Time To Buy Stock In These Innovative Companies After Earnings?

Image: Bigstock

Investors are always on the lookout for technology-driven companies that are able to offer innovative solutions.

The reward for investing in such stocks can often be very lucrative, with Synaptics (SYNA - Free Report) and Verra Mobility (VRRM - Free Report) being two options to consider after impressive quarterly results on Thursday.

Synaptics Electronics Solutions Presence

Since the height of the pandemic, Synaptics has positioned itself well to capitalize as a leader in human interface solutions, such as touchpads for notebook computers, capacitive touch screen controllers for handsets, and biometric fingerprint solutions for mobile devices.

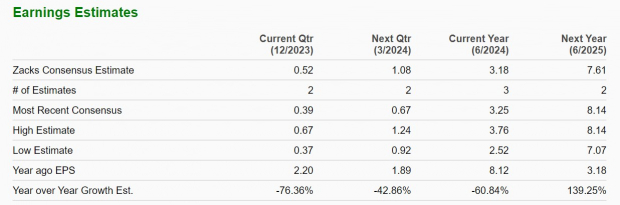

Synaptics stock popped +11% on Friday following its strong fiscal first-quarter results after market hours on Thursday. Earnings of $0.52 per share easily surpassed Q1 expectations of $0.38 a share, with sales coming in at $237.70 million and 2% above estimates.

Image Source: Zacks Investment Research

Facing an extremely tough to-compete-against quarter that saw Q1 EPS at $3.52 per share and sales at $448.10 million, the strengthening prospects of Synaptics may have been overlooked.

To that point, annual EPS is now forecasted to dip to $3.18 per share in Synaptics' current fiscal 2024. However, SYNA stock trades reasonably at 27.8X forward earnings, which is roughly on par with its Zacks Electronics-Semiconductors industry average.

Furthermore, FY25 earnings are forecasted to rebound and soar 139% to $7.61 per share as the company’s bottom line has expanded significantly from pre-pandemic levels, with 2019 earnings at $2.50 a share.

Image Source: Zacks Investment Research

Verra’s Expansion Among Security & Safety Services

Verra’s attractive stock price at $20 a share is compelling considering the company’s expansion in recent years as a smart mobility technology solutions provider. Going public in 2018, Verra offers speed, bus lane, railroad crossing, and school bus top arm enforcement and enforcement ticketing, along with crash reports and video-enabled crime data analysis solutions.

With increasing demand for Verra’s services, VRRM shares spiked +4% on Friday after Q3 earnings of $0.29 per share reassuringly topped expectations by 7% on Thursday and rose 7% from the prior year quarter as well. Quarterly sales of $209.93 million slightly surpassed estimates of $208.59 million and were up 6% year-over-year.

Image Source: Zacks Investment Research

Furthermore, investors are not paying a premium for Verra’s intriguing growth as VRRM shares trade on par with the Zacks Security and Safety Services industry average of 18.4X forward earnings and below the benchmark.

Better still, Verra’s earnings are now forecasted to be up 4% in fiscal 2023 and rise another 8% in FY24 to $1.16 per share. Notably, fiscal 2024 EPS projections would represent 78% growth from pre-pandemic levels, with 2019 earnings at $0.65 a share.

Image Source: Zacks Investment Research

Bottom Line

In correlation with their innovative technology solutions, the expansion of Synaptics and Verra Mobility shouldn’t be overlooked. Following their favorable quarterly reports Synaptics and Verra Mobility's stock both sport a Zacks Rank #2 (Buy), as demand for their unique services appears to be increasing.

More By This Author:

3 Top-Ranked Stocks Suited For Growth Investors3 Key Quarterly Releases To Watch Next Week - Friday, November 10

3 Funds To Boost Your Portfolio On Soaring Semiconductor Sales

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any specific ...

more