Time To Buy These Affordable Tech Stocks For More Upside

Considering the innovation and growth of technology services and applications, the broader technology sector continues to be a focal point of the economy and stock market.

To that point, over the last decade the Nasdaq has soared over +250% to easily top the S&P 500’s +160%. Surely, investors are always on the lookout for promising tech stocks as these investments can lead to lofty gains.

Even better is when investors don’t have to break the bank to find them and can watch their growth in the portfolio. At the moment several highly ranked Zacks Computer and Technology sector stocks are worthy of consideration in this regard.

Sporting a Zacks Rank #1 (Strong Buy), now looks like an ideal time to invest in these affordable and promising tech stocks for more upside.

(Click on image to enlarge)

Image Source: Zacks Investment Research

eGain (EGAN)

Belonging to the top-rated Zacks Internet-Software Industry, eGain’s stock is very intriguing as a provider of customer engagement solutions including social interaction applications and contact center applications.

Currently in the top 12% of over 250 Zacks industries, eGain looks like one of the Zacks Internet-Software Industry players that could have more upside with earnings estimate revisions nicely up in the last 30 days.

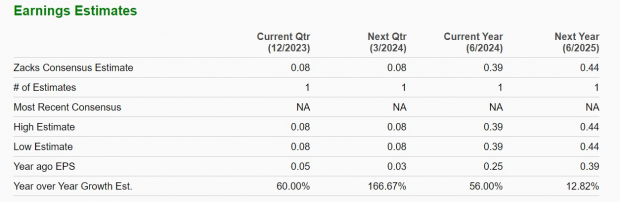

To that point, eGain’s current fiscal 2024 earnings estimates have risen 18% over the last month with FY25 EPS estimates rising 7%. More appealing is that eGain’s stock currently trades around $7 with annual earnings now forecasted to be up 56% in FY24 to $0.39 per share versus EPS of $0.25 in FY23.

(Click on image to enlarge)

Image Source: Zacks Investment Research

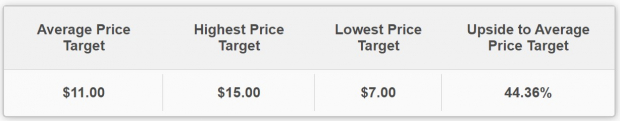

Even better, FY25 earnings are projected to rise another 13% and EGAN shares trade at a 19.5X forward earnings multiple which is a noticeable discount to the industry average of 36.5X and beneath the S&P 500’s 21.4X. Notably, the Average Zacks Price Target of $11 a share suggests 44% upside for eGain’s stock.

(Click on image to enlarge)

Image Source: Zacks Investment Research

TTM Technologies (TTMI)

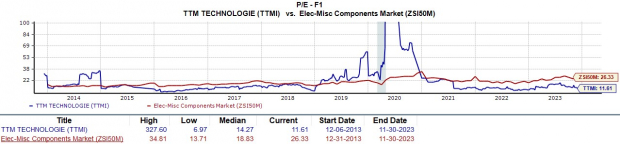

Among the Zacks Electronics-Miscellaneous Components Industry, TTM Technologies stock is very appealing in terms of value with the Average Zacks Price Target of $17.81 a share suggesting 18% upside.

TTM Technologies is a leading circuit board manufacturer and after surpassing third quarter top and bottom line expectations in November the trend of earnings estimate revisions is very compelling. Fiscal 2023 EPS estimates have soared 19% over the last 30 days from $1.08 per share to $1.29 a share. Plus, FY24 EPS estimates are up 8% over the last month.

(Click on image to enlarge)

Image Source: Zacks Investment Research

Furthermore, TTM Technologies’ stock has an “A” Zacks Style Scores grade for Value and trades at 11.6X forward earnings which is a 55% discount to its industry average of 26.3X and well below the benchmark.

(Click on image to enlarge)

Image Source: Zacks Investment Research

Other Stocks to Watch

With it being noteworthy that the Zacks Internet-Services Industry is in the top 19% of all Zacks industries, Dropbox (DBX) and Upwork (UPWK) are two stocks to watch with annual EPS estimates rising for both companies.

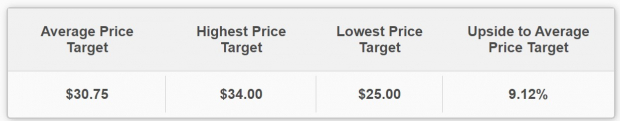

Starting with Dropbox, its cloud collaboration platform allows users to store and share files, photos, videos, songs, and spreadsheets. As a growing cloud provider annual earnings are expected to soar 24% in FY23 and rise another 4% in FY24 to $2.05 per share. More impressive, Dropbox shares have soared +28% this year and are near 52-week highs but still trade at a reasonable 14.3X forward earnings multiple with the Average Zacks Price Target of $30.75 a share being 9% above current levels.

(Click on image to enlarge)

Image Source: Zacks Investment Research

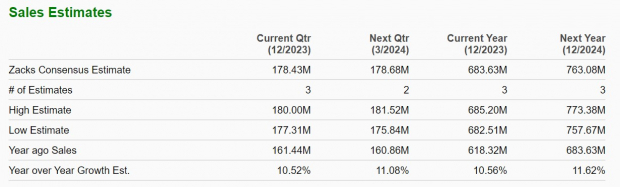

Turning to Upwork, the Average Zacks Price Target of $14.64 a share offers 4% upside with the company providing online recruitment services for website developers, virtual assistants, sales and marketing experts among others.

With an “A” Zacks Style Scores grade for Growth, Upwork’s earnings potential and road to probability looks very compelling at the moment. Fiscal 2023 earnings are now expected at $0.48 per share compared to an adjusted loss of -$0.06 a share in 2022. Better still, earnings are projected to expand another 38% next year with Upwork expecting double digit sales growth for both FY23 and FY24 as well.

(Click on image to enlarge)

Image Source: Zacks Investment Research

Takeaway

Considering their reasonable valuations, rising earnings estimates are very compelling for these affordable tech stocks. Despite the Nasdaq already soaring +37% for the year, these tech stocks could have an abundance of upside and may serve as ideal buy-the-dip candidates following a correction.

More By This Author:

Best & Worst ETFs Of NovemberBull Of The Day: CommVault Systems - Friday, December 1

Bear Of The Day: Landstar System

Disclaimer: Neither Zacks Investment Research, Inc. nor its Information Providers can guarantee the accuracy, completeness, timeliness, or correct sequencing of any of the Information on the Web ...

more