Top-Rated Stocks To Buy From A Variety Of Sectors After Earnings

There are a number of top-rated Zacks stocks standing out from a variety of sectors as investors eye Wednesday’s Federal Open Market Committee (FOMC) meeting.

With most eyes on the direction of monetary policy, here is a look at a few companies that may be ahead of the curve after beating earnings expectations on Monday.

A Promising Cloud Services Giant

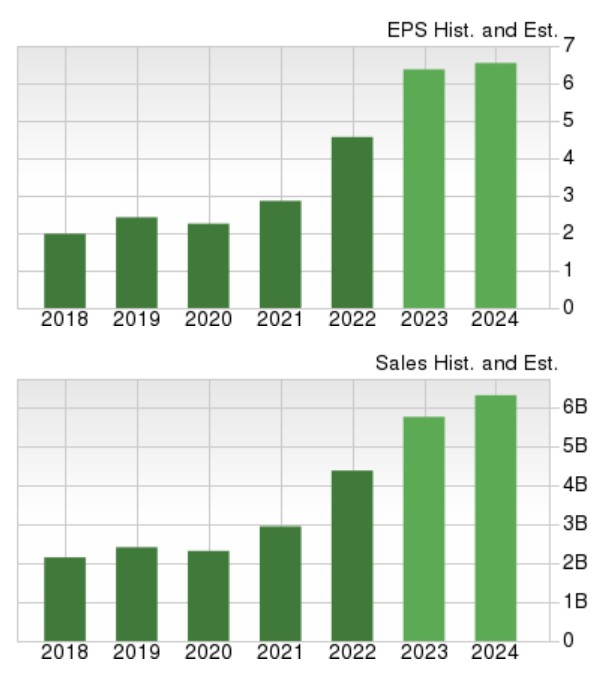

Among tech stocks cloud networking solutions provider Arista Networks (ANET) had a standout third quarter and easily surpassed top and bottom-line expectations.

Arista’s stock popped +14% today after Q3 earnings of $1.83 per share beat the Zacks Consensus of $1.58 a share by 16%. More impressive, Q3 earnings soared 46% year over year with sales of $1.50 billion topping estimates by 2% and rising 28% from the prior-year quarter.

Image Source: Zacks Investment Research

Catering its solutions to internet companies, cloud service providers, and enterprises, Arista’s annual earnings are now projected to soar 35% in fiscal 2023 to $6.17 per share with sales forecasted to climb 31% to $5.75 billion. Plus, Arista is expecting high single-digit percentage growth on its top and bottom lines in FY24.

Image Source: Zacks Investment Research

Transportation Leaders

The Zacks Transportation sector had two standouts on Monday in XPO (XPO) and Matson’(MTX). Both were able to beat top and bottom-line expectations and are enjoying favorable earnings estimate revisions.

Providing asset-based less-than-truckload (LTL) transportation primarily in North America, XPO’s Q3 earnings of $0.88 per share blasted expectations of $0.63 a share by 39% with sales of $1.98 billion topping estimates by 3%. Plus, fiscal 2023 earnings estimates have risen 5% in the last 60 days with FY24 EPS estimates up 7%.

Image Source: Zacks Investment Research

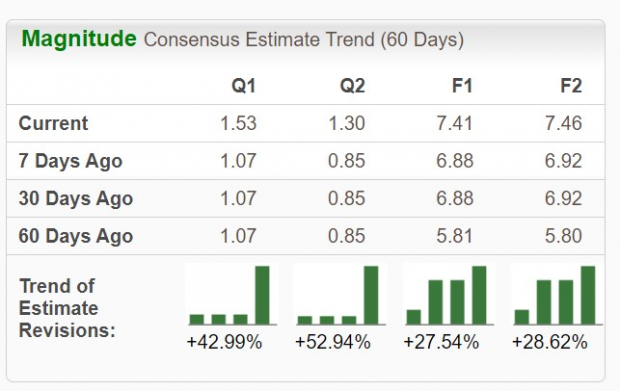

Offering international logistic services including rail intermodal service, truckload, and LTL, Matson’s Q3 earnings of $3.40 per share surpassed estimates by 1% with sales of $827.50 million coming in 1% above the Zacks Consensus as well.

More impressive, in the last two months, Matson’s FY23 and FY24 earnings estimates have skyrocketed 27% and 28% respectively.

Image Source: Zacks Investment Research

Undervalued Construction Titan

Lastly, Boise Cascade (BCC) is intriguing with its stock starting to stand out among the Zacks Construction sector.

Boise Cascade operates as a wood products manufacturer and building materials distributor engineering plywood, lumber, and particleboard. Third-quarter earnings of $3.58 per share beat expectations by 3% despite sales of $1.83 billion missing estimates by roughly -1%.

Furthermore, it’s noteworthy that Boise Cascade’s stock trades at just 7.9X forward earnings with annual EPS estimates modestly higher over the last 60 days offering further support to the notion that BCC shares may still be undervalued despite soaring +36% year to date.

Image Source: Zacks Investment Research

Bottom Line

With EPS estimates on the rise now looks like a great time to buy these top-rated Zacks stocks after impressively beating their Q3 earnings expectations and looking poised for more upside as they shape up to be viable investments for 2023 and beyond.

More By This Author:

Will Dow Jones ETFs Show The Halloween Effect?Bear Of The Day: Polaris

Caterpillar Q3 Earnings And Revenues Top Estimates

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any specific ...

more