Top Consumer Staples Aristocrats To Buy Amid Recent Market Volatility

Image: Bigstock

Among the conversation of stocks to consider during the recent market downturn, there is certainly opportunity brewing on the dividend aristocrats list. In 2023, there are currently 67 dividend aristocrats meeting the criteria by increasing their payouts for at least 25 consecutive years.

The consumer staples sector has heavy representation on the dividends aristocrats list, with several of these companies also being top-rated Zacks stocks at the moment. Here are a few to consider.

Pepsi (PEP - Free Report)

One of the most popular consumer staples stocks on the dividend aristocrat list is Pepsi, which has raised its dividend for 51 consecutive years, classifying the company as a “dividend king” (50 consecutive years or more).

More intriguing, Pepsi’s stock currently sports a Zacks Rank #2 (Buy), with earnings estimates modestly higher over the last 30 days for both fiscal 2023 and FY24 after the beverage giant slightly surpassed its third-quarter top and bottom line expectations earlier in the month. Notably, Pepsi’s annual EPS is now forecasted to expand 11% in FY23, and to rise another 7% next year to $8.10 per share.

Image Source: Zacks Investment Research

In addition to Pepsi’s sound growth, its current 3.12% annual dividend yield tops the Zacks Beverage-Soft Drinks Markets' 2.63% average and is well above the S&P 500’s 1.50% average.

Image Source: Zacks Investment Research

Walmart (WMT - Free Report)

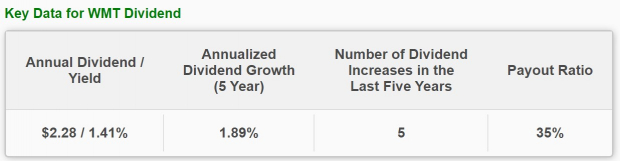

Another very familiar name among the consumer staples aristocrats is Walmart, with the retail supermarket leader raising its dividend for 50 consecutive years and now meeting the classification of a dividend king.

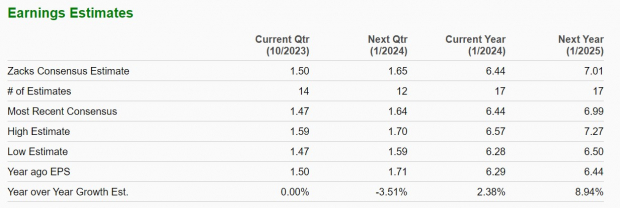

Walmart’s stock also sports a Zacks Rank #2 (Buy), with earnings expected to rise 2% in its current fiscal 2024 and jump another 9% in FY25 to $7.01 per share. Earnings estimate revisions for FY24 and FY25 are slightly up over the last 60 days.

Image Source: Zacks Investment Research

The omnichannel giant’s low-price offerings have remained ideal for consumers amid high inflation, with Walmart benefiting from its extensive reach including a growing e-commerce business and dominance in the grocery retail market. This makes WMT stock a viable option to hedge against market volatility, with Walmart's current dividend yield at a respectable 1.41%.

Image Source: Zacks Investment Research

Other Consumer Staples Aristocrats to Watch

Two more consumer staples aristocrats that investors may want to consider are The J.M. Smucker Company (SJM - Free Report) and Proctor & Gamble (PG - Free Report), with both similarly sporting a Zacks Rank #2 (Buy).

It's very noteworthy that these consumer staples titans are expecting high single-digit EPS growth in their current fiscal 2024 and FY25.

To that point, J.M. Smucker is a leading manufacturer of consumer food, beverage products, and pet food, with the company raising its dividend for 26 straight years. With a current annual dividend yield of 3.75%, J.M. Smucker's payout attractively tops the Zacks Food-Miscellaneous Markets’ 2.76% while being significantly above the S&P 500’s average.

Image Source: Zacks Investment Research

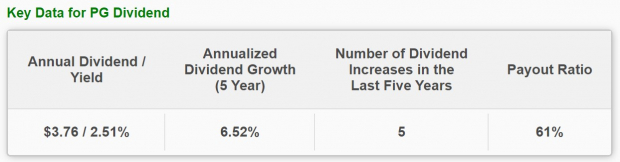

As for Proctor & Gamble, the company has a stronghold in regard to branded consumer products related to beauty, grooming, and healthcare. Proctor & Gamble is a dividend aristocrat and dividend king, as it has been raising its payout for the last 67 years with a current yield of 2.51%, which is slightly below its Zacks Soap and Cleaning Materials Market average but pleasantly above the benchmark.

Image Source: Zacks Investment Research

Bottom Line

Amid recent market volatility, the strengthening earnings outlook and reliable dividends of these somewhat essential consumer staples companies is hard to overlook, making now an opportune time to buy their stocks.

More By This Author:

3 Key Quarterly Releases To Watch Next Week - Saturday, Oct. 28These 3 Top-Ranked Companies Boast Robust Sales Growth

Roku Gears Up To Report Q3 Earnings: What's In The Cards?

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any specific ...

more