Time To Buy Commercial Metals (CMC) Or FedEx (FDX) Stock After Earnings?

Two notable companies that were able to beat their quarterly earnings expectations this week were steel producer Commercial Metals Company (CMC) and global delivery services leader FedEx (FDX).

After surpassing earnings expectations, let’s see if now is a good time to buy Commercial Metals or FedEx stock.

CMC Q3 Review

Driven by strength in North American construction activity, Commercial Metals was able to exceed its fiscal third-quarter top and bottom line expectations on Thursday.

Commercial Metals topped its Q3 EPS estimates by 10% at $2.02 per share compared to expectations of $1.84 a share. Third-quarter sales of $2.34 billion beat estimates by 9%.

The top and bottom line beats were impressive considering easing inflation has cooled off steel prices. To that point, Commercial Metals' Q3 earnings declined -22% from a very tough-to-compete-against prior-year quarter with sales down -7% from a year ago.

Following a record year, Commercial Metals’ earnings are now forecasted to dip -5% in fiscal 2023 at $7.78 per share. Fiscal 2024 earnings are expected to drop another -26% to $5.77 a share as Commercial Metals’ bottom line comes back to reality following immense profits from inflated steel prices.

Still, CEO Barbara Smith stated Commercial Metals’ North American segment volumes should continue to be supported by significant structural trends including the re-shoring of manufacturing and logistical supply chains, and increasing investment to improve the condition and functionality of the core infrastructure and energy markets in the United States.

In correlation, earnings estimates have remained higher throughout the quarter supportive of Commercial Metals stock being undervalued at $51 a share and just 6.6X forward earnings.

(Click on image to enlarge)

Furthermore, Commercial Metals stock trades nicely beneath its industry average of 8.3X and intriguingly below the S&P 500’s 20.4X. Even better, shares of CMC trade 74% below their decade high of 25.3X and at a 39% discount to the median of 11X.

(Click on image to enlarge)

FDX Q4 Review

Higher operating margins helped FedEx beat its fiscal fourth-quarter earnings expectations on Tuesday but the company came up short on the top line. CEO Raj Subramaniam said continued demand weakness and cost inflation negatively impacted quarterly results although operating margins were the strongest of the fiscal year.

FedEx surpassed its Q4 EPS estimates by 2% at $4.94 per share despite sales missing estimates by -3% at $21.93 billion. Year over year, sales were down -10% and earnings dropped -28% with EPS at $6.91 in the prior-year quarter.

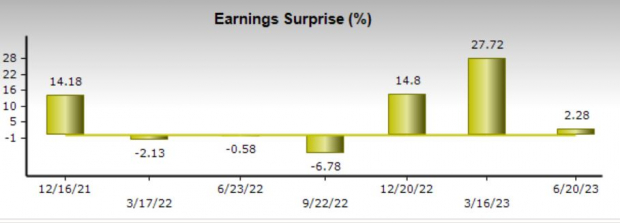

(Click on image to enlarge)

However, FedEx’s annual earnings are forecasted to jump 18% in its current fiscal 2024 at $17.74 per share compared to EPS of $14.96 in FY23. Plus, fiscal 2025 earnings are projected to climb another 18% at $20.88 per share.

Trading at $232 a share, FedEx stock trades at 13.1X forward earnings which is beneath its industry average of 14.5X and the benchmark. With that being said, earnings estimate revisions have trended down over the last 30 days.

(Click on image to enlarge)

Takeaway

At the moment Commercial Metals stock sports a Zacks Rank #2 (Buy) with FedEx landing a Zacks Rank #3 (Hold). Their rankings are largely attrbuted to the trend in earnings estimate revisons.

After beating its quarterly top and bottom line expectations, Commercial Metals stock continues to look undervalued considering its attractive P/E valuation with earnings estimates remaining higher.

As for FedEx, despite earnings estimate revisions trending down in the last month the company’s anticipated bottom-line growth is intriguing. Surpassing quarterly earnings expectations was a good sign although sales came up short. Still, investors could be rewarded for holding FedEx stock at its current levels.

More By This Author:

Carnival Gears Up For Q2 Earnings: What's In Store?Will Nike Beat Estimates Again In Its Next Earnings Report?

Bull Of The Day: Graphic Packaging Holding Company

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any specific ...

more