Top Apparel Stocks Hitting 52-Week Highs In December

Image Source: Unsplash

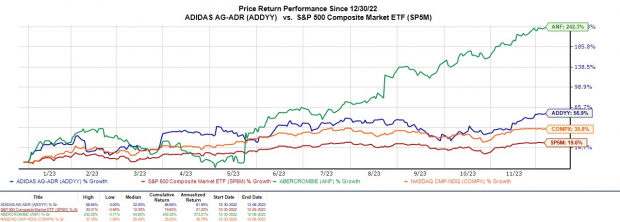

The holiday shopping season is a focal point for retailers and apparel companies with the last few months being very kind to Abercrombie & Fitch (ANF) and Addidas’ (ADDYY) stock.

With Christmas approaching, Abercrombie and Adidas shares may be early to what is hopefully an end-of-the-year and infamous Santa Clause rally. Hitting their 52-week highs this week both remain top-rated Zacks stocks at the moment.

Recent Performance Overview

Adidas shares have now rebounded and soared +57% in 2023 as the footwear and sporting apparel leader has been able to put inventory issues from the fallout with fashion collaborator Kanye West behind it. As for Abercrombie, its resurgence as a high-quality casual apparel retailer has been underestimated upon easing inflation with its stock catapulting over +240% YTD.

Image Source: Zacks Investment Research

Strong Q3 Results

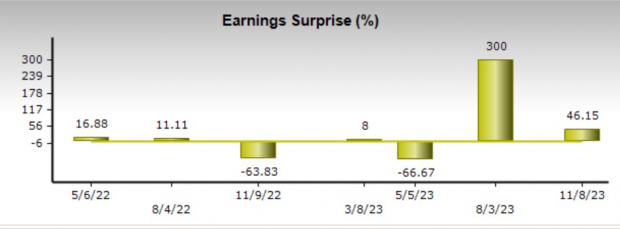

Continuing the ascension of Abercrombie and Adidas shares were their favorable third quarter results in November after widely surpassing Q2 bottom line expectations during the summer.

Abercrombie’s Q3 earnings of $1.83 per share blasted the Zacks Consensus of $1.14 a share by 60% and skyrocketed from $0.01 a share in the prior year quarter. On the top line, Q3 sales of $1.05 billion came in 8% above estimates and soared 19% from $880.08 million a year ago.

Image Source: Zacks Investment Research

Similarly, Addidas easily surpassed Q3 earnings expectations with EPS at $0.76 per share and 46% above estimates of $0.52 a share. Third quarter earnings also leaped 347% year over year from $0.17 a share in Q3 2022. Quarterly sales of $6.52 billion topped estimates by 3% and was up a percentage point from the comparative quarter.

Image Source: Zacks Investment Research

Earnings Estimate Revisions

Since reporting strong Q3 results, Abercrombie's current fiscal 2024 EPS estimates have soared 30% over the last 30 days from $4.44 a share to $5.76 per share. Even better, FY25 EPS estimates have climbed 24% in the last month from $4.42 a share to $5.50 per share.

Image Source: Zacks Investment Research

Meanwhile, Addidas’ fiscal 2023 earnings estimates now call for an adjusted loss of -$0.16 a share compared to -$0.13 a share 30 days ago but FY24 EPS estimates have risen 2% and are expected to be further in the black next year at $2.18 a share versus $2.08 per share a month ago.

Image Source: Zacks Investment Research

Bottom Line

After reaching 52-weeks highs in December, Abercrombie’s stock currently boasts a Zacks Rank #1 (Strong Buy) while Addidas stock sports a Zacks Rank #2 (Buy). As we move closer to rounding out 2023, the strengthening outlook for both companies next year is still compelling and may lead to more short-term upside.

More By This Author:

Bear of the Day: Floor & Decor (FND)Bull of the Day: The Progressive Corp.

5 ETFs To Play In December

Disclaimer: Neither Zacks Investment Research, Inc. nor its Information Providers can guarantee the accuracy, completeness, timeliness, or correct sequencing of any of the Information on the Web ...

more