Three Dividend Stocks To Buy Tomorrow (And One Trade To Line Your Pockets With Extra Income)

Having more income than you know what to do with every month sounds pretty exciting, huh? Well, I'm going to give you a crack at it today. And the cool part is, we're going to do it with some of the most boring, ho-hum stocks trading on the market right now. They're not a thrill-a-minute, but the truth is they're some of the market's top performers this year.

Buying and holding these picks alone would get you a long way toward Easy Street, but the dead-simple trading strategy I'm going to show you - that anyone can make, whether you've been trading for 15 minutes or 15 years - will have you collecting regular payouts as a "kicker."

These Three Stocks are the Key This Week

It's not flashy technology, it's not red-hot real estate or healthcare, but regular old everyday utilities - water and power - is where we'll find the best stocks right now. Take a look at the utilities "Sector Spider," the Utilities Select Sector SPDR Fund (XLU):

We saw a big pop in XLU earlier this month as stocks started wheezing along. That's a classic sign of a "flight to safety." Safe? People use utilities no matter what the economy is doing, and right now, there are real concerns that the Delta variant is throwing a wrench into a historic economic recovery.

That pop has cooled off a little bit, but I don't think the economy is out of the woods yet, which means this "safe harbor" sector is actually a great buy right now. Stocks in the XLU are paying some great dividends, too.

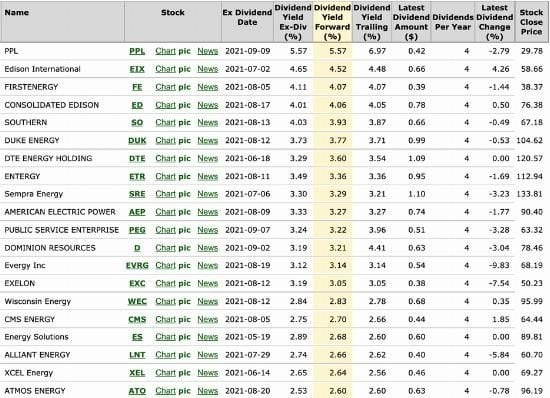

Check out the yields for the top 20 XLU holdings - the yellow column - in this screenshot from Tom's Trading Tools. Most of them are easily beating inflation, too.

The average dividend yield for S&P 500 stocks is 2.5%. Each one of the top 20 stocks in the XLU sector is greater than average. PPL Corp. (PPL) is over twice that.

There we have reason No. 2 to buy the cream of this crop: dividends. From here, you could simply buy the higher dividend stocks and ride the ride -- and get paid to do so. But we can afford to be selective about our stocks, because my proprietary screener has picked out the three best stocks to own here.

Entergy Corp. (ETR) is up 12.9% over the past six months and pays a 3.4% dividend. It's within $4 of 52-week highs, and it's close to major support and primed for another run up.

Exelon Corp. (EXC) is up more than 16.5% over the past six months and 3.5% over the past month alone. It's less than $1 away from 52-week highs, and it's a serious contender to revisit all-time highs above $80. Exelon management could put 3.06% in your pocket every quarter while you wait, too.

Southern Co. (SO) has moved up 7.22% over the past six months, and it's less than $3 from its all-time high. If it reclaims that territory, the sky's the limit. The payout on this stock is very appealing, too - 4.06%.

The strategy here is simple: Grab these stocks, profit on continuing rotation into utilities, and collect the dividend payouts every quarter. But with just one extra step, you can really boost your profits and monthly income with another simple trading strategy - the covered call. You can start writing covered calls on any optionable stock you own with no worries about higher options trading clearance levels from your brokerage.

Just take a look at the options chain for the stock you want to trade and pick an expiration close to 30 days out from the current date, and select strike prices that are out-of-the-money (OTM), or higher than the current stock price. You could pocket instant premium.

Disclaimer: Any performance results described herein are not based on actual trading of securities but are instead based on a hypothetical trading account which entered and exited the suggested ...

more