Top Best Gold Mining Stocks To Buy In 2022

Gold has always been one of the most valuable and profitable commodities, especially for long-term investors. During uncertain times, gold has kept the investors’ money safe and secure. Moreover, the advent of high gold prices in 2020 catapulted the industry to new heights.

Strengthened gold prices have led to the gold industry performing well on most economic key performance indicators, (as per the McKinsey Report):

- Returns to shareholders: The industry generated a TRS of approximately 33% as of December 15, 2020

- Balance-sheet health: Gold companies improved on leverage ratios in 2020. Leverage ratios for the gold industry are expected to be significantly better than other mining industries.

- Fundamental performance: Revenue for the next 12 months is expected to be even higher relative to that of the previous 12 months. Similarly, the margin is also expected to improve significantly over the next year

Photo by Michael Steinberg from Pexels

According to the Australian Government’s Department of Industry, Science, Energy, and Resources (DISER), the world’s gold mine production is forecast to increase by 5.5% (to 3,588 tonnes) in 2021, by 3.0% (to 3,696 tonnes) in 2022, and by 2.0% (to 3,769 tonnes) in 2023. In light of the increased production and strengthening of the gold industry, now is the best time to invest in gold mining stocks. Here we have compiled a list of 10 gold mining stocks that are likely to benefit hugely from the growth in the industry:

| Sr. | Company Name | Symbol | Market Capitalization | Price (as of 21st January 2021) |

| 1. | Freeport-McMoRan Inc. | FCX | $ 60.19 Billion | $ 40.99 |

| 2. | Newmont Corporation | NEM | $ 50.3 Billion | $ 63.09 |

| 3. | Barrick Gold | GOLD | $ 34.6 Billion | $ 19.34 |

| 4. | Franco-Nevada | FNV | $ 25.135 Billion | $ 130.62 |

| 5. | Newcrest Mining | NCMGY | $ 14.697 Billion | $ 17.92 |

| 6. | Agnico Eagle Mines Limited | AEM | $ 12.46 Billion | $ 50.89 |

| 7. | Kirkland Lake Gold Ltd | KL | $ 10.575 Billion | $ 40.06 |

| 8. | Endeavor Mining | EDV | $ 5.776 Billion | $ 22.42 |

| 9. | Kinross Gold Corporation | KGC | $ 7.118 Billion | $ 5.65 |

| 10. | Alamos Gold Inc. | AGI | $ 2.768 Billion | $ 7.03 |

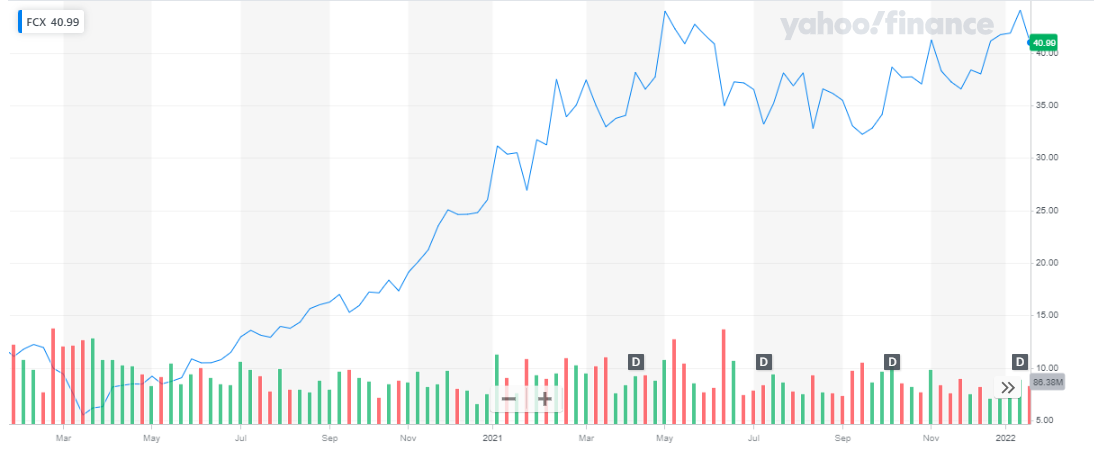

Freeport-McMoRan Inc.

Freeport-McMoRan Inc. is a mining company that owns geographically diverse assets with proven and probable reserves of copper, gold, and molybdenum, and traded copper producers.

The company’s portfolio of assets include:

- Grasberg minerals district in Indonesia- one of the world’s largest copper and gold deposits

- Mining operations in the Americas – which include the large-scale Morenci minerals district in North America and the Cerro Verde operation in South America

In the recent quarterly report, the company reported:

- Total Sales of:

- 1,033 Copper mm lbs

- 402,000 Gold ozs

- 20 Molybdenum mm lbs

- Revenue of $ 6.1 billion

- Net Income of $ 1.4 billion

The stock of the company is currently trading at $ 40.99. the company’s market valuation is $ 60.19 billion. The stock of the company has been steadily rising over the past two years. In the year 2021, the stock started at a price of $ 26.02 and closed the year at a price of $ 41.73. The stock appreciated by 60% within the year.

(Click on image to enlarge)

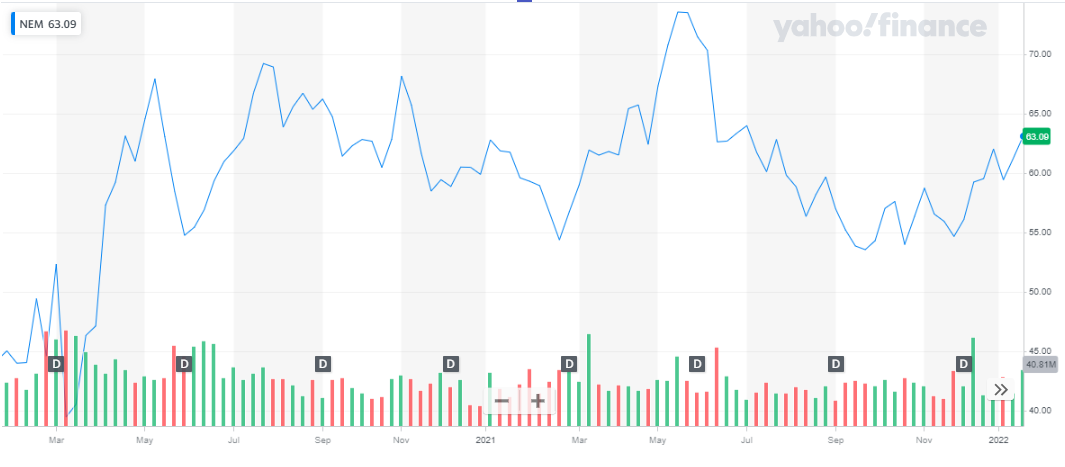

Newmont Corporation

Newmont is the world’s leading gold company and a producer of copper, silver, zinc, and lead. Newmont is the only gold producer listed in the S&P 500 Index and is widely recognized for its principled environmental, social, and governance practices. Checkout some of the best oil and gas ETFs to buy now.

In the recent quarterly report, the company reported:

- Gold production of 162 k oz

- Revenue of $ 2,895 million

- Net Income of $ 483 million

- Dividend of $0.55 per share

- Nine world-class assets in top-tier jurisdictions

- Robust gold reserves of 94Moz and 65Moz in GEO reserves

The stock of the company is currently trading at $ 63.09. the company’s market valuation is at $ 50.31 billion. The stock of the company has been pretty volatile in the past two years. In the year 2021, the stock peaked at $ 73.48 and dropped to the lows of $ 53.5.

(Click on image to enlarge)

Newmont has a very strong balance sheet with a very good liquidity position. Therefore, the company was able to handle the disruptive business environment brought by the pandemic. Newmont’s strong financial position makes it an excellent opportunity for investors to take benefit from gold mining stocks.

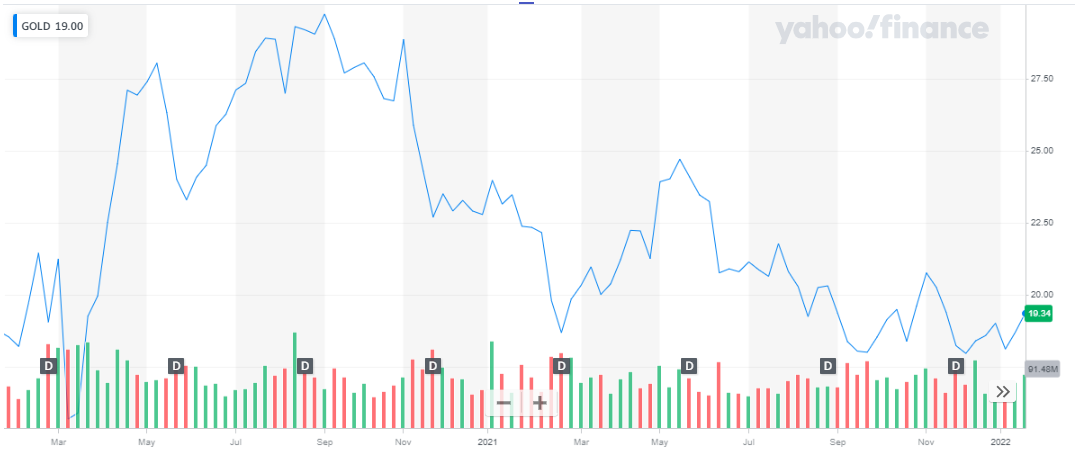

Barrick Gold

Barrick Gold Corp. is the second-largest gold mining company in the world. the company has gold and copper mining operations and projects in 13 countries in North and South America, Africa, Papua New Guinea, and Saudi Arabia. Our diversified portfolio spans many of the world’s prolific gold districts and is focused on high-margin, long-life assets.

In the recent quarterly report, the company reported:

- Gold Attributable production of 1,092 k oz

- Revenue of $ 2,826 million

- Net Earnings of $ 347 million

- EPS of $ 0.2

The stock of Barrick Gold is currently trading at $ 19.34. the company’s market valuation is $ 34.6 billion. The stock has exhibited moderate level volatility in the past two years. Moreover, the stock price was on an upward trend in the year 2020 but in the year 2021, the stock has picked up a downward trend. The stock kicked off the year 2021 at a price of $ 22.78 and it was trading at $ 19 on the last trading day. This represents a 17% decline in share price during the year.

(Click on image to enlarge)

Warren Buffet’s investment in the company has made Barrick Gold an even more lucrative investment. Moreover, a good cash holding also makes the balance sheet of the company strong. Hence Barrick Gold is an excellent gold mining stock to invest in.

Franco-Nevada

Franco-Nevada Corporation is the leading gold-focused royalty and streaming company with the largest and most diversified portfolio of cash-flow producing assets. Its business model provides investors with gold price and exploration optionality while limiting exposure to cost inflation.

In the recent quarterly report, the company reported:

- Total GEOs sold 146,495

- Gold – 94,829

- Silver – 23,405

- PGMs – 9,458

- Revenue of $ 316.3 million

- Net Income of $ 166 million

- Quarterly dividend of $0.3 per share

The stock of Franco Nevada is currently trading at $ 130.62. Its market valuation is at $25.135 billion. The share of the company has exhibited extreme volatility in the past two years. Within the year 2021, the share hit the lows of $107 and the highs of $159. Overall, the share appreciated by 10% during the year.

(Click on image to enlarge)

Franco-Nevada is debt-free and the company is focusing on growing its cash balances. All the more reasons to invest in this gold mining stock.

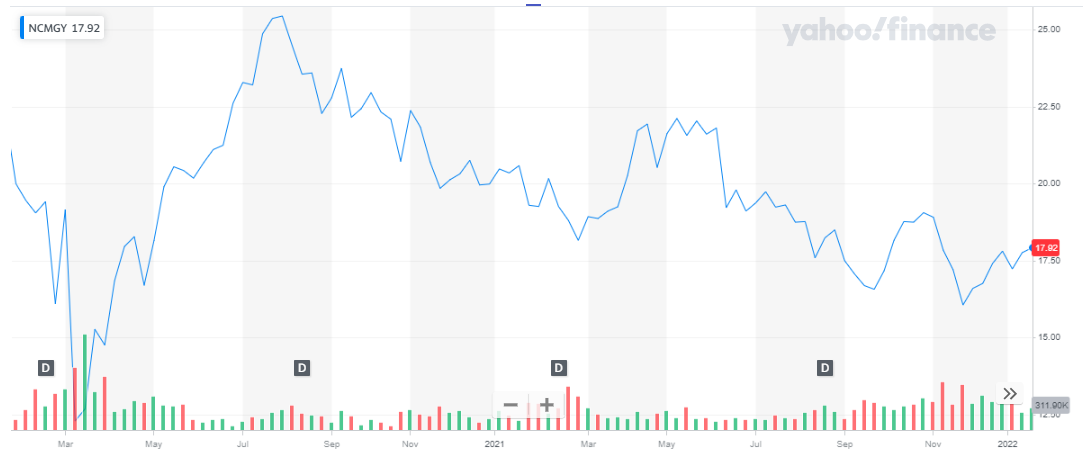

Newcrest Mining

Newcrest is one of the world’s largest gold mining companies. Newcrest owns and operates a portfolio of predominantly low-cost, long-life mines and a strong pipeline of brownfields and Greenfields exploration projects. Its operating mines are located in Australia, Canada, and Papua New Guinea.

In the recent quarterly report, the company reported:

- Gold production of 396 Koz and copper production of 25kt

Newcrest is advancing its global organic growth portfolio. The findings of the Red Chris Block Cave, Havieron Stage 1, Lihir Phase 14A, and Cadia PC1-2 Pre-Feasibility Studies demonstrate the depth and quality of our global organic growth portfolio.

Newcrest Mining has a market valuation of around $14.91 billion. Its share is trading at $17.92. The stock of the company has been slowly declining for the past one and a half years. At the start of the year 2021, the stock was trading at $19.99 and on the last trading day of 2021, the stock closed at 17.92. Overall, the stock declined by 10% during the year.

(Click on image to enlarge)

Agnico Eagle Mines Limited

Agnico Eagle is a senior Canadian gold mining company. Its mines are located in Canada, Finland, and Mexico, with exploration activities in each of these countries as well as in the United States, and Colombia. The Abitibi and Meliadine mines are the key drivers to the Company’s ongoing operational success. Moreover, the proposed merger with Kirkland Lake Gold will give a huge boost to the company’s growth. As an investor, you need to stay put and wait a while before you can benefit from your investment.

In the recent quarterly report, the company reported:

- Payable gold production of 523,706 ounces

- Revenue of $ 974 million

- Net Income of $ 114 million

- Quarterly dividend of $0.35 per share

The share of Agnico Eagle Mines is trading at $50.89. The company’s market valuation is at $ 12.53 billion. The share performance has been moderately volatile in the past two years. In the year 2021, the share price declined from $70.51 to $50.89. this represents a 28% depreciation in a year.

(Click on image to enlarge)

Kirkland Lake Gold Ltd

Kirkland Lake Gold Ltd. is a senior gold producer operating in Canada and Australia. Its production profile is anchored by three high-quality operations including, the Macassa Mine and Detour Lake Mine, both located in Northern Ontario, Canada, and the Fosterville Mine located in the State of Victoria, Australia.

In the recent quarterly report, the company reported:

- Gold production of 370,101 oz

- Revenue of $667 million

- Net earnings of $254.9 million

The company’s market capitalization is at $10.63 billion. The stock of the company is currently trading at $39.7. The stock kicked off the year 2021 at a price of $41.27 and concluded at $41.95.

(Click on image to enlarge)

Endeavor Mining

Following its acquisitions of SEMAFO and Teranga, Endeavour has become one of the top 10 major gold producers globally, with seven mines in Côte d’Ivoire, Burkina Faso, and Senegal plus a portfolio of development projects, all in the West African Birimian greenstone belt.

In the recent quarterly report, the company report:

- Gold production of 382 Koz

- Net Earnings of $153 million

The stock of the company is currently trading at $ 22.42. The company’s market valuation is at $ 5.8 billion. The stock of Endeavor Mining has been pretty volatile in the past two years. The stock started in the year 2021 at a price of $ 23.28 and closed off at $21.92.

(Click on image to enlarge)

The mining company has a healthy balance sheet with very low debt and a decent cash flow. Hence it is a very good gold mining stock to invest in in 2022.

Kinross Gold Corporation

Kinross Gold is a senior gold mining company with a diverse portfolio of mines and projects in the United States, Brazil, Chile, Ghana, Mauritania, and Russia.

Kinross Gold has continued to expand its Tasiast 24k Expansion Project. The project takes an approach where they seek to continuously improve the capacity to 24,000 tons per day by 2023.

In the recent quarterly report, Kinross Gold reported:

- Gold production of 483,060 oz

- Revenue of $862.5 million

- Net Loss of $44.9 million

Kinross Gold has a market valuation of around $7.12 billion. Its share is trading at $ 5.65. after a rise in 2020, the stock of Kinross Gold picked up a downward trend. It started in the year 2021 at a price of $ 7.34 and ended at a price of $5.81. Overall, the stock depreciated by approx. 20% during the year.

(Click on image to enlarge)

The balance sheets from Kinross Gold show high liquidity with $2.2 billion in available credit, $676 million of which is cash. Which makes this an excellent gold mining stock to buy now.

Alamos Gold Inc.

Alamos Gold is a Canadian-based gold producer. It currently operates three mines – two in Canada and one in Mexico. Furthermore, the company has a strong portfolio of development-stage projects in Canada, Mexico, Turkey, and the United States.

In the recent quarterly report, the company reported:

- Gold Production of 104,700 oz

- Operating revenues of $198 million

- Net Earnings of $25 million

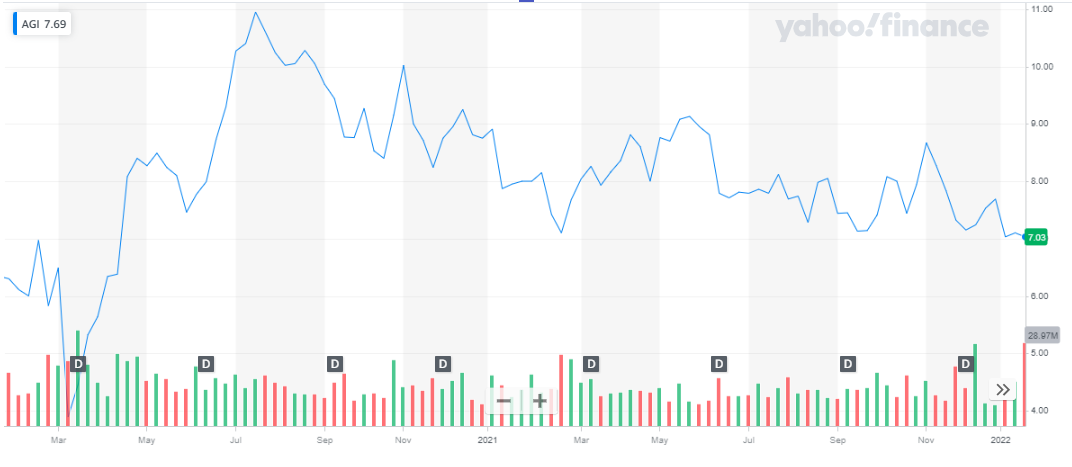

The market valuation of the company is at $2.77 billion. The stock of the company is trading at $7.03. following the pandemic driver market crash, the stock price spiked. After a few months, the stock price momentum settled and the stock experienced a slight decline. The stock started in the year 2021 at a price of $8.75 and ended at a price of $7.69. A 12% decline in share price was reported.

(Click on image to enlarge)

Conclusion

No doubt gold remains a preferred investment during times of inflation since it’s a way to protect your money. Investing in gold mining stocks is a good approach to secure investment as you are also investing in the company’s growth. The above-listed stocks have been picked after considering their projected growth and increased production in near future.

Disclaimer: Futures, options, and over the counter foreign exchange products may involve substantial risk and may not be suitable for all investors. Leverage can work against you as well as for ...

more