Time To Buy Tesla Stock Before Q1 Earnings?

Image Source: Pexels

Tesla (TSLA - Free Report) ) will be a highlight of this week’s earnings lineup, set to report its first-quarter results on Wednesday, April 19.

With shares of TSLA off to a magnificent start this year, investors may be wondering if now is a good time to invest in the EV leader.

Let’s see if Tesla stock is a buy right now or if there are better opportunities ahead.

Q1 Preview

The Zacks Consensus Estimate for Tesla’s Q1 earnings is $0.85 per share, which would be a -20% decline from EPS of $1.07 in the prior-year quarter. Sales are expected to be up 25% at $23.56 billion Vs. $18.76 billion in Q1 2022.

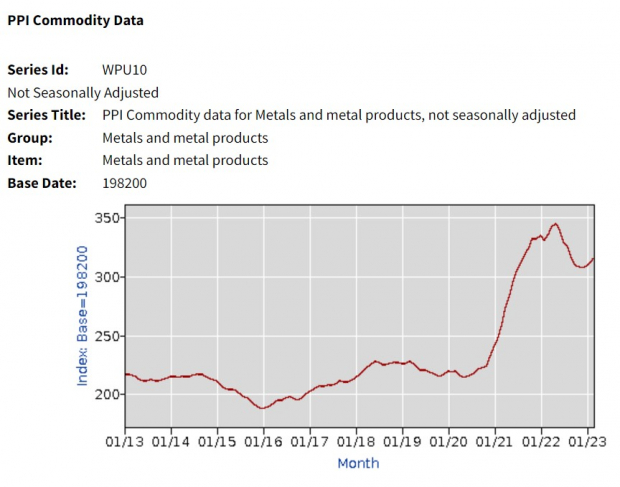

The dip in Tesla’s YoY quarterly bottom line is partly attributed to higher commodity prices among raw materials like steel and aluminum in correlation with inflation. However, Tesla has also implemented several price cuts in the pricing of its EVs to boost deliveries and roll out newer models.

Image Source: U.S. Bureau of Labor Statistics

While Tesla hopes its price cuts will boost demand and lead to higher sales volume, Wall Street will be closely monitoring the effect this has on the company’s earnings. To that point, many analysts are concerned that lower vehicle pricing will chip away at Tesla’s profit margins with the company cutting its prices five times since January.

Tesla has now dropped the prices of its Model S sedan by roughly 5% to $89,000 and its Model X SUV by 9% to $99,000. The luxury versions of these models have also been lowered by about $5,000.

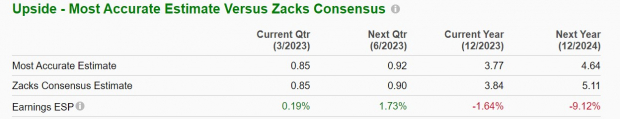

With that being said, the Zacks Expected Surprise Prediction indicates Tesla should reach its Q1 earnings expectations with the Most Accurate Estimate also at $0.85 per share.

Image Source: Zacks Investment Research

Deliveries & Demand

The ability to continue expanding deliveries is critical during Tesla’s quarterly results. In this regard, the increasing popularity and demand for EVs may justify Tesla’s willingness to slash its prices. With demand in focus, Tesla announced earlier in the month that it delivered a quarterly record of 422,875 vehicles during the first quarter, a 36% increase from 310,000 deliveries in Q1 2022.

This would still fall short of Wall Street’s estimates of 430,000 deliveries for the first quarter. As shown in the chart below, Tesla stock soared in its last quarterly report after beating delivery expectations but plummetted in the prior quarter when missing estimates. Still, Tesla’s ability to offer strong guidance for continued delivery growth next quarter could boost its stock.

(Click on image to enlarge)

Image Source: Zacks Investment Research

Growth & Outlook

Tesla is still the global leader in EV sales and controls about 65% of the market share in the United States. However, monitoring Tesla’s growth is very important for investors with companies like General Motors (GM - Free Report) ) and Ford (F - Free Report) ) looking to even the playing field.

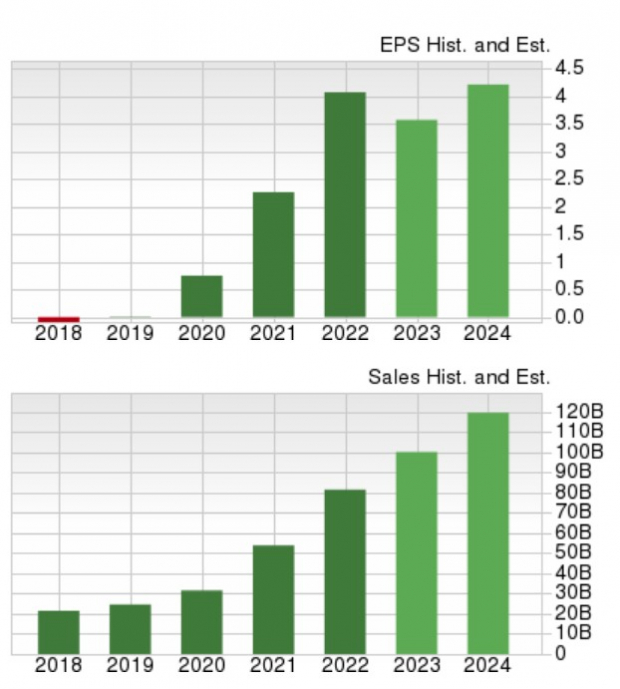

According to Zacks estimates, Tesla earnings are expected to dip -5% this year but rebound and climb 33% in fiscal 2024 at $5.11 per share. It is important to note that earnings estimate revisions have gone down over the last quarter.

On the top line, sales are forecasted to jump 25% in FY23 and soar another 21% in FY24 to $123.03 billion. More impressive, fiscal 2024 would be a very stellar 401% increase from pre-pandemic levels with 2019 sales at $24.57 billion.

Image Source: Zacks Investment Research

Performance & Valuation

Tesla stock is up an impressive +52% year to date to largely outperform the S&P 500’s +8% and the Auto Manufacturers-Domestic Markets +22%. As a loose comparison, Tesla has easily topped General Motors’ +4% and Ford’s +9% YTD performance.

Even better, Tesla stock has now climbed +272% over the last three years to beat the benchmark, General Motors’ +41%, Ford’s +151%, and its Zacks Subindustry’s +88%.

(Click on image to enlarge)

Image Source: Zacks Investment Research

Shares of TSLA currently trade around $187 and 48.2X forward earnings which is well below its extreme decade-long high and 78% beneath the median of 223.9X. Tesla still trades above the industry average of 10.8X but Wall Street has historically been ok with paying a premium for the company's growth as a leader and pioneer in its space.

Bottom Line

Going into its Q1 report Tesla stock lands a Zacks Rank #3 (Hold). Tesla’s annual top and bottom line growth are still intriguing despite the decline in earnings estimates with its more reasonable P/E valuation offering support.

Although the recent price cuts among its EVs may lead to better buying opportunities in Tesla stock, this should also boost future demand. In this regard, investors could be rewarded for holding on to Tesla shares at current levels especially as inflation begins to ease.

More By This Author:

4 Retail Stocks That Look Promising Despite Dip In March Sales

4 Stocks To Watch From The Prosperous Heavy Construction Industry

What's In Store For Abbott Laboratories In Q1 Earnings?

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any specific ...

more