Time To Buy Shopify Or Target's Stock After Partnership Announcement?

Image Source: Unsplash

In a bid to bolster its online sales and further compete with fellow omnichannel giant Walmart (WMT - Free Report) and Amazon (AMZN - Free Report), Target (TGT - Free Report) announced a partnership with Shopify (SHOP - Free Report) on Monday to enhance its e-commerce marketplace.

The collaboration will allow merchants using Shopify’s popular global commerce platform to sell their products on Target Plus, an invite-only third-party marketplace.

That said, let’s see if now is a good time to buy Shopify or Target’s stock amid their intriguing partnership.

Much-Needed Partnership (Especially for Target)

While partnering with Target should benefit Shopify’s expansion after going public in 2015, the collaboration is much needed for Target to catch up to Walmart’s lofty e-commerce expansion. To that point, Walmart’s e-commerce sales totaled $100 billion last year compared to Target’s $19.4 billion.

Closing the Gap on Walmart appears to be at the forefront of Target's focus with the company’s total sales expected to slightly dip to $106.88 billion in its current fiscal 2025 but projected to rebound and rise 4% in FY26 to $110.84 billion.

In comparison, Walmart’s top line is expected to expand by 4% in what is its current FY25 as well and is projected to rise another 3% in FY26 to $700.05 billion.

Image Source: Zacks Investment Research

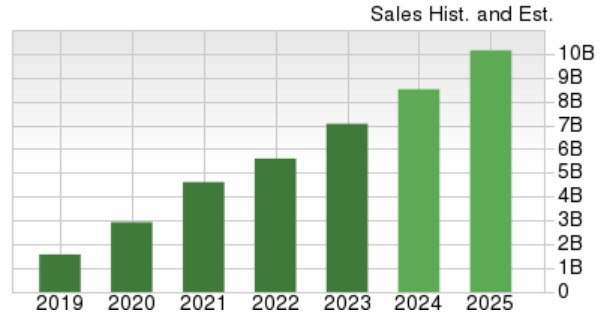

As for Shopify, its growth trajectory remains very compelling with total sales forecasted to jump 20% in its FY24 to $8.51 billion versus $7.06 billion last year. Plus, FY25 sales are projected to climb another 19% to $10.13 billion.

Image Source: Zacks Investment Research

Earnings Outlook

Based on Zacks estimates, Target’s annual earnings are expected to be up 4% in FY25 and are projected to jump another 13% in FY26 to $10.51 per share. However, FY26 projections would reflect a 22% decrease over the last five years with earnings at a very impressive $13.56 per share in Target's FY22.

Image Source: Zacks Investment Research

Pivoting to Shopify, annual earnings are expected to soar 34% this year to $0.99 per share compared to $0.74 a share in 2023. More impressive, FY25 EPS is forecasted to leap another 24% to $1.23 and would represent a 272% increase over the last five years with earnings at $0.33 a share in FY21.

Image Source: Zacks Investment Research

Performance Comparison

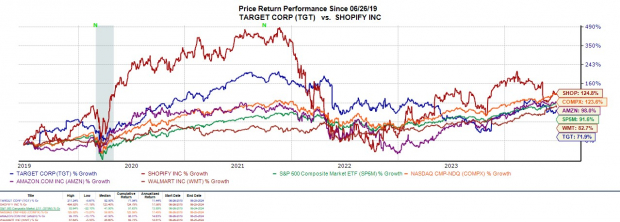

Year to date, Shopify’s stock is down -16% with Target shares up +3% but both have underperformed the S&P 500’s +14% and the Nasdaq’s +17% along with Amazon’s +23% and Walmart’s +28%.

This comes as Shopify’s stock has soared +125% over the last five years which has topped the broader indexes, Amazon’s +98% and Walmart’s +83% while Target’s +72% has lagged its commerce peers.

Image Source: Zacks Investment Research

Takeaway

Although Shopify and Target’s price performance has been subpar this year both stocks currently land a Zacks Rank #3 (Hold). In this regard, longer-term investors may certainly be rewarded as the collaboration between Shopify and Target should strengthen the favorable outlook for both companies.

More By This Author:

3 Crypto Stocks To Buy From Bitcoin's Long-Term Perspective3 Cheap Stocks To Buy For Growth & Value

Top Stock Picks For Week Of June 24, 2024

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any ...

more