Too Much Tesla Hype From Wedbush's Daniel Ives? Deutsche Bank Sees Q4 Deliveries Missing

Image Source: Pexels

Wedbush analyst Daniel Ives recently told clients that Tesla (TSLA) could surpass a $2 trillion market cap by the end of 2025. He raised Tesla's price target to $515 from $400 while reiterating an "Outperform" rating.

Ives called incoming policy shifts under Trump's second term a "total game changer" as Tesla's autonomous driving and artificial intelligence businesses are expected to surge in a more friendly operating environment.

"We are raising our price target on Tesla to $515 from $400 as we believe the Trump White House the next 4 years will be a "total game changer" for the autonomous and AI story for Tesla and Musk over the coming years. Our bull case is $650 for 2025," Ives told clients.

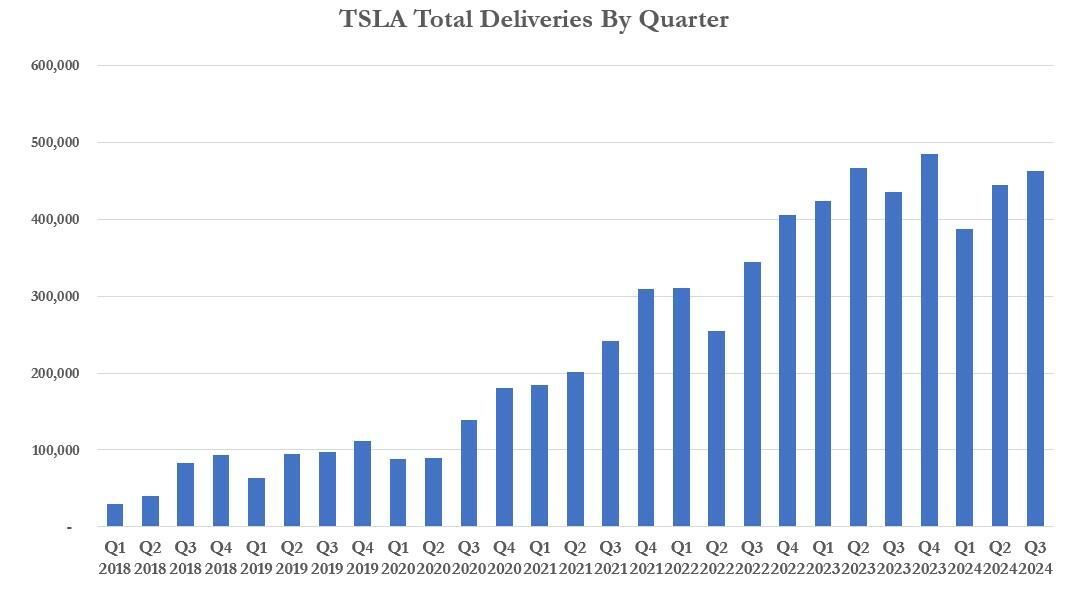

However, in a separate note, Deutsche Bank's Edison Yu and Winnie Dong provided clients with the understanding that quarter four "represents the largest delivery quarter for Tesla" and "so far we think it is tracking somewhat below" the 515,000 mark needed to grow volume on the year.

"Tesla volume could fall slightly below target Tesla would need to deliver at least 515k vehicles in Q4 to grow volume slightly for the full year, and based on quarter-to-date data, it appears to be tracking closer to 500k vs. DBe/Street at 510-511k," the analysts said.

They expect, "The largest source of volume in Q4 should come from China, which appears to be tracking to nearly 210k deliveries, helped by zero % financing incentives, along with a cash discount on the Model Y. N. America should be around 150k and Europe at 84k units," adding, "In October and November, retail sales in China totaled 40.5k and 73.5k units, and December MTD is >40k units (through the 15th). By model, our tracking suggests 153k units of Model 3, 322k of Model Y, 11k of Model S+X, and ~14k of Cybertruck."

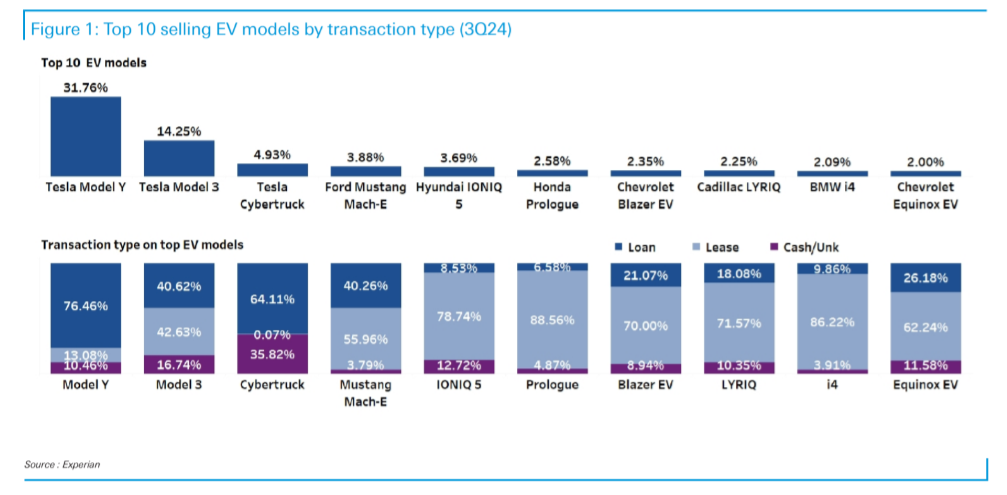

The analysts also provided third-quarter figures showing that the Tesla Model Y, Model 3, and Cybertruck were the best-selling models in the US. Regarding purchasing these vehicles, Experian data shows Teslas have the highest percentage of loans and or cash transactions compared to all other EV sales, with many other brands seeing more leases by consumers. Perhaps that speaks volumes about Elon Musk's brand in the eyes of the consumer...

In the third quarter, Tesla reported 462,890 deliveries and 469,796 vehicles produced, slightly missing the FactSet StreetAccount. As for Tesla, hitting the 515,000 mark for the fourth quarter to achieve growth in the full year remains questionable.

Entering the new year, Musk's EV price war with startups and legacy brands is expected to intensify as President-elect Donald Trump plans to eliminate the $7,500 EV tax credit. Musk has applauded Trump's decision to roll back EV tax credits, which could bankrupt his competitors.

New auto loan rates remain at two-decade highs and are expected to stay elevated through 2025, adding continued headwinds to auto sales amid an affordability crisis.

More By This Author:

The Musk-Led Manufacturing Revolution Nobody Is Talking AboutChina To Issue Record 3 Trillion Yuan In Special Treasury Bonds To Boost Economy

Solid 5Y Auction Stops Through With Yields At 6 Month High

Disclosure: Copyright ©2009-2024 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more