Three Safe Dividend Kings To Weather Any Storm

Image Source: Pixabay

Income investors should focus on stocks with solid yields, sustainable payouts, and strong business models. One way to achieve this is by investing in safe dividend kings.

The Dividend Kings are an excellent place to look for stocks with sustainable dividends, as they have raised their dividends each year for over 50 consecutive years.

The following three safe Dividend Kings have low dividend payout ratios and recession-proof business models, meaning their dividends are well-covered even during a recession.

Three Safe Dividend Kings

Walmart (WMT)

Walmart traces its roots back to 1945 when Sam Walton opened his first discount store. The company has since grown into the largest retailer in the world, serving more than 230 million customers weekly. Revenue should be around $670 billion this year.

Walmart posted second-quarter earnings on August 15th, 2024, with excellent results, sending the stock soaring. Adjusted earnings-per-share beat estimates by two cents at 67 cents. Revenue was up almost 5% year-over-year to $169.3 billion, beating estimates by nearly $2 billion. The company noted global e-commerce sales soared 21%, which was led by store-fulfilled pickup and delivery, as well as strength in Marketplace.

Comparable sales in the U.S. rose 4.2%, 80 basis points ahead of estimates. Transactions were 3.6% higher, and the average ticket added a further 60 basis points. The gain in e-commerce sales amounted to 3% of the 4.2% gain, so the physical stores added only 1.2%. Walmart’s burgeoning advertising business saw growth of 26% in the quarter, including 30% for Walmart Connect in the U.S.

Looking forward, we are forecasting 11% annual earnings growth for the next five years as Walmart continues to work through its margin issues and caution on consumer spending. The company continues to buy back stock as well. We see low single-digit sales growth each year, with its e-commerce business being the primary driver of top-line growth.

Walmart’s competitive advantage is its enormous size, as it can buy and ship products at a scale with which few retailers can compete. This allows it to operate at low prices to consumers, and as more than half of its revenue comes from groceries, its recession performance is excellent.

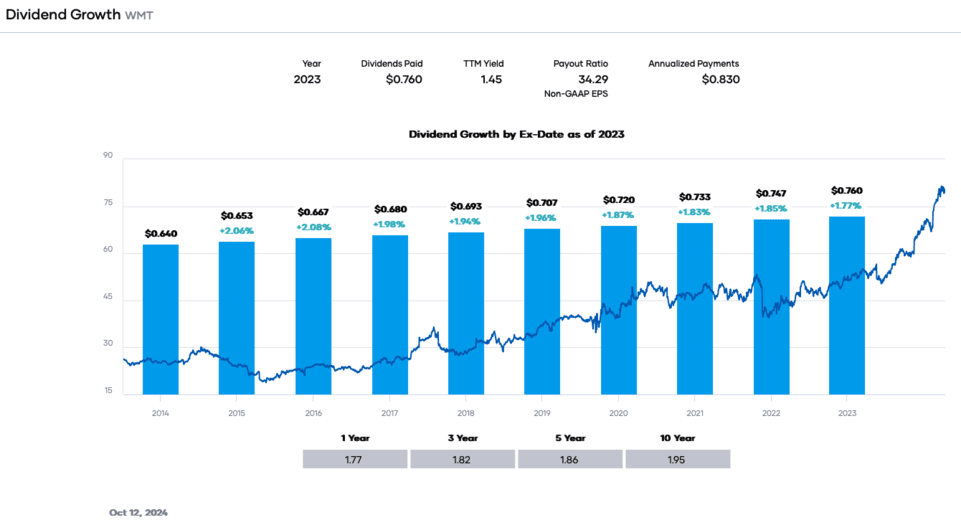

The company’s payout ratio is quite low at 34% expected for the full fiscal year, making for a conservative dividend policy. The regular cash dividend should be very safe, even in a recession. Walmart has increased its dividend for 51 years.

Source: Portfolio Insight*

Dover Corporation (DOV)

Dover Corporation is a diversified global industrial manufacturer with annual revenues approaching $9 billion. Dover comprises five reporting segments: Engineered Systems, Clean Energy & Fueling, Pumps & Process Solutions, Imaging & Identification, and Climate & Sustainability Technologies. Dover is a Dividend King with more than six decades of dividend increases. Slightly more than half of revenues come from the U.S., with the remainder from international markets. Dover is the second stock on our list of safe Dividend Kings.

In August 2024, Dover announced it was raising its dividend by 1%, marking 69 consecutive years of dividend growth. This is the second-longest dividend growth streak among U.S. companies.

On July 25th, 2024, Dover announced the second quarter results for the period ending June 30th, 2024. The quarter’s revenue grew 3.8% to $2.18 billion, $30 million more than expected. Adjusted earnings-per-share of $2.36 compared favorably to $2.05 in the prior year and was $0.15 above estimates.

Organic revenue improved 5% year-over-year, while bookings grew 16%. For the quarter, Engineered Products had organic growth of 20% due to continued strong demand for waste handling and aerospace and defense products. Vehicle service improved in Europe. Clean Energy & Fueling was up 2% from gains in clean energy, software systems, and above-ground retail fueling equipment. Imaging & Identification grew by 7% due to higher demand for serialization software.

Dover’s key competitive advantage is its focus on niche industries. The company offers highly engineered products that customers have come to depend on, so switching to a different provider may yield different results for their businesses.

Dover has increased its dividend for 68 consecutive years.

Source: Portfolio Insight*

Johnson & Johnson (JNJ)

Johnson & Johnson is a diversified healthcare company that is a leader in pharmaceuticals and medical devices. Johnson & Johnson was founded in 1886 and employs more than 150,000 people worldwide. It is the third stock on our list of safe Dividend Kings.

On July 17th, 2024, Johnson & Johnson announced second quarter results for the period ending June 30th, 2024. Revenue grew 4.3% for the quarter to $22.4 billion, $60 million more than expected. The adjusted earnings-per-share of $2.82 compared to $2.80 in the prior year was $0.12 ahead of estimates. Excluding COVID-19 vaccine sales, the company’s total revenue grew 7.1% in the second quarter.

Revenue for Innovative Medicines improved by 5.5% on a reported basis but was higher by 8.8% when excluding currency translation. Infectious Disease fell 13%, excluding currency, primarily due to reduced COVID-19 vaccine revenue, though the year-over-year declines are becoming less pronounced. Oncology continues to act well, with revenue up almost 19%.

Johnson & Johnson offered revised guidance for 2024 as well. The company now expects revenue in a range of $89.2 billion to $89.6 billion, up from $88.7 billion to $89.1 billion and $88.2 billion to $89 billion previously. Adjusted earnings-per-share is now projected to range from $10.00 to $10.10.

Johnson & Johnson has grown earnings over the past ten years at a rate of 6.3%. The company managed to grow earnings before, during, and after the last recession, showing that the company’s products are in demand regardless of market conditions. We expect earnings-per-share to grow at a rate of 6% per year through 2029 due to gains in revenue and share repurchases.

Its diversified business model and stable growth have allowed the company to increase its dividend every year, even during recessions. J&J has increased its dividend for 62 consecutive years. Johnson & Johnson has a reasonably low dividend payout ratio of approximately 49% for 2024. This gives the company ample room to raise its dividend, even in a prolonged recession.

More By This Author:

Factor Investing: A Simple Guide On How It WorksInvest In Starbucks Now? – Not A Chance

The Effects Of 3M Company's Dividend Cut

Disclaimer: Dividend Power is not a licensed or registered investment adviser or broker/dealer. We are not providing you with individual investment advice on this site. Please consult with ...

more