Time To Buy These Highly Ranked Growth Stocks

Image Source: Pixabay

Among the Zacks Rank #1 (Strong Buy) list Palantir Technologies (PLTR) and Stellantis (STLA) are two attractive growth stocks to consider. Both have an “A” Zacks Style Scores grade for Growth as they continue to benefit from strong business industries.

To that point, Stellantis’ Zacks Automotive-Foreign Industry is currently in the top 12% of over 250 Zacks industries while Palantir’s Technology Services Industry is in the top 29%. With that being said, here is a look at why now is a good time to buy stock in both of these intriguing companies.

Performance Overview

Palantir has been one of the best-performing stocks of the year skyrocketing +177% as a new-generation defense, security, and counterterrorism company engaged in building software platforms for the intelligence community. Going public in September of 2020, Palantir’s stock is now up +81% since its IPO.

Image Source: Zacks Investment Research

Formerly known as Fiat Chrysler, Stellantis went public in January of 2021 and has seen its stock soar +63% YTD with shares now up +36% since its IPO. Operating as an automaker and mobility provider, Stellantis sells vehicles, components, and production systems with industrial operations in more than 30 counties.

Image Source: Zacks Investment Research

Top Line Growth & Cash Flow

As two of the top-performing IPOs in recent years, Palantir and Stellantis’ top-line growth continues to excite investors. Palantir’s total sales are projected to be up 16% in fiscal 2023 and climb another 20% in FY24 to $2.67 billion. More impressive, FY24 sales projections would be a 145% increase over the last five years with 2020 sales at $1.09 billion. Palantir‘s cash and equivalents have continued to climb as well from $1.1 billion in 2019 to an estimated $3 billion in 2023.

Image Source: Zacks Investment Research

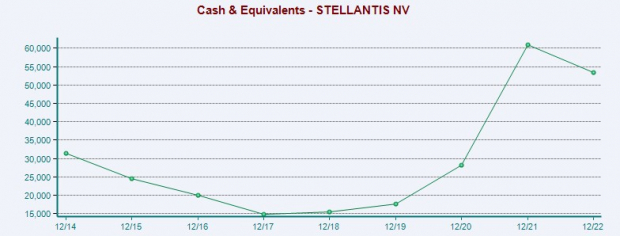

Pivoting to Stellantis, sales are now expected to jump 12% this year to $198.48 billion and edge up to almost $200 billion in FY24. Fiscal 2024 projections would represent 102% growth over the last five years with sales at $99 billion in 2020. Even better, Stellantis still has a cash pile of $50 billion which has soared from pre-pandemic levels of around $17.5 billion.

Image Source: Zacks Investment Research

EPS Outlook

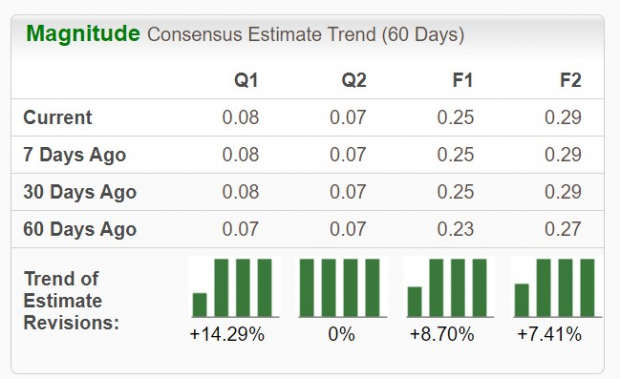

Most compelling about Palantir and Stellantis stock at the moment is their strengthening earnings outlook. Palantir’s road to probability has been very enticing with earnings anticipated at $0.25 per share in FY23 and up 316% from $0.06 a share last year. Fiscal 2024 EPS is expected to rise another 18% to $0.29 a share. Furthermore, earnings estimates for both FY23 and FY24 have remained higher over the last 60 days.

Image Source: Zacks Investment Research

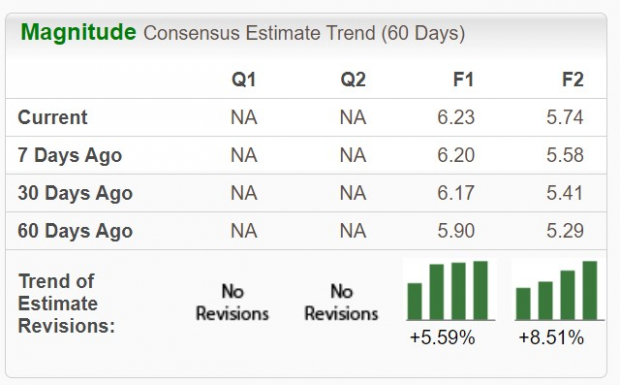

Stellantis’ annual earnings are expected to be up 11% this year to $6.23 per share and then dip -8% in FY24. However, FY23 and FY24 earnings estimates have continued to trend higher in the last two months and the company’s bottom line has expanded immensely over the last five years with 2020 earnings at $1.36 a share.

Image Source: Zacks Investment Research

Bottom Line

Rounding out the year, Palantir and Stellantis remain two of the hottest growth stocks to watch as positive earnings estimate revisions continue to be a further catalyst. Now appears to be a good time to buy stock in both companies as they have solid balance sheets with good cash flow to continue their expansion in 2024.

More By This Author:

2023 Rewind: 5 Valuable LessonsMicron Reports Q1 Loss Tops Revenue Estimates

Top Industrial Products Stocks Reaching Higher Highs In December

Disclaimer: Neither Zacks Investment Research, Inc. nor its Information Providers can guarantee the accuracy, completeness, timeliness, or correct sequencing of any of the Information on the Web ...

more