Time To Buy The Dip In These High-Growth Stocks

Image Source: Unsplash

As investors continue to digest the excellent year for stocks in 2023 several of last year’s best performers have seen pullbacks.

However, for a few very profitable high-growth stocks in Griffon Corporation (GFF) and The Andersons (ANDE), this correction seems like an opportunity with both sporting a Zacks Rank #1 (Strong Buy). Let’s take a look at their recent dips and see why their growth trajectories still suggest it's time to buy.

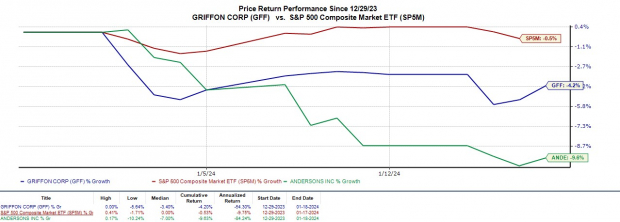

Recent Performance Overview

As a diversified management holding company, Griffon’s stock has soared +52% in the last year while The Andersons which is a diverse agricultural merchandiser has seen its shares climb +45%. This has been fueled by their versatile operations which have led to increased profitability in recent years.

The opportunity to get it on a potential rebound in their strong price performances comes as Griffon’s stock has pulled back -4% in January while The Andersons stock is down -9% year to date.

Image Source: Zacks Investment Research

Still, over the last three years, Griffon and The Andersons' shares have skyrocketed +146 and +102% respectively to largely outperform the broader indexes.

Image Source: Zacks Investment Research

Growth Trajectories & Profitability

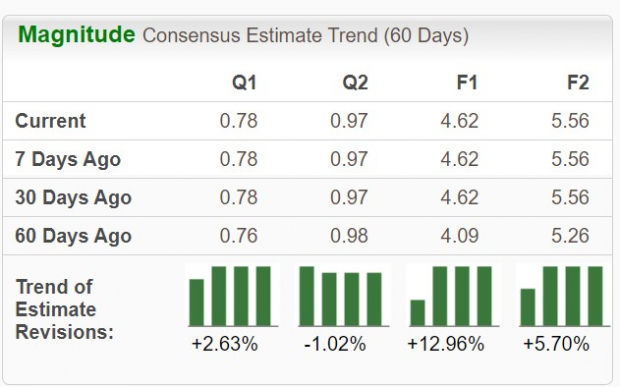

Despite the minor selloff to start the year, Griffon’s annual earnings are forecasted to increase 2% in fiscal 2024 and climb another 20% in FY25 to $5.56 per share. Furthermore, FY25 EPS projections would represent an astonishing 227% growth over the last five years with earnings at $1.70 a share in 2021. Plus, earnings estimate revisions are nicely up for both FY24 and FY25 over the last 60 days which is usually an indicator of more upside.

Image Source: Zacks Investment Research

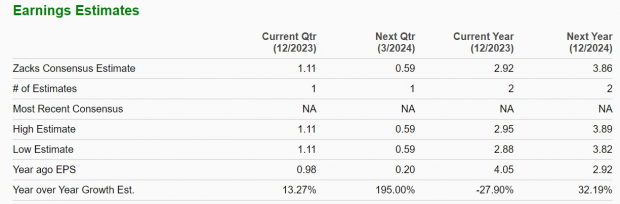

As for The Andersons, the company is facing an extremely tough to compete against fiscal 2022 and is expected to round its FY23 with EPS down -28% to $2.92 a share. With that being said, earnings are projected to rebound and leap 32% to $3.86 per share this year which would be a monstrous increase and continued post-pandemic recovery with EPS at just $0.09 a share in The Andersons' fiscal 2020.

Image Source: Zacks Investment Research

Takeaway

When it comes to buying the dip prospects amid recent market volatility, Griffon Corporation and The Andersons are two of the most enticing stocks due to their increased profitability with expansive bottom lines in recent years.

More By This Author:

3 Stocks To Buy For Growth And StabilityAmerican Superconductor Surges 5.4%: Is This An Indication Of Further Gains?

Small Caps Offer Big Potential In 24'