This Stock Soared On Robust Quarterly Results

Image Source: Pixabay

The 2025 Q3 earnings cycle continues to chug along, with a nice chunk of S&P 500 companies already delivering results. The period has so far been one of resilience, with overall growth remaining strong and an above-average number of companies exceeding quarterly expectations.

Wayfair (W - Free Report) posted notably strong results, raising guidance as a result. Let’s take a closer look at the release.

Wayfair

Wayfair posted a double-beat concerning our headline expectations, with adjusted EPS of $0.70 climbing 220% year-over-year and sales of $3.1 billion growing 8.1%. Further, its 6.7% adjusted EBITDA margin reflected its highest read ever outside of the pandemic.

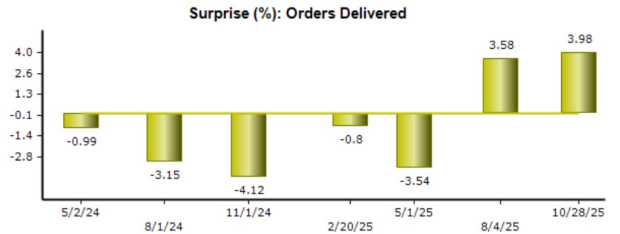

Orders delivered grew by more than 5% year-over-year, including new orders now growing mid-single digits for two consecutive periods. As shown below, the company has now strung together a few sizable beats concerning its Orders Delivered, reflective of the above-mentioned momentum.

Image Source: Zacks Investment Research

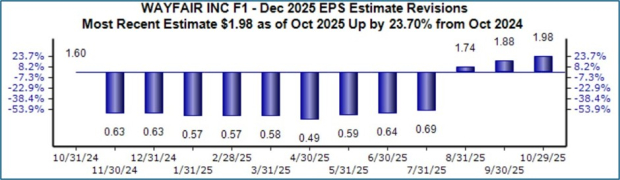

The stock sports a favorable Zacks Rank #2 (Buy), with EPS expectations moving higher for its current fiscal year. It’s reasonable to expect Wayfair’s EPS outlook to remain bullish in the near-term on the back of the strong quarterly results.

Image Source: Zacks Investment Research

Bottom Line

The 2025 Q3 earnings season has so far been stellar, with an above-average number of companies exceeding quarterly expectations. Growth has remained strong, with the big banks also giving us a solid read on the state of the consumer.

And concerning post-earnings pops so far, Wayfair posted results that had investors celebrating.

More By This Author:

Shares Of These Companies Soared Following Robust ResultsPepsiCo Vs. Coca-Cola: What's The Stronger Near-Term Buy?

Insider Buys: 3 CEOs Buying Shares