Thursday Afternoon Earnings Roundup: DOCU RH SWBI

Three companies I follow reported earnings Thursday afternoon: Docusign (DOCU), Restoration Hardware (RH), and Smith & Wesson (SWBI).

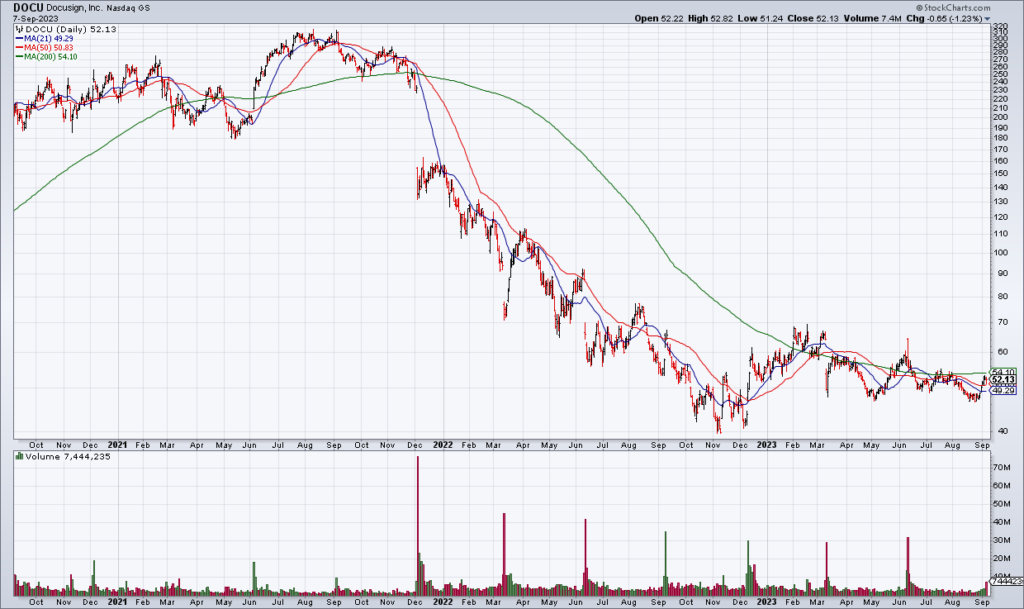

(Click on image to enlarge)

DOCU was a pandemic darling as everybody used their eSignature platform during social distancing. However, the stock has lost 5/6ths of its value over the last two years – and even Cathie Wood bailed out. But the fundamentals are starting to be there. Current quarter billings of $711 million blew away guidance of $646-$656 million. DOCU also raised full year billings guidance to $2804-$2824 million from $2737-$2757 million. DOCU has always been highly profitable and with fundamentals starting to turn I think shares could catch a bid. DOCU shares are currently +4% in the after-hours.

(Click on image to enlarge)

Like DOCU, RH shares have been hammered over the last couple of years – though they ran up hard into today’s earnings report on hopes the luxury home market is in recovery mode. However, RH’s 3Q23 guidance looks to be quite weak – especially operating margins of 8.0%-10.0%. RH shares are currently -9% in the after-hours.

(Click on image to enlarge)

SWBI shares have also been a roller coaster over the last few years – trading as high as $37 and as low as $8. Gun sales surged during the pandemic, propelling the stock, but have since tailed off. Nevertheless, I continue to believe that the demand for guns for self defense is in a secular uptrend due to rising crime (consider, for example, all the retailers cutting operating margins due to increased “shrink” i.e. theft of late). SWBI is an unloved and cheap way to play this. SWBI shares are currently +11% in the after-hours.

More By This Author:

Looking Ahead: August CPI, Fed Meeting, Zscaler, DocuSign & Kroger Earnings

DG’s Struggles: Economic And Political Implications; Adding To My Position

The Stock Game: Value, Macro, Momentum And Technical Approaches

Disclosure: Top Gun is long shares of DOCU and SWBI.