Time To Buy These E-Commerce Stocks As Amazon Leads The Way?

Image Source: Pexels

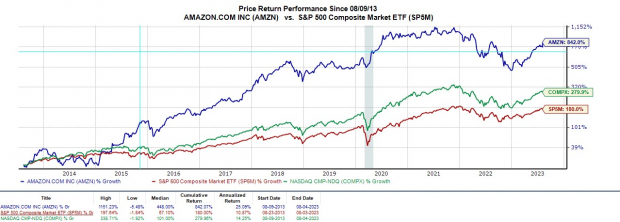

Following Amazon’s (AMZN - Free Report) impressive second-quarter results on Thursday, investing in e-commerce looks very intriguing right now. Many Chinese e-commerce companies also look attractive, with Alibaba (BABA - Free Report) and JD.com (JD - Free Report) standing out before their quarterly reports later in the month. Notably, the global e-commerce market is thought to be valued at upwards of $10 trillion.

This makes investing among the major e-commerce players very lucrative, as there is certainly potential for massive gains in the future. Although the compound annual growth rate (CAGR) for the global e-commerce market has naturally slowed, it’s still estimated to be over 10%.

Furthermore, a 10% CAGR is attractive considering the size of some of the major e-commerce players like Alibaba and Amazon. Additionally, there are hidden gems in the global e-commerce market, making this moment seem like a good time to invest in the space.

Image Source: Zacks Investment Research

Amazon’s Q2 Report

With inflation continuing to ease, Wall Street has been scoping out the growth and outlook for big tech companies during their quarterly reports -- and Amazon did not disappoint.

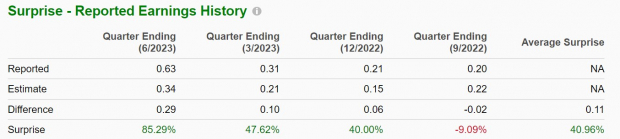

Amazon’s stock spiked after blasting Q2 earnings expectations on Thursday, highlighting that sales were boosted by strong demand for its diverse e-commerce products and record delivery times. Earnings of $0.63 per share impressively topped Q2 EPS estimates of $0.34 by 85% and soared 530% from earnings of $0.10 a share in Q2 2022.

Image Source: Zacks Investment Research

Surprising many analysts and delighting investors, Amazon appears to be prioritizing profits rather than expansion at the moment. To that point, Amazon’s net income for Q2 was a very impressive $6.7 billion compared to a loss of -$2 billion in the prior-year quarter.

Quarterly sales of $134.38 billion beat Q2 expectations by 2% and rose 11% from a year ago. Amazon’s dominance as an e-commerce provider has allowed the company to expand into other areas. It’s notable that Amazon Web Services (AWS) sales were up 12%, with Advertising Services sales up 22%.

Amazon's stock currently lands a Zacks Rank #3 (Hold). A buy rating could be on the way, with Q2 results reconfirming a strong earnings outlook. Annual earnings are now forecasted to skyrocket 118% in fiscal 2023 at $1.55 per share compared to $0.71 a share in 2022. Plus, FY24 earnings are expected to soar another 50% to $2.33 per share, with it likely that EPS estimates will start to rise.

Image Source: Zacks Investment Research

Chinese E-Commerce

Shares of Alibaba and JD.com look attractive ahead of their quarterly reports on Aug. 10 and 16, respectively. Both companies currently boast a Zacks Rank #2 (Buy). The earnings outlook for both of these Chinese e-commerce leaders is strengthening, as logistics concerns subside following the reopening of China’s economy earlier in the year.

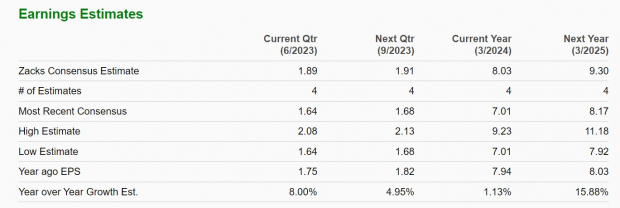

Alibaba’s fiscal first-quarter earnings are projected to rise 8% year-over-year to $1.89 per share, with sales expected to be virtually flat at $30.79 billion. Annual earnings are expected to be up 1% in Alibaba’s current fiscal 2024 and to climb another 16% in FY25 at $9.30 per share.

Image Source: Zacks Investment Research

Pivoting to JD, its second-quarter earnings are anticipated to leap 19% year-over-year to $0.73 per share, despite sales forecasted to dip -2% to $39.25 billion. Overall, JD’s fiscal 2023 earnings are expected to jump 12%, with its bottom line projected to expand another 16% in FY24 at $3.36 per share.

Image Source: Zacks Investment Research

Hidden Gems

There are certainly e-commerce companies that are often overlooked for more popular names. On top of that, companies like United Parcel Service (UPS - Free Report) are critical to transportation, deliveries, and broader logistic components. UPS currently lands a Zacks Rank #3 (Hold), and it will be a company to keep an eye on when it reports its second-quarter results next Tuesday, Aug. 8.

eBay (EBAY - Free Report) is also a viable option among e-commerce players, and the company was able to beat its Q2 top and bottom line expectations in late July. The company also has a Zacks Rank #3 (Hold). The stock may reward patient investors, with earnings expected to rise roughly 1% this year and jump another 9% in FY24 at $4.52 per share.

Bottom Line

It’s starting to look like an ideal time to invest in e-commerce companies. The outlook for many e-commerce players' is strengthening, and this should remain a viable space to invest in for 2023 and beyond.

00:01:01

More By This Author:

3 Buy-Rated Technology Stocks Sporting Attractive Valuations3 Upcoming Quarterly Reports Investors Can't Ignore

Eli Lilly To Report Q2 Earnings: What's In The Cards?

Disclaimer: Neither Zacks Investment Research, Inc. nor its Information Providers can guarantee the accuracy, completeness, timeliness, or correct sequencing of any of the Information on the Web ...

more