pick the top 10 performance stocks with the best returns for 2022 (Total Return Year to Date). The top ten companies are all related to the energy sector and the Oil & Gas Industry. As a result, the energy sector, especially Oil & Gas, has thus far performed well on the market.

(Figure 3: Top Ten Performance Stocks in the US by Oct 19th, 2022)

The growing energy crisis in Europe, countries lowering their reliance on Russian oil and gas, and rising demand in advance of the winter are all expected to boost the energy sector. As we know, oil prices have typically been correlated with the performance of energy stocks. Despite a decline in crude oil prices, the energy sector is benefiting from strong earnings reports and rising natural gas prices as a result of the Russia-Ukraine conflict. The S&P 500 Energy Index has increased driven by some energy stocks’ good performance, like Devon Energy Corporation (DVN) and ConocoPhillips (COP) in the chart.

Global Energy Market Analysis

As concerns about the possibility of a worldwide economic recession have grown, crude oil prices have decreased to about $80 per barrel at the end of September from more than $120 in early June. Oil prices are anticipated to rise as a result of OPEC+’s announcement, on October 5, 2022, to reduce oil production by 2 million barrels per day from November. Rohan Reddy, director of research at Global X ETFs, believes that oil prices will most likely stay in the $90 to $100 area in the near future as market volatility is probably going to resume.

However, the U.S. had frequently urged the energy alliance to pump more in order to boost the global economy and reduce fuel prices prior to the midterm elections next month. Under Biden’s directive, another 10 million barrels from the Strategic Petroleum Reserve will be released by the Department of Energy next month. Considering OPEC+ action, the Biden Administration will also speak with Congress about other tools and powers to lessen OPEC’s influence over energy prices. As a result, the price of oil would fluctuate, as would the price of energy stocks.

(Figure 4: WTI Crude Price)

Since the Russian-Ukrainian War in February, Russia has cut back on natural gas exports and terminated agreements with a few nations. Additionally, the primary channel for western flows was entirely shut down due to potential NordStream system sabotage. European gas prices remain high. In late August, when the price of natural gas soared to 341 euros per megawatt hour from about 45 euros a year earlier, the front-month gas price at the Dutch TTF hub, a benchmark for natural gas trading in Europe, reached record heights. Today’s pricing for natural gas in Europe has reduced to approximately 100 euros per megawatt hour after some series of actions in the EU.

Natural gas prices have decreased as EU countries have improved their energy supplies, but they continue to be quite high historically and are a significant issue for the European economy. The European Commission has suggested placing a cap on daily gas trade levels. The objective is to prevent price increases that can result in family energy bills that are higher.

(Figure 5: Dutch TTF Price)

Suggestions for Investment in Energy Sector

For investors, the energy industry presents several difficulties, particularly for the oil and gas industry. Prices for energy can shift instantly. Energy demand and pricing can be significantly negatively impacted by the economy’s slowdown, which occurred during the epidemic. On the other hand, when the economy accelerates as it did in 2021, demand jumps, and prices typically rise along with it. We’d better pick a company with a stable financial position, manageable capital expenditures, and a low-risk business plan. Investors should concentrate on oil and gas firms that have the capacity to endure in the event that the industry suffers a severe decline.

Top Stocks: Conclusion

The top 10 US performance stocks in 2022 are all related to the energy sector. Energy price volatility has a significant effect on both energy sector stocks and the world economy. Many factors could cause such volatility, like COVID-19 and Russian-Ukrainian War.

More By This Author:

Space Of Chaos On The Stock Market

ASML Stock Forecast: Strong Top-Line Results

Chewy Stock Forecast: What’s The Pawtential?

DVN OXY EQT MPC HES XOM COP MRO CTRA VLO

Disclosure: This article originally appeared on Iknowfirst.com, a financial services firm ...

more