Thousands Of 'Dollar Stores' Clustered In Swing States May Offer New Insights

Dollar General (DG) and Dollar Tree (DLTR), with over 19,000 stores and nearly 16,800 US stores, respectively, delivered some alarming news in the past week about their crumbling core customer bases battered by elevated inflation and high interest rates—consequences of Bidenomics. The extensive nationwide footprint these two discount retailers have could give political strategists a glimpse into even gloomier consumer sentiment on a state-by-state basis, even potentially capturing some consumer sentiment in critical battleground states.

Last Thursday, Dollar General shares crashed the most on record after earnings underwhelmed for the second quarter, and the sales outlook for the full year was slashed on what management warned its core customers "feel financially constrained."

About one week later, on Wednesday, Dollar Tree shares plunged after second-quarter earnings fell short of Wall Street expectations. The discount retailer also cut its full-year outlook, pointing to mounting financial pressures on middle-income and higher-income customers.

Dollar Tree Chief Financial Officer Jeff Davis wrote in a statement that the "increasing effect of macro pressures on the purchasing behavior of Dollar Tree's middle- and higher-income customers" was the main driver in reducing its full-year sales forecast.

Given that Dollar General and Dollar Tree have a combined footprint of over 36,000 stores, primarily centered in the eastern half of the US, the warnings from both management teams about faltering low/mid-tier customer bases provide political strategists with deeper insight into how consumers feel ahead of the elections this fall and what topics dominate at the dinner table. We suspect Biden-Harris' inflation storm is the most dominant topic as folks can barely afford discount retailer junk food.

A recent report from analytics firm Numerator prepared for Business Insider noted about 40% of shoppers in the US buy from Dollar General. There was no data on Dollar Tree. What's very clear is that millions upon millions of Americans shop at both of these discount retailers. Suppose average ticket sizes are sliding for junk food, such as candy, chips, and sodas, basically a one-stop-shop for diabetes. In that case, the average shopper at these discount retailers is feeling the financially crushing effects of failed Bidneomics. This type of sentiment can impact elections and make 'inflation' a top concern when choosing their candidate.

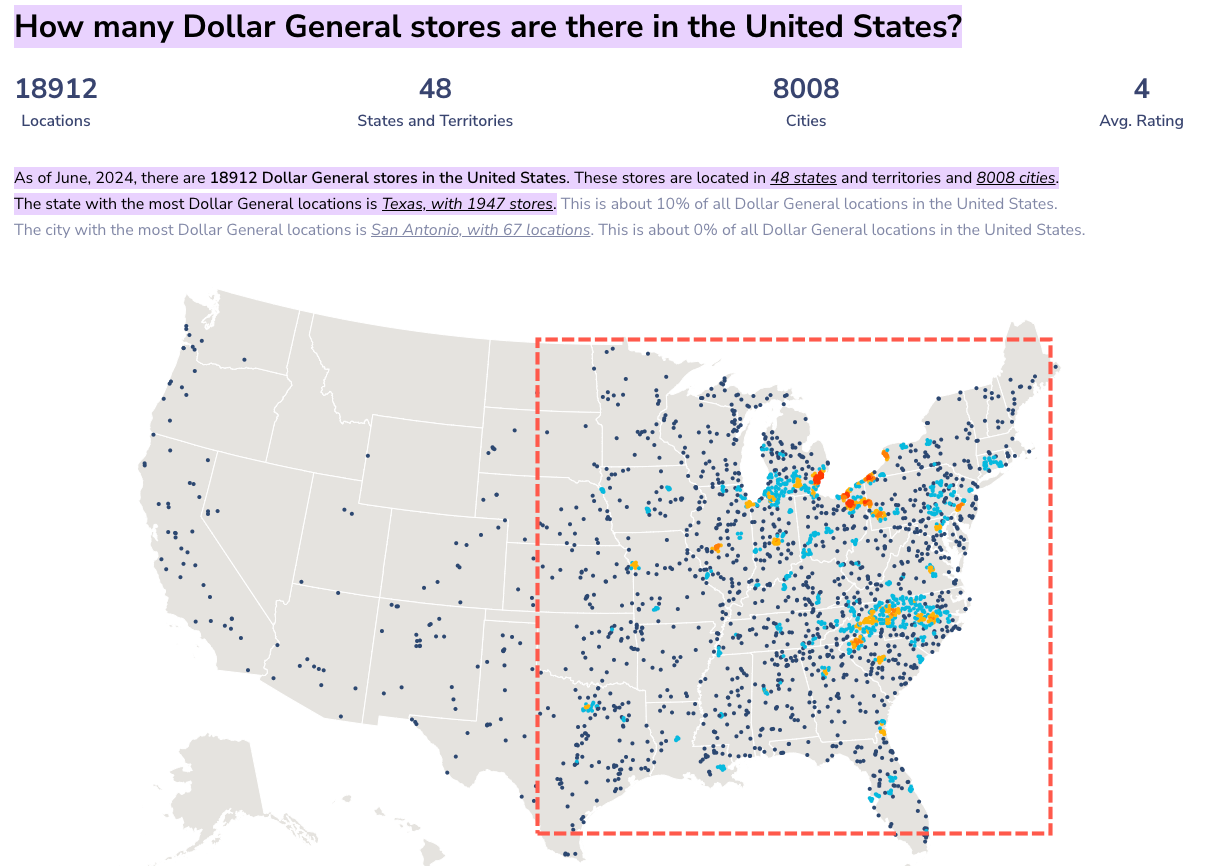

Geographically, Dollar General stores are primarily centered in the eastern half of the US. Thousands of these stores are clustered in critical swing states in the region, including Pennsylvania, Michigan, Wisconsin, North Carolina, and some in Georgia.

(Click on images to enlarge)

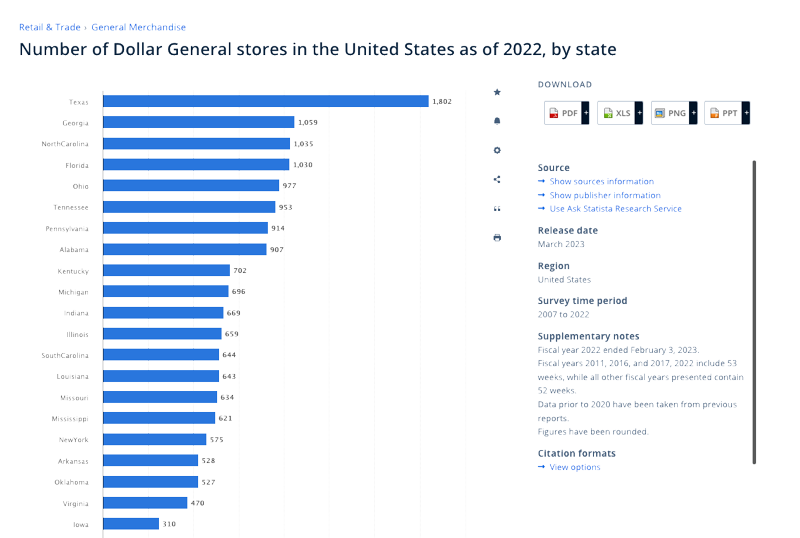

Data from Statista shows swing state North Carolina has 1,035 Dollar General Stores, Pennsylvania has 914, and Michigan 696.

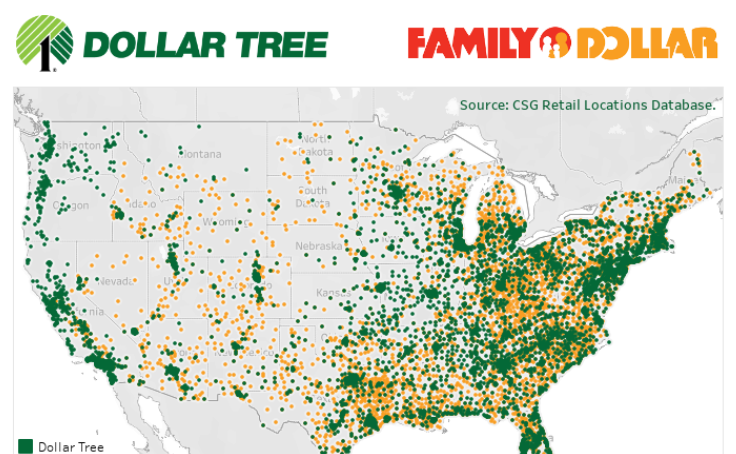

(Click on images to enlarge)

For Dollar Tree and Family Dollar, most of the stores reside in the eastern half of the US. Again, given what management has said about its core customer base under pressure, the geographical locations of the stores can suggest a whole lot of gloom and doom for the working poor across critical swing states.

This gives us a much more true glimpse into souring consumer sentiment on a geographical basis, where inflation dominates household discussions ahead of the fall elections, especially in critical swing states.

Meanwhile, former President Trump has hammered VP Harris for igniting the inflation storm with President Biden. VP Harris offered communist price controls as a solution, but the entire nation was in disbelief. Folks realize they had it good under Trump's first term, and just awful under Biden-Harris.

More By This Author:

"Due To Popular Demand": Tesla Announces Full Self-Driving Coming To China, Europe In Early 2025Stocks Pump And Dump After Waller Advocates For "Front-Loading" Rate Cuts, But Timiraos Intervenes To Hawk Things Up

Oil Slides Despite Huge Draw Sending Total US Crude Inventories To 2024 Low

Disclosure: Copyright ©2009-2024 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more