Time To Buy The Dip On Alphabet Following Earnings?

Image: Bigstock

Alphabet (GOOGL - Free Report) reported earnings on Tuesday and beat analysts’ estimates on both the top and bottom lines, yet the stock has been rolling over. Is it time to get out of the stock? I think not. Rather, it may be a fantastic buying opportunity.

There are two primary reasons for Alphabet's sell-off following its recent earnings report, both of which I believe are temporary. First, the overall market weakness has been weighing on the stock. Second, there are concerns about whether the significant capital expenditures on AI infrastructure will generate sufficient near-term profits.

While these concerns are reasonable, Alphabet is such a sturdy asset that I believe you can overlook any near-term concerns, as the long-term still looks so fruitful for the company.

But what is especially compelling is that the stock has been trading at a relatively discounted valuation, all while business fundamentals are strong and the company appears set to enter exciting, new, technological ventures.

For investors who are keen on buying leading technology stocks at a discount, Alphabet may be the next addition to your portfolio.

Image Source: TradingView

Earnings Beat but the Alphabet Stock Falls

Alphabet has reported a solid second quarter for 2024, showcasing strong performance across its key segments and continued innovation in artificial intelligence. The company's results underline its robust financial health and strategic investments in AI and cloud infrastructure.

Alphabet delivered revenues of $85 billion, marking a 14% year-on-year increase. This growth was driven by strong performance in Search and Cloud services. The Cloud segment achieved quarterly revenues exceeding $10 billion for the first time, alongside a notable $1 billion in operating profit.

Search revenues reached $48.5 billion, growing 13.8% year-over-year while Cloud revenues saw a slight acceleration, growing 28.8% to $10.4 billion. AI is playing a pivotal role here, with the majority of Alphabet's top 100 customers utilizing AI-driven services.

Additionally, seeing a reacceleration of the core search business is a fantastic development, as many investors had begun to doubt it. Furthermore, notes about the development at Waymo are very encouraging and has the potential to open another massive business opportunity for Alphabet.

Huge Potential in Autonomous Driving

Alphabet announced that they would be committing another $5 billion for expansion at Waymo, and I think investors are still underestimating the incredible potential here.

Waymo has made significant strides, delivering over 50,000 paid rides per week across San Francisco and Phoenix. But most importantly, Waymo has focused on optimizing its service for profitability and scalability, making strategic decisions that enhance its configurability across various vehicle types and conditions.

This is a very different approach than Tesla (TSLA - Free Report) has been taking, as Alphabet believes providing the underlying technology will be a superior business model and is similar to the way Google influences the mobile computing industry with Android. They make no devices, but are the most widely used mobile software in the world.

Waymo is also taking a bottom’s up approach, developing its own sensors to control the whole tech stack. Alternatively, Tesla relies solely on camera-based vision and must manage all the additional logistics of producing a full vehicle. The longer it takes Tesla to get full self-driving to actually work, the more I am favoring Waymo in leading the industry.

Alphabet Stock Trading at a Discount

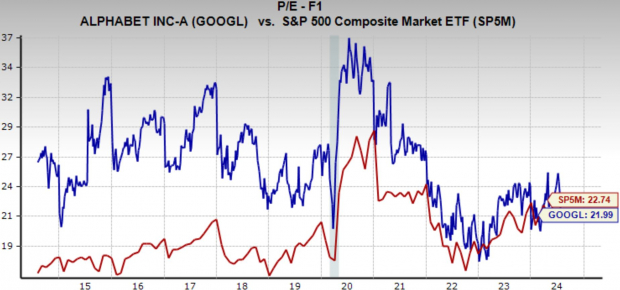

As previously noted, Alphabet has recently been trading at a valuation that I consider to be appealing for long-term investors. Recently, GOOGL stock has been seen trading at 22x forward earnings, which is below its 10-year median of 26.1x and below the market average.

Because I believe Alphabet is among the best companies in the world, I think it unreasonable that it trades in line with the average of the index. With continued strong performance across business segments, and some incredible growth catalysts, I think Alphabet is compelling at recent levels.

Image Source: Zacks Investment Research

Final Thoughts

Despite Alphabet's recent post-earnings dip, this may be an opportune moment for investors to buy the stock.

Alphabet's second-quarter earnings report showed strong performance across key segments, with impressive growth in Search and Cloud services. The company continues to lead in AI-driven innovations, reinforcing its competitive edge. Additionally, the significant investment in Waymo highlights Alphabet's potential in the autonomous driving market, offering another promising growth avenue.

At its recent valuation, Alphabet presents an attractive opportunity for long-term investors. For investors seeking to capitalize on a leading technology stock at a discount, Alphabet could be a compelling choice.

More By This Author:

Has The Recent Selling Bout Come To A Screeching Halt?3 Iconic Companies To Buy Stock In After Earnings

Bull Of The Day: The Progressive

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any specific ...

more