Time To Buy Walmart Or Target Stock As Q3 Earnings Approach?

Image Source: Pexels

Third-quarter results from retail giants Walmart (WMT - Free Report) and Target (TGT - Free Report) will be a highlight of this week’s earnings lineup.

Both omnichannel retailers are expected to post sound quarterly growth with Walmart and Target set to release their Q3 reports on Tuesday, November 19, and Wednesday, November 20, respectively.

Walmart Q3 Expectations

Based on Zacks estimates, Walmart’s Q3 sales are expected to be up 4% to $167.49 billion. On the bottom line, Walmart’s Q4 EPS is projected to increase 4% as well to $0.53 versus $0.51 a year ago.

Walmart most recently surpassed Q2 earnings expectations by 3% in August with EPS at $0.67 compared to estimates of $0.65. Notably, Walmart has reached or exceeded the Zacks EPS Consensus for nine consecutive quarters posting an average earnings surprise of 6.89% in its last four quarterly reports.

Image Source: Zacks Investment Research

Target Q3 Expectations

Starting to reach its goals of curving inventory shrink, Target’s Q3 sales are projected to increase 2% to $25.94 billion. More importantly, Target’s Q3 EPS is expected to rise 9% to $2.29 versus $2.10 in the comparative quarter.

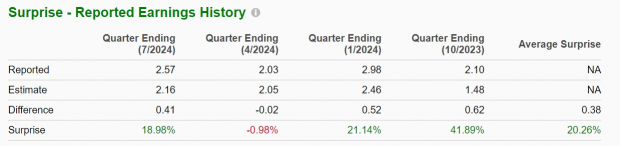

Target most recently beat Q2 EPS estimates by nearly 19% in August with earnings at $2.57 per share compared to expectations of $2.16. Target has surpassed the Zacks EPS Consensus in three of its last four quarterly reports posting a very impressive average earnings surprise of 20.26%.

Image Source: Zacks Investment Research

Tracking WMT & TGT:

Price Performance

Thanks to its low-cost offerings, consumers have gravitated toward Walmart amid higher inflation in recent years with the company also seeing considerable expansion in its online sales. This has been a primary catalyst to Walmart’s enhanced financial performance and ability to take market share with WMT soaring +60% year to date compared to the benchmark S&P 500’s +23% and Target’s +10%.

Image Source: Zacks Investment Research

Valuation Comparison

While Walmart’s stock has had a clear edge in terms of price performance, Target shares have stood out in terms of valuation. To that point, Target’s stock trades at 15.9X forward earnings which is a pleasant discount to the benchmark’s 24.8X with Walmart at 34.4X.

Furthermore, Target trades nicely beneath its decade-long high of 30.4X forward earnings and at a slight discount to its decade-median of 16.2X. As for Walmart, WMT trades on par with its own decade-long high of 34.7X but above the median of 22X during this period. Reassuringly, Walmart and Target both trade at the optimum level of less than 2X sales.

Image Source: Zacks Investment Research

WMT & TGT Dividends

In regards to dividends, Target has the edge here as well with a 2.95% annual yield that tops Walmart’s 0.99% and the S&P 500’s 1.22% average.

Image Source: Zacks Investment Research

Bottom Line

Ahead of their Q3 reports, Target’s stock sports a Zacks Rank #2 (Buy) with Walmart landing a Zacks Rank #3 (Hold). Magnifying Target’s more attractive P/E valuation is that earnings estimate revisions are noticeably higher over the last 90 days for its current fiscal 2025.

Meanwhile, Walmart’s current FY25 EPS estimates have remained unchanged in the last three months although both retail giants are expecting steady growth on their bottom lines for the foreseeable future.

More By This Author:

Bull Of The Day: Tactile Systems Technology

Enphase Energy's Software Now Offers AI Upgrade: Time To Buy The Stock?

Why CyberArk Stock Is A Standout After Q3 Earnings This Week

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any specific ...

more