Time To Buy Chipotle's Stock As Much Anticipated Q2 Earnings Approach?

Image Source: Unsplash

In its first earnings report since a historic 50-1 stock split last month, Chipotle Mexican Grill (CMG - Free Report) will report Q2 results on Wednesday, July 24.

Wall Street and of course retail investors will be scoping the retail restaurant giant’s Q2 report with its stock trading at a much more affordable price tag of $52 compared to over $3,000 pre-split. Seeing as the underlying fundamentals of a company don’t change when its stock splits, let’s see if it’s time to buy CMG as earnings approach.

Q2 Expectations for CMG

As mentioned, financial figures like Chipotle’s actual operating profit are not affected by a stock split but EPS is adjusted to reflect the increased number of shares. In this regard Chipotle is expected to post Q2 earnings of $0.31 per share which would be a 24% increase from $0.25 a share (EPS of $12.50/50) in the comparative quarter.

Quarterly sales are projected to rise 17% to $2.94 billion versus $2.51 billion a year ago. Notably, Chipotle has exceeded top and bottom line expectations in three of its last four quarterly reports posting an average earnings surprise of 8.33%.

Recent Growth Drivers

During Q1 Chipotle highlighted successful marketing campaigns as a key contributor to its sales growth this year, including spotlighting barbacoa and the return of Chicken al Pastor as a limited-time offer. Furthermore, digital sales from online orders have been a further catalyst to Chipotle's growth making up 37% of its revenue during Q1.

Marketing barbacoa, a unique traditional Caribbean-style method of cooking meat also comes at a much-needed time as many consumers are becoming more familiar with Cava Group (CAVA - Free Report), a Mediterranean-style restaurant and growing competitor that offers a build-your-own-bowl model similar to Chipotle.

Post-Split Performance

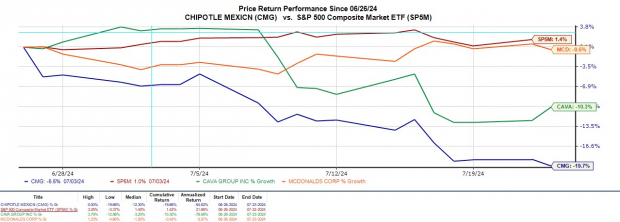

Since its stock split on June 26, CMG shares have fallen -20% to underperform the S&P 500’’s +1% with it noteworthy that this has also trailed McDonald’s (MCD - Free Report) virtually flat performance and Cava Group’s -10%.

Image Source: Zacks Investment Research

Monitoring CMG’s Valuation

At current levels, CMG trades at a 48.4X forward earnings multiple which is still a noticeable premium to the broader market. However, CMG does trade attractively below its decade-long high of 231.1X forward earnings while offering a slight discount to the median of 50.4X.

Image Source: Zacks Investment Research

Bottom Line

While it may be too soon to say a post-split rebound is in store for Chipotle’s stock, CMG lands a Zacks Rank #3 (Hold). Now more than ever, investors will want to see Chipotle’s attractive growth trajectory is still intact when it reports Q2 results. To that point, CMG's stock price is far more reasonable but its valuation is not cheap.

More By This Author:

Tesla Lags Q2 Earnings EstimatesCoca-Cola Tops Q2 Earnings And Revenue Estimates

Time To Buy Alphabet Or IBM Stock As Earnings Approach?

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any specific ...

more