This Stock Now Pays Half Of Each Quarter’s Profits As Dividends

After a year that featured tech stocks as the big winner, many investors (and television talking heads) have expressed shock that the energy sector leads the way so far in 2021. With the price of crude oil rising higher, the Energy Select Sector SPDR ETF (XLE) has gained 43% through the first five months of 2021. However, don’t worry that you have missed out on all the energy gains. I suspect that by the end of 2021, the sector will have doubled its gains from the first half of the year.

The price of crude oil drives energy sector stock prices. After trading around $40 through the second half of 2020, west Texas intermediate crude oil (WTI) now goes for $68 per barrel, and the uptrend will continue. It looks like WTI will hold $75 to $80 per barrel in the second half of 2021.

Energy sector stocks should put up some significant gains when they release second-quarter results. (Remember that earnings results are always about four months behind.) If WTI oil stays above $70, we should see a repeat of outstanding financial results in late October.

Outside of the mega-cap energy stocks, most companies in the energy sector focus on one of the three subsectors.

Energy upstream covers those companies drilling wells to produce oil and natural gas. This sector will profit the most from higher oil (and natural gas) prices. Upstream companies face the challenge of a steady production depletion from existing wells, so there is a constant need to invest in new drilling to maintain and grow production levels. Low energy prices can be devastating to the upstream sector. Fortunately, that will not be the case in 2021.

Energy midstream includes the pipeline companies. Midstream services include gathering and processing in the upstream areas, as well as providing transport (pipelines, railcars, etc.) between producers and users, storage facilities, and terminals. Midstream companies have stable, fee-based revenue streams and are more valued as income investments. You can find plenty of high single-digit yields from solid companies in this sector. However, a rising energy sector will likely pull up midstream share prices, too.

Refining companies make up the bulk of downstream energy stocks. These companies refine crude oil into the full range of fuels we use, including gasoline, diesel fuel, and jet fuel. I find this part of the process to be very interesting because the refiners control neither the input costs (crude oil) nor the output prices (fuels). Those prices are set in the financial trading pits. This situation means refiners must be highly efficient to stay profitable when “crack spreads” are tight. It can also be very, very profitable when the spread widens out. Refining stock prices tend to be cyclical, but I think this phase of rising energy prices will lift all sectors.

As you can see, it takes some research to invest in the right sectors of energy, based on your investment goals. Here is one stock I recommend to my subscribers that should do very well for the remainder of 2021:

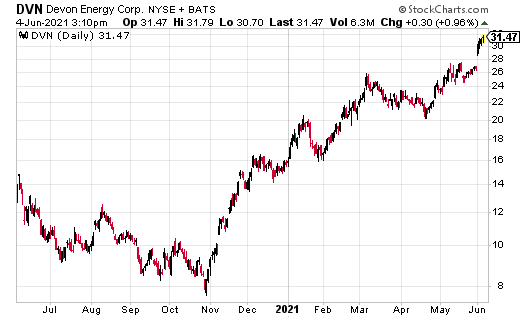

Devon Energy Corp. (DVN) recently instituted a dividend policy in which half of each quarter’s profits will be paid out as common stock dividends. This stock will benefit from the ongoing energy bull market and some very hefty dividend payments over the next several quarters.

Disclaimer: The information contained in this article is neither an offer nor a recommendation to buy or sell any security, options on equities, or cryptocurrency. Investors Alley Corp. and its ...

more