Top Picks 2025: Kennametal

Image Source: Pexels

With an 86-year history in the metal cutting business, Pittsburgh, Pa.-based Kennametal Inc. (KMT) is just the kind of company you might expect to find in “Steel Town.” Founded in 1938 by metallurgist Philip McKenna, Kennametal today is a global leader in its sector.

It manufactures tungsten carbide metal cutting tools and supplies, doing business in more than 100 countries with a workforce of more than 8,400 employees. McKenna’s development of the tungsten carbide alloy for machine tooling allowed for much more precise and efficient cutting and shaping of steel, aluminum, and other metals. It also found eager adoption by companies engaged in mining, oil drilling, and various jobs that involved boring through rock and mineral formations.

Kennametal Inc. (KMT)

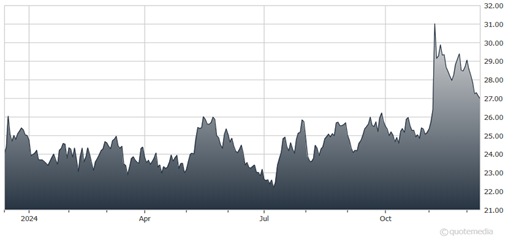

Expected revenue for 2024 of $2.07 billion is forecast to rise 1.1% relative to 2023, and earnings of $1.55 per share are seen rising by 5.4%. Trading at 16.6 times year-ahead earnings, Kennametal is priced 5.7% below its five-year average forward P/E of 17.6. Looking at trailing 12-month earnings, the discount to the five-year average is much steeper at 51%. As a multiple of revenue, the stock trades 17% below its five-year average price-to-sales ratio.

Kennametal has been a reliable dividend payer since it became a public company in 1967. Annual dividends of $0.80 per share are amply covered by free cash flow of $2.12 per share over the past 12 months.

CEO Sanjay Chowbey purchased $121,400 worth of company stock in June 2024 at $24.28 per share. Plus, the CEO has plenty of company among billionaire investors who are buying Kennametal stock. Millennium Management, headed by quantitative investing expert Israel Englander, reported owning 154,000 shares as of June 28, and increased its stake by 57,000 shares in the second quarter.

Clifford Asness’ AQR Capital Management reported a stake of 189,000 shares and added 51,000 shares to its position in the April-June period. Tudor Investment reported a stake of 270,000 shares at the end of June and inched up ownership by 19,000 shares in the second quarter. Among billionaire hedge fund managers, DE Shaw & Co. in its most recent 13F filing reported the largest stake in Kennametal at 482,000 shares.

More By This Author:

Top Picks For 2025: Boeing Co.Market Minute: Inflation Dips, Bank Earnings Pop, Stocks Soar

Top Picks For 2025: Dream Finders Homes

Disclosure: © 2024 MoneyShow.com, LLC. All Rights Reserved. Before using this site please read our complete Terms of Service, ...

more