Time To Buy Kraft Heinz And Ingredion's Stock For Value

Image Source: Pixabay

Two consumer staples stocks that appear to have a nice amount of upside ahead of them are Kraft Heinz (KHC - Free Report) and Ingredion Incorporated (INGR - Free Report).

Both belong to the Zacks Food-Miscellaneous Industry which is currently in the top 38% of over 250 Zacks industries and make the case for being undervalued at their current levels. Let’s see why Kraft Heinz and Ingredion look like promising value stocks going into 2024.

Overview & Outlook

Not needing much of an introduction, Kraft Heinz is one of the largest consumer packaged food and beverage companies in North America with some of the company's popular brands also including Oscar Meyer and Velveeta. With much notoriety, Warren Buffett’s Berkshire Hathaway (BRK-B - Free Report) owns more than 400 million shares of Kraft Heinz’s stock having a 34.5% stake in the company.

Berkshire has added about 100 million shares in Kraft Heinz stock since 2013 and the resurgence of the company’s lucrative earnings potential may be its reason for doing so. To that point, Kraft Heinz’s annual earnings are now projected to be up 6% in fiscal 2023 and are expected to rise another 2% in FY24 to $3.01 per share. On the top line, sales are forecasted to be up 1% this year to $26.75 billion and are expected to edge up to $26.91 billion in FY24.

Image Source: Zacks Investment Research

Pivoting to Ingredion, the company’s growth has been remarkable as an ingredients solutions provider specializing in nature-based sweeteners, starches, and nutrition ingredients. Ingredion’s EPS is expected to expand 25% this year to $9.29 per share compared to $7.45 a share in 2022. Plus, FY24 earnings are projected to rise another 5%. Total sales are anticipated to rise 5% in FY23 and expand another 3% in FY24 to $8.63 billion.

Image Source: Zacks Investment Research

Attractive Valuations

Making Kraft Heinz and Ingredion’s favorable outlooks more attractive is their very reasonable valuations. Kraft Heinz stock trades at 12.3X forward earnings which is a 31% discount to the Zacks Food-Miscellaneous industry average of 17.8X and well below the S&P 500’s 22.4X.

Furthermore, Kraft Heinz shares trade even further below their decade-long high of 34.7X forward earnings and also offer a slight discount to the median of 15.3X. In terms of price-to-sales, Kraft Heinz's P/S ratio of 1.6X is just above the industry average of 1.3X but beneath the optimum level of less than 2X and the S&P 500’s 3.9X.

Image Source: Zacks Investment Research

Similarly, Ingredion’s stock trades at a sharp P/E discount to the Zacks Food-Miscellaneous industry average with INGR shares trading at an 11.7X forward earnings multiple. More intriguing, Ingredion’s stock trades at just 0.8X sales.

Image Source: Zacks Investment Research

Generous Dividends

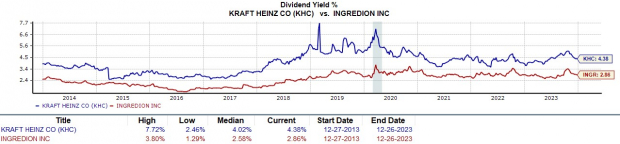

Bolstering the value they offer to investors at their current levels is that Kraft Heinz has a 4.38% annual dividend yield with Ingredion’s at 2.86%. Both yields top the industry average of 2.53% and tower over the S&P 500’s 1.37% average.

Image Source: Zacks Investment Research

Takeaway

Going into 2024 value investors may want to take notice of Kraft Heinz and Ingredion’s stock. For now, both sport a Zacks Rank #2 (Buy) and have an “A” Zacks Style Scores Grade for Value. Generous dividends, very reasonable valuations, and favorable outlooks certainly make Kraft Heinz and Ingredion two of the more attractive consumer staples stocks for the new year.

More By This Author:

These 3 Stocks Enjoyed A Red-Hot DecemberTop Stock Picks For Week Of December 25, 2023

Bull of the Day: Shopify (SHOP)

Disclaimer: Neither Zacks Investment Research, Inc. nor its Information Providers can guarantee the accuracy, completeness, timeliness, or correct sequencing of any of the Information on the Web ...

more