Time To Buy Alphabet And Amazon Stock After Q1 Earnings

Image: Bigstock

Technology conglomerates Alphabet (GOOGL - Free Report) and Amazon (AMZN - Free Report) haven’t recently experienced the extensive rallies that were seen in their stocks years ago, but more upside may lie just ahead. Let’s see why now may be a good time to buy these tech giants’ stocks after their first-quarter earnings last week.

Alphabet Q1 Review

Having reported Q1 earnings last Tuesday, Alphabet was able to put to rest some of the fears that the company’s slower progress in ChatGPT would affect its search engine dominance. CEO Sundar Pichai stated the Search segment was performing well along with momentum in the Cloud segment. This led to Q1 sales rising 3% from the prior year quarter at $58.06 billion, which topped estimates by 1%.

On the bottom line, first-quarter earnings nicely beat estimates by 10% at $1.17 per share despite dipping -5% from Q1 2022. More importantly, Alphabet put an end to a string of four consecutive quarters in which the company missed its bottom-line expectations.

Image Source: Zacks Investment Research

Amazon Q1 Review

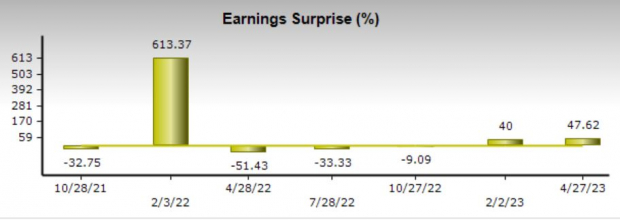

Amazon also had a solid first quarter after releasing its results last Thursday. The multi-operational behemoth expects slower cloud revenue growth at the moment, but Amazon Web Services (AWS) sales were still up 16% year-over-year at $21.35 billion. Total sales for the quarter topped estimates by 2% at $127.35 billion and increased 9% from Q1 2022.

Earnings widely topped expectations by 47% at $0.31 per share compared to EPS estimates of $0.21. This was also a 47% increase from the prior year quarter, with Q1 2022 earnings at $0.21 per share.

Image Source: Zacks Investment Research

Growth & Outlook

Alphabet and Amazon’s better-than-expected first-quarter results are reason enough to be optimistic about their outlooks, as well as the possibility that operating conditions may begin to stabilize.

To that point, Alphabet earnings are now forecasted to climb 18% this year and jump another 16% in FY24 at $6.25 per share. Earnings estimate revisions have remained higher over the last 30 days and are nicely up over the last quarter.

On the top line, sales are projected to be up 6% in FY23 and rise another 10% in FY24 to $274.53 billion. Fiscal 2024 would represent 69% growth from pre-pandemic sales of $161.85 billion in 2019.

Image Source: Zacks Investment Research

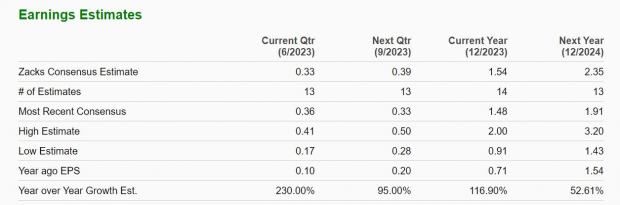

Turning to Amazon, earnings are expected to continue to rebound and soar 117% in FY23 at $1.54 per share compared to EPS of $0.71 in 2022. Plus, FY24 EPS is forecasted to climb another 52% to $2.35 per share. Earnings estimates revisions have trended higher in the last week since Amazon’s Q1 report.

Sales are projected to rise 9% this year and jump another 12% in FY24 to $629.96 billion. Furthermore, fiscal 2024 would be a very stellar 124% increase from 2019 pre-pandemic sales of $280.52 billion.

Image Source: Zacks Investment Research

Takeaway

Simply put, Alphabet and Amazon’s first quarter reports appeared to confirm the tech giants' anticipated annual growth and that inflationary concerns could potentially subside in the near future. Amazon currently holds a Zacks Rank #2 (Buy) rating as higher earnings estimate revisions are also supportive of buying shares right now.

With Alphabet and Amazon stock both recently seen trading at around $105 a share, it’s starting to look more plausible that they will move closer to their Average Zacks Price Targets over the course of the year, which are notably over $130 per share, respectively.

More By This Author:

Dividend Watch: 3 Companies Boosting PayoutsPayPal To Post Q1 Earnings: What's In The Offing?

AMC Entertainment To Post Q1 Earnings: What's In Store?

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any specific ...

more