Top Picks 2024: Marathon Digital

Image Source: Unsplash

There’s one word sure to get eyerolls: Bitcoin. You either love it or believe cryptocurrency is an untenable house of cards. But I’ll show you that, like many other currencies or commodities, Bitcoin enjoys a very predictable, boom-and-bust cycle. Marathon Digital Holdings (MARA) is a vehicle for profiting from this, writes Matthew Carr, editor of Tipping Point Profits.

If you want to rake in some serious gains in the year ahead, this is the cycle you need to know. Because it sets us up for the most predictable moonshot of 2024. You see, Bitcoin moves in a four-year cycle. This revolves around what’s known as “reward halving” - the most pivotal event for the crypto’s blockchain.

For the uninitiated, what makes Bitcoin (and other cryptos) unique is it’s designed to have a finite supply. There are only 21 million BTC. In the simplest of terms, crypto miners use high-powered computers to add blocks of transaction data to the Bitcoin blockchain. Once a miner completes a new block - and provides proof of their work - they earn a reward. That reward is Bitcoin.

However, the Bitcoin creators wanted to ensure that it would increase in value. So, they built in synthetic price inflation. After every 210,000 blocks are mined, the Bitcoin reward is chopped in half. And this happens roughly every four years.

The result is Bitcoin is harder to mine and the available new supply is reduced. The result? The price of the cryptocurrency surges. But here’s the deal: The next reward-halving is still a few months away. What we saw unfold in 2023 should be merely the warm-up to its next launch higher.

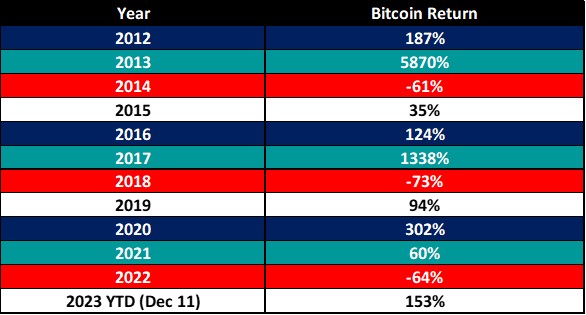

This table shows the annual returns for Bitcoin since 2012.

It’s my gift to you. Copy it, keep it, update it, and use it to make better decisions about trading Bitcoin and other cryptocurrencies today, tomorrow, and in the future. In the table, we see years of explosive gains and years of red. And if you’re an observant person, you’ve likely already noticed something very important: They take place four years apart.

So, what’s happening here? First, our three Bitcoin reward halvings took place on:

- Nov. 28, 2012

- July 9, 2016

- May 11, 2020

Those years are marked in dark blue. And we can see in each of those years, Bitcoin’s price rose triple-digits. But that reward-halving momentum carries over into the next year (the years in lighter blue). That’s because there’s a supply shock, prices jump, and it ignites the fear of missing out from investors who want their ship to be part of the rising tide.

Our next halving is in 2024. Now, you can own Bitcoin itself, or an ETF, such as the Grayscale Bitcoin Trust (GBTC). But my favorite is crypto miner is MARA. Moves here are more exaggerated than crypto. In fact, during the last reward-halving, shares surged 9,000%.

We see the same pattern from Bitcoin again and again and again. Maybe you ignored 2012, 2016, and 2020. Do you want to ignore 2024?

About the Author

Matthew Carr is the founder of First Bar with Matthew Carr, where he writes about all things money. He is also currently the trend investing strategist at Money Map Press.

For more than 13 years he served as chief trends strategist for The Oxford Club, earning ten awards for portfolio performance and trades of the year—more than any other strategist in the company's history. His strategic approach focuses on high-growth, pre-momentum companies trading at steep discounts.

More By This Author:

Top Picks 2024: CamecoTop Picks 2024: CTO Realty Growth

Inflation: A Deep Dive Into The Downturn – And A Look At What Comes Next

Disclaimer: © 2023 MoneyShow.com, LLC. All Rights Reserved.