Time To Buy Meta Platforms Stock As Q2 Earnings Approach?

Image Source: Pixabay

As the world’s largest social media company, investors will be scoping Meta Platforms (META - Free Report) stock as big tech continues to headline this week’s earnings lineup.

Let’s see if it's time to buy Meta’s stock as its Q2 results approach after market hours on Wednesday, July, 31.

Meta’s Q2 Expectations

With the majority of its revenue derived from advertising, Meta’s Q2 sales are thought to have increased 19% to $38.27 billion. Furthermore, Q2 EPS is projected to soar 45% to $4.69 versus $3.23 a share in the comparative quarter.

This comes as Omnicom Group (OMC - Free Report), the largest advertising agency in the US was able to exceed top and bottom line expectations earlier in the month.

Notably, Meta has surpassed earnings expectations for six consecutive quarters posting an average EPS surprise of 13.3% in its last four quarterly reports.

Image Source: Zacks Investment Research

Meta AI & Metaverse

As ad spending continues to recover since the pandemic Wall Street will also be looking for updates on the contributions and outlook of META AI, an intelligent AI assistant offered across Meta’s apps including Facebook, Instagram, and WhatsApp.

Social media peers such as Snapchat (SNAP - Free Report) and Pinterest (PINS - Free Report) have also expanded their services with AI assistants but Meta has stood out in its quest to expand into the metaverse. Like Wall Street, investors have had mixed opinions in regards to Meta’s spending on virtual and augmented reality to build out the metaverse with the company appeasing shareholders when it cut back on doing so.

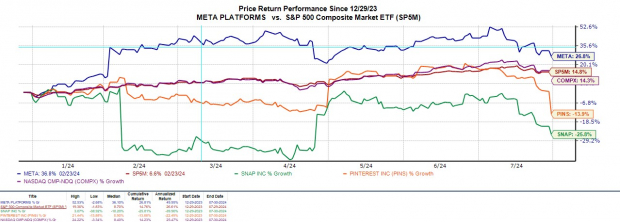

YTD Performance

Meta’s stock has soared +27% year to date which has impressively topped many of its “Magnificent Seven” peers and the broader indexes while largely outperforming Snap’s -26% and Pinterest's -14%.

Image Source: Zacks Investment Research

Monitoring Meta’s Valuation

After recently pulling back below $500 a share, META trades at 23X forward earnings which is on par with the S&P 500. It’s also noteworthy that META trades pleasantly below its decade-long high of 74.5X forward earnings and at a slight discount to the median of 25.1X during this period.

Image Source: Zacks Investment Research

Bottom Line

After such a sharp YTD rally, Meta Platforms stock lands a Zacks Rank #3 (Hold). Despite META trading at what has become a very reasonable valuation, the ability to reach or exceed Q2 expectations and offer positive guidance will be crucial to more upside.

More By This Author:

Time To Buy Stock In The World's Most Valuable Company As Earnings Approach?Roku Gears Up To Report Q2 Earnings: Here's What To Expect

Bear Of The Day: Robert Half Inc (RHI)

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any specific ...

more