Time To Buy Amazon's Stock As Q1 Earnings Approach?

Image Source: Unsplash

After Alphabet’s (GOOGL - Free Report) exhilarating quarterly results last week, Wall Street will be eying its big tech peer and cloud computing rival Amazon’s (AMZN - Free Report) Q1 report on Tuesday, April 30.

More so than Alphabet, Amazon’s stock has been on an ascending course to hit $200 a share after their 20-for-1 stock splits in 2022 and investors may be wondering if it's time to buy as earnings approach.

Q1 Preview

Amazon’s Q1 earnings are thought to come in at $0.81 per share which would be a 161% increase from $0.31 a share in the comparative quarter. On the top line, Q1 sales are projected to rise 12% to $142.55 billion.

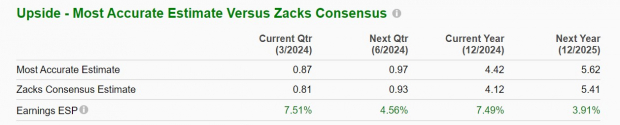

Notably, Amazon has exceeded the Zacks EPS Consensus for five consecutive quarters and has posted an impressive average earnings surprise of 51.04% in its last four quarterly reports. Furthermore, the Zacks Expected Surprise Prediction (ESP) indicates Amazon could exceed earnings expectations again with the Most Accurate Estimate having Q1 EPS at $0.87 and 7% above the Zacks Consensus.

Image Source: Zacks Investment Research

Cloud Expansion

Outside of its commanding e-commerce business, Amazon’s AWS still controls the primary share of the domestic cloud computing market ahead of Microsoft’s (MSFT - Free Report) Azure and Alphabet’s Google Cloud. According to Zacks estimates, AWS segment sales are expected to rise 13% to $24.25 billion versus $21.35 billion in Q1 2023.

Edging Towards $200 a Share

Amazon’s stock has risen +19% this year with a current stock price of $180 a share and has matched Alphabet’s YTD performance with GOOGL having a current price of $166. Over the last year, AMZN has now soared +77% to slightly top GOOGL at +55%.

Image Source: Zacks Investment Research

Earnings Estimate Revisions

The catalyst for Amazon’s stock edging closer to $200 a share has been the positive trend of earnings estimate revisions. Over the last 60 days, fiscal 2024 and FY25 EPS estimates have now risen 1% and 2% respectively, and are slightly up in the last week.

Even better, Amazon’s annual earnings are currently projected to rise 42% this year to $4.12 per share with another 31% EPS growth expected in FY25.

Image Source: Zacks Investment Research

Takeaway

Amazon’s stock currently sports a Zacks Rank #2 (Buy). To that point, the trend of positive earnings estimate revisions ahead of its Q1 report is compelling along with the Zack ESP suggesting the Magnificent Seven titan should top bottom line expectations.

More By This Author:

Pharma Stock Roundup: Merck, Sanofi, AstraZeneca, Novartis' Q1 Results, Pipeline & Regulatory Updates5 Stocks In Focus On Their Recent Dividend Hikes

Airline Stock Roundup: AAL, LUV, JBLU & HA Incur Q1 Loss

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any ...

more