Time To Buy, Hold, Or Sell CEA Industries Stock?

Image Source: Pexels

It’s been an exciting start to the week for CEA Industries (VAPE - Free Report) stock, to say the least, after announcing a bold move into the crypto space via a $500 million private investment in public equity (PIPE) deal.

Previously operating as an agricultural tech firm, the crypto announcement led to VAPE shares surging more than +500% on Monday to a new all-time high of $82. That said, CEA Industries saw its stock reverse course in today’s trading session, falling 30% to just under $40 a share.

This certainly makes it a worthy topic of whether it's time to buy, hold, or sell CEA Industries stock after such roller coaster price movement.

Image Source: Zacks Investment Research

Key Points of CEA Industries Stock Surge

Positioning CEA Industries between traditional finance and the crypto ecosystem, the PIPE deal includes $400 million in cash and $100 million in Binance Coin (BNB), with up to $750 million more if warrants are exercised, potentially totaling $1.25 billion.

CEA Industries' transformation is set on being the largest publicly traded BNB treasury company, with it noteworthy that Binance Coins are the fourth largest cryptocurrency. In order to capitalize on its crypto endeavors, CEA Industries plans to generate revenue through staking and lending on the BNB chain.

Influencing CEA Industries' focus on Binance Coin is that BNB has now appreciated more than 600,000% since its inception in 2017 to current levels of over $800. Following its strategic move into the crypto treasury space, CEA Industries has recently appointed David Namdar as its new CEO, who is the co-founder of Galaxy Digital (GLXY - Free Report), a digital asset and blockchain service provider.

Image Source: TradingView

Tracking CEA Industries Outlook

Zacks' projections currently call for CEA Industries' total sales to skyrocket over 600% in fiscal 2025 to $21 million compared to $2.8 million last year. Plus, FY26 sales are projected to spike another 77% to $37.3 million.

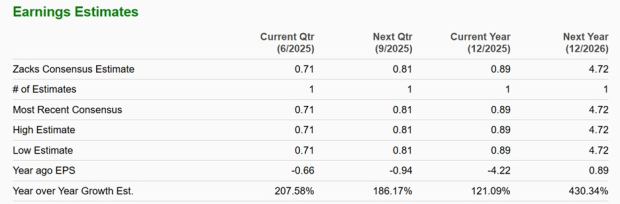

More intriguing, CEA Industries' annual earnings are expected to climb swing from an adjusted loss of -$4.22 a share in 2024 to $0.89 per share this year. Even better, FY26 EPS is projected to soar 430% to $4.72.

Image Source: Zacks Investment Research

Monitoring CEA Industries Valuation

With CEA Industries expected to cross the probability line, VAPE shares trade at 64.7X forward earnings. However, CEA Industries has been public since 2011, making the company’s P/E valuation a bit of a stretch even with its now promising growth trajectory.

In terms of price to sales, VAPE still has a very reasonable 2.2X forward P/S ratio, and the company’s top line expansion does suggest CEA Industries has become a viable investment.

Image Source: Zacks Investment Research

Conclusion & Final Thoughts

For now, CEA Industries stock lands a Zacks Rank #3 (Hold). Becoming the largest publicly traded BNB treasury company should be advantageous for CEA Industries stock in the future, but there could still be better buying opportunities after Monday’s surge.

While monitoring CEA Industries' valuation will be important, the transformation into the cryptocurrency space has come at the right time, with legislation such as the GENIUS Act pushing these digital assets into another threshold regarding their acceptance.

More By This Author:

3 Top-Ranked Mid-Cap Blend Mutual Funds For Remarkable ReturnsBull Of The Day: Amazon.Com Inc

UnitedHealth Group Q2 Earnings Lag Estimates

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any ...

more