Time To Buy Stock In These 2 Attractive Industry Leaders After Earnings

Rounding out this week’s earnings lineup there are a few more standout stocks that investors may want to take notice of.

Here is a rundown of two industry leaders whose stocks currently sport a Zacks Rank #2 (Buy) after impressively surpassing third-quarter earnings expectations.

An Insurance Titan

While many finance sector stocks including those of banks and other insurance companies have struggled, Aflac (AFL) shares are now up a very respectable +14% in 2023 which has outperformed its Zacks Subindustry’s +9% and slightly edged the S&P 500's +13%.

Image Source: Zacks Investment Research

With that being said, Aflac’s Zacks Insurance-Accident and Health Industry is currently in the top 2% of almost 250 Zacks industries. To that point, Aflac was able to easily surpass its Q3 top and bottom line expectations on Wednesday.

Third-quarter earnings of $1.84 per share beat estimates of $1.44 a share by +28% with sales of $4.95 billion coming in 11% better than expected.

Image Source: Zacks Investment Research

Aflac’s annual earnings outlook is very attractive with EPS now forecasted to jump 13% this year and rise another 3% in fiscal 2024 to $6.23 per share. More impressive, Aflac has beaten earnings expectations for a remarkable 27 consecutive quarters and trades reasonably at 13.1X forward earnings.

Image Source: Zacks Investment Research

A Growing Building Products King

Among the Zacks Construction sector, Martin Marietta Materials (MLM) also posted strong Q3 earnings on Wednesday with its Zacks Building Products-Concrete and Aggregate Industry in the top 38% of all Zacks industries.

Martin Marietta produces and supplies construction aggregates and cement among other heavy building materials with some of its notable peers including Eagle Materials (EXP) and Vulcan Materials (VMC) . Impressively, Martin Marietta posted Q3 earnings of $6.94 per share topping expectations of $6.04 a share by 15% despite sales of $1.99 billion slightly missing estimates of $2 billion.

Image Source: Zacks Investment Research

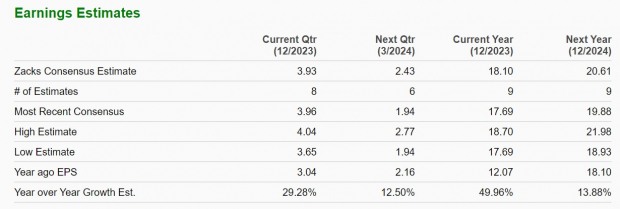

Still, annual earnings are now forecasted to soar 50% in fiscal 2023 to $18.10 per share with it being noteworthy that total sales are projected to climb 19% to $6.83 billion. Even better, Martin Marietta’s bottom line is expected to expand another 14% in FY24 with sales anticipated to rise another 9%.

Image Source: Zacks Investment Research

Surpassing earnings expectations in its last four quarterly reports Martin Marietta’s stock has now soared +31% YTD to top Eagle Material’s +24% and Vulcan Materials’ +19% while also outperforming their Zacks Subindustry’s +27% and the benchmark.

Image Source: Zacks Investment Research

Bottom Line

Investors looking for companies with a competitive edge in their industry may want to consider Aflac and Martin Marietta’s stock as their earnings outlook remains compelling. Looking like viable investments for 2023 and beyond, Aflac and Martin Marietta’s stock may continue to outperform their Zacks Subindustry's and the broader market.

More By This Author:

Time To Buy The Post Earnings Rebound In Block Or PayPal Stock?

2 Key Quarterly Releases To Watch Next Week

Bull Of The Day: Dell Technologies.

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any specific ...

more