Three Paths Ahead

On this day of lifetime highs across the board, I was musing about what the market might look like over, say, the next twenty months or so (that is, up through the end of next year, which will also be following what is bound to be a really interesting Presidential election). The possibilities, of course, are pretty much infinite, but allow me to offer up three broad scenarios.

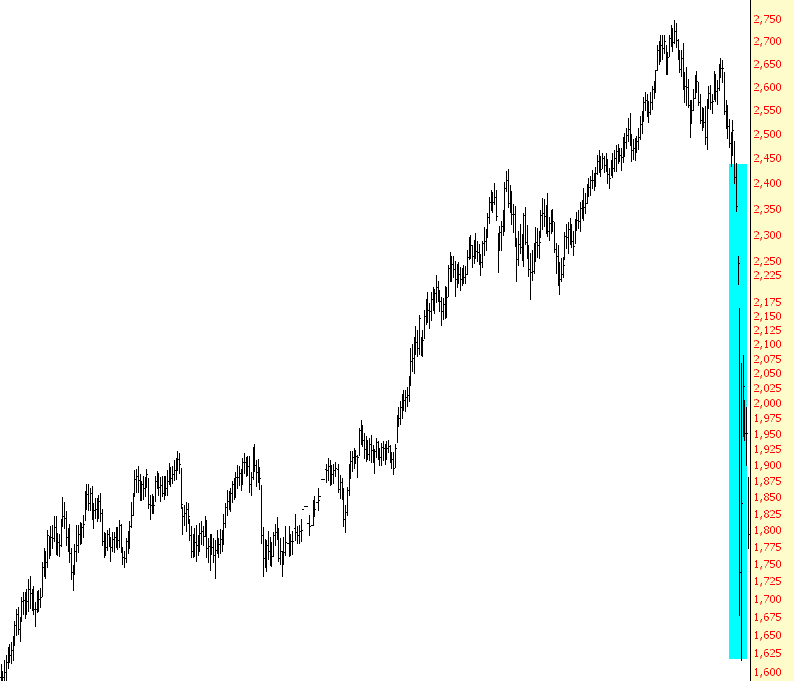

One: A Crash

This is what has been craved by the ZH crowd pretty much since its founding. It’s the kind of crash we saw in 1987 and the autumn of 2008. I think that, given international central bank intervention and the ghastly complacency around the globe, the chances of a straight-down stock crash is a little smaller than the odds of Bruce Jenner announcing his engagement to Bill Clinton. Crashes are fun, they’re historic…………but a new one isn’t going to happen (unless, for instance, China declares war on the United States, which I think is possible years from now, but not just yet).

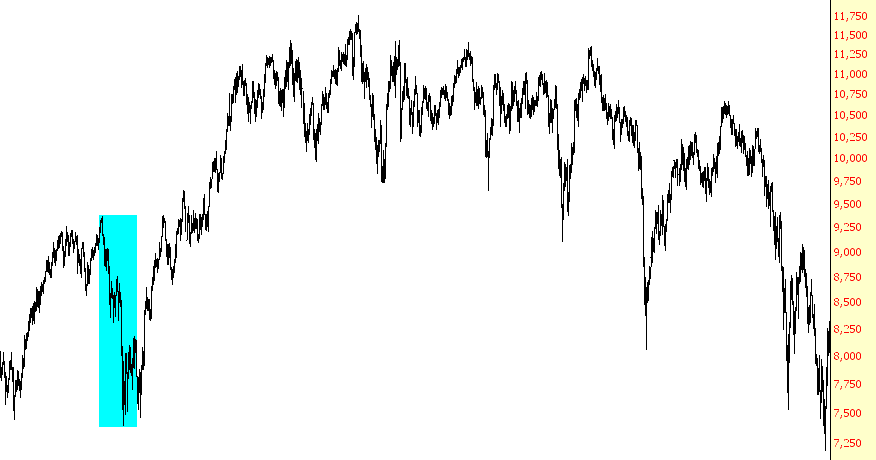

Two: Scare the Children

This is a situation somewhat like 1998 in which the market has, at long last, a meaningful drop of, say, 15%. It would be enough to get everyone’s attention (and enough to make Dennis Gartman go wildly bearish on CNBC) and enough to conjure up some new “help” from the central bankers. It would shake out the weak longs, but it would merely be followed by More Of The Same until such time an honest-to-God bear market was simply unavoidable.

This, I think, is a perfectly sound possibility. The Fed (and its equivalents around the world) has enough credibility to stave off a bear market for a while longer, and a reasonable drop would give it enough “cover” to do God-knows-what-else to prop up this house of cards for a while more. But at some point there will be a problem that the Fed can’t solve with more money-printing (like, oh, gosh, let’s say steadily rising interest rates) and the fact they’ve utterly painted themselves into the biggest corner of all time will be plainly evident. At that point, the market will go down for years.

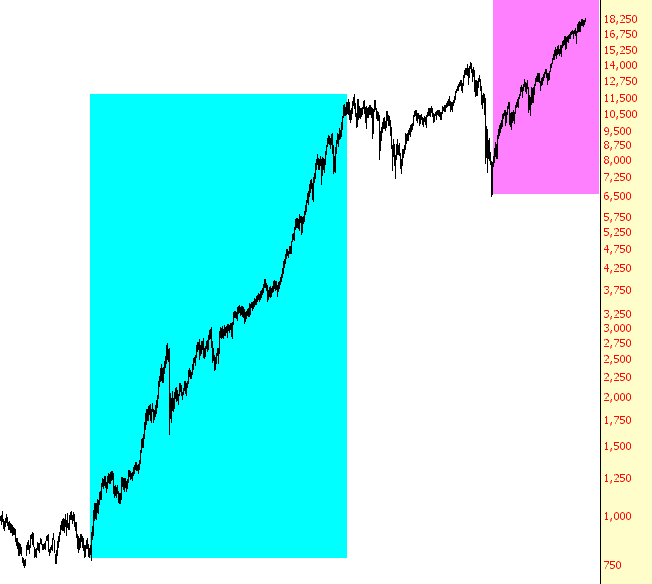

Three: The Neverending Story

Finally, here’s a scenario in which the past 6+ years was merely the first chunk of a market that will take the Dow to – – I dunno – – 25,000? 30,000? Pick a number! If we live in a new world of Mutually-Assured Financial Destruction (in other words, completely global, coordinated central bank intervention) and the “formula” keeps working for year after year after year – – well, time to roll up the ol’ carpet on Slope.

My general supposition is that something approaching the “scare the children” situation is what’s in the cards. And, frankly, I’ll happily take even a modest down-market this year! Because a day like today proves to me, yet again, that the bulls remain profoundly in control, and the “best” the bears could possibly hope for is a modest and short-lived diminishment is these incredibly-inflated asset prices. I was able to eke out a small profit on my totally short portfolio, even on a riotously “up” day like this, but…………this is just too much work!

This blog is not, and have never been, investment advice. It is a place that allows me to express my own views on the market and specific securities – as well as make whatever cultural ...

more

cheap drivel, your kid could do better. No analysis whatsoever, waste of my time.